Key Takeaways

- On Monday, spot Bitcoin ETFs in the U.S. recorded an enormous inflow of $1.2 billion.

- BlackRock topped the flows with $970 million influx as Fidelity and Bitwise’s products followed the trail.

- The bTC price recorded a new all-time high at $126,000 amid the strong ETF flows.

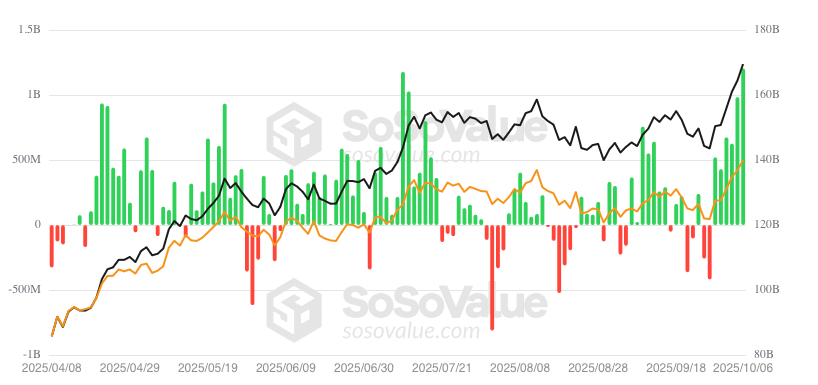

A wave of institutional influx has only added to the current October crypto market boom, with U.S. spot Bitcoin ETFs registering their largest daily inflows of 2025. On Monday, October 6, 2025, Bitcoin ETFs overall attracted $1.205 billion, a new annual record and the sixth consecutive day of positive flows. The inflow streak has reached some $4.35 billion, which indicates excellent investor confidence with Bitcoin recording new all-time highs.

BlackRock’s Bitcoin ETF Smashes Records

The iShares Bitcoin Trust (IBIT) of BlackRock was the largest issuer with a huge inflow of $970 million in one day. It was the second-largest inflow day of the year, a record that the fund just missed on April 28, which was also its record of $970.93 million.

Other ETF providers also registered positive flows. Fidelity’s FBTC ETF raised $112.3 million, and Bitwise’s BITB made $60.1 million. Further ARK 21Shares Bitcoin ETF (ARKB) and BRR by Valkyrie attracted modest deposits of $7.5 million and $15.1 million, respectively.

In the meantime, the outflows of Grayscale GBTC amounted to $30.6 million. It marks the continuation of an outflow trend as investors switch to less expensive ETF products.

BTC ETFs Mirror July’s Strong Performance

The most recent similar outburst was on July 10, 2025, when the ETFs recorded inflows amounting to $1.18 billion. The step was followed by a sharp rise in Bitcoin that boosted the BTC price above $119,000. Bitcoin has already reached new heights and has exceeded the mark of $126,000, having passed the latest inflows.

Total inflows in spot Bitcoin ETFs stand at over $61 billion to date in 2025. BlackRock’s IBIT leads the pack with 63.6 billion in total cumulative inflows, Fidelity coming in at $12.7 billion, and Bitwise at $2.5 billion.

Uptober Prolongs Market Optimism

The Bitcoin boom coincides with “Uptober,” a term used to describe which crypto’s strong performance in October. BTC price has soared to several highs since the onset of the month of October, and it is currently trading at a price that is slightly below its highs, about $124,000.

Last week, the total amount of digital asset investment products attracted almost $6 billion, and Bitcoin-based funds have attracted $3.55 billion. The recovery comes after a turbulent month of September, when a number of ETFs, such as BlackRock and Fidelity, saw massive outflows before investors switched abruptly to a bullish mood.

Hence, analysts believe that the story is cooking just right for Bitcoin. Now, they expect Ethereum to post similar gains with altcoins following since an AltSeason is in sight.

Read More: BlackRock Bitcoin ETF Seizes the Limelight with $100B Milestone in Sight