Key Takeaways

- Bitcoin dropped over 19% on October 10 as US-China tariff tensions sparked a major crypto selloff.

- Over $19 billion in leveraged positions were liquidated in 24 hours, marking a record for market volatility.

- Gold set a new record high amid the turmoil, raising questions about Bitcoin’s ‘digital gold’ status.

On Friday, the crypto market was in high stalling after increased trade war tension between the U.S. and China sent shockwaves through the digital asset industry, wiping billions of dollars in hours. Bitcoin (BTC) and other large cryptocurrencies fell, whereas gold rose to new heights, highlighting the opposite direction between risk assets and safe havens.

Table of Contents

Tariff Shock Sparks Crypto Market Bloodbath

The selloff was initiated soon after Trump announced that he had plans of sweeping a 100% tariff on Chinese imports on October 10. This news caused a widespread sell off in financial marketplaces with cryptocurrencies being some of the worst affected. The total crypto market cap fell to less than $4 trillion, almost reaching $3.24 trillion at its lowest point as per CoinGecko data.

Bitcoin, which had been trading around its all-time high of $126,000 a few days before, dropped to a low of $101,000 by over 19%. Ethereum (ETH) experienced an additional decline of more than 17% and dropped below the critical support level of $4,000. The sheer scale and velocity of the event was given the title of ‘Crypto Black Friday’ by its analysts. This failure triggered huge liquidations in the leveraged positions, estimated at about $19 billion over the course of 24 hours and an estimated 1.6 million traders worldwide were affected.

The numbers were one of the biggest one-day wiping in the history of the sector.The Coin Bureau co-founder Nic Puckrin told the author that the sharp turnaround in the market was a reminder of how open cryptocurrencies are to institutional action despite rising institutional involvement. “Institutional adoption and spot ETF approvals have given investors a sense of stability,” he said.

“But crypto still trades in an environment of thin liquidity and 24/7 volatility. That combination magnifies every shock,” he added, according to BeInCrypto. Moreover, he blamed the excessive leverage, softened depth of the market, and the increasing influence of large institutional players as the cause of the steep losses.

Read More: Bitcoin Price Crashes to $105K Amid $2.6B Liquidations, Here’s Why

Market Rebounds As Tariff Fears Ease

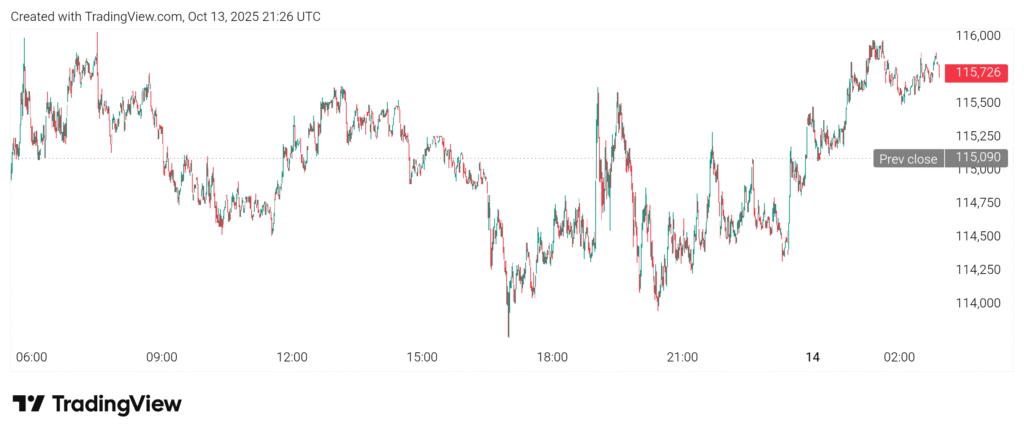

Towards the weekend, the digital assets started to recuperate as the U.S. President made new remarks indicating a less aggressive position with regard to China. Bitcoin rose rapidly again to over $115,000 and Ethereum topped the $4000 mark. The total value of the crypto market had recovered by over 5% in one day.

Puckrin cited the rebound as evidence of the volatility of crypto markets. He said many of the big assets have recovered almost all the grounds. It is a reminder that volatility is a two sided effect. He contributed that the crash could have been a positive role by purging speculative leverage and clearing up risk. Nevertheless, he cautioned that Bitcoin will have to break several resistance lines before it would seek another charge towards a new all-time high.

Gold Lengthens The Bull Run As Investors Seek Safety

As Bitcoin was not able to stabilize, gold kept increasing. Gold price shot to over $4,110 per ounce, a new record, with investors fleeing the market and political risk. According to economist Peter Schiff, the disparity in the performance of the two assets was stark with Bitcoin recording losses, whereas gold had continued to ride the wave without experiencing turmoil. Silver also approached record territory.

Puckrin however, warned that gold rally is not a risk-free investment. He explained that the lucrative metal has become a congested business and may be subjected to drastic mood swings. “Momentum is driving gold higher, but once enthusiasm fades, the reversal could be equally swift,” he observed.

Nevertheless, there is high demand for inflation and currency-hedging assets. Puckrin feels that the focus may soon shift to underrated alternatives, namely other metals, commodities, tokenized real-world assets, and even Bitcoin-assets, which have the same characteristic as gold and that of being protection against macroeconomic uncertainty.

The latest price prediction made by Goldman Sachs indicates that it has projected the price of gold to hit $4,900 by the close of the following year. Although gold reinforces its status as the safe haven of preference, crypto markets are still struggling to find answers to the question of whether Bitcoin could ever be the same.

Read More: Will Crypto Market Crash Further? China Poised To Hit Back At Trump Tariffs