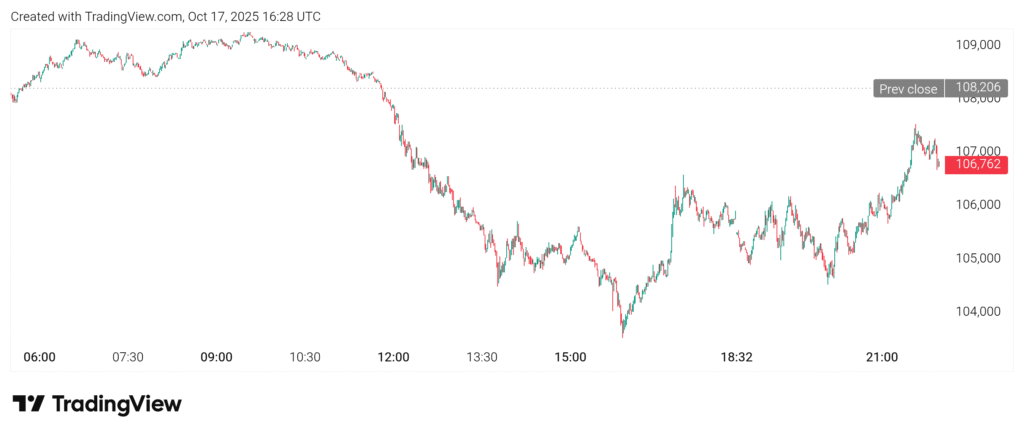

The crypto market extended its sharp downturn on Friday, with Bitcoin tumbling 4.44% to $105,841.97, one of its lowest levels in weeks, bringing its seven-day losses to nearly 13%. Ethereum also crashed 5.54% and traded at $3,790.73 at press time. The sell off has wiped billions of dollars in market capitalization, and this has also led to fear that a more serious correction might be in progress.

Peter Schiff Predicts Extended Bitcoin, Crypto Crash

Economist and gold advocate Peter Schiff, one of Bitcoin’s most vocal critics, seized on the market slide to renew his warnings about a broader financial collapse. On Friday morning, Schiff wrote on X (formerly Twitter), “The Bitcoin bear market continues this morning, with Bitcoin now down 34% versus gold since it hit its record high in August. If you think this bear market is nearing its end, think again!”

Schiff associated the fall of cryptocurrencies with broader economic vulnerabilities in America. “As U.S. stock investors brace for a replay of the 2008 financial crisis, with regional bank stocks tanking due to losses tied to loose lending standards and a weakening economy, the bigger risk is a dollar crisis that sends consumer prices and long-term interest rates soaring,” he said.

He further warned that “the losses that are about to hit the crypto industry will be staggering,” predicting “a wave of bankruptcies, defaults, and layoffs as the sector is decimated by the imminent Bitcoin and Ether crash.” Schiff added that the unfolding turmoil carries “systemic risk” for financial markets as a whole.

Bitcoin vs. Gold Debate

Just a day earlier, Schiff declared on X: “Gold is eating Bitcoin’s lunch. Bitcoin has fallen 32% against gold since its August peak. This Bitcoin bear market will be brutal. HODLers, sell your fake gold now and buy the real thing, or have fun going bankrupt.”

Cryptocurrencies have been performing poorly, yet gold has remained on a rally. The metal reached a new record of $4,318 per ounce, which was due to safe-haven demand in the face of increasing geopolitical beats between China and the U.S, along with the anticipation of a cut in Federal Reserve rate. Schiff argues that this divergence proves Bitcoin has failed to deliver as “digital gold” or a viable hedge against economic instability.

According to Schiff, the market is witnessing not only “de-dollarization” but also what he calls “de-bitcoinization.” In his view, Bitcoin “failed the test as a viable alternative to the U.S. dollar or digital gold” as he insisted that “HODLers are in denial, and their refusal to accept reality will cost them dearly.”

The crypto community has, however, reacted negatively to the comments made by Schiff. One user, @BTCPeakHub, responded that volatility is intrinsic to Bitcoin, writing, “It’s not a ‘failure.’ It’s just Bitcoin being Bitcoin.” Others pointed to Bitcoin’s long-term returns as evidence of resilience.

Investor Alex Stanczyk noted that while gold’s rise from $650 in 2007 represents a 521% gain, Bitcoin’s appreciation over the same period stands at an astronomical 174 million percent. The digital asset has even achieved a value of more than 1,000 outperforming gold over the past five years, Stanczyk added, indicating that the two assets can be used in a complementary manner in a diversified portfolio.

At this point, both camps are drawing their swords with the former focused on history and stability and the latter on innovation and promise. With market uncertainty deepening, Bitcoin’s next move may determine which side gains the upper hand.

Also Read: Why Crypto Is Falling Today: Over $240 Billion Wiped Out in Hours