Key Takeaways

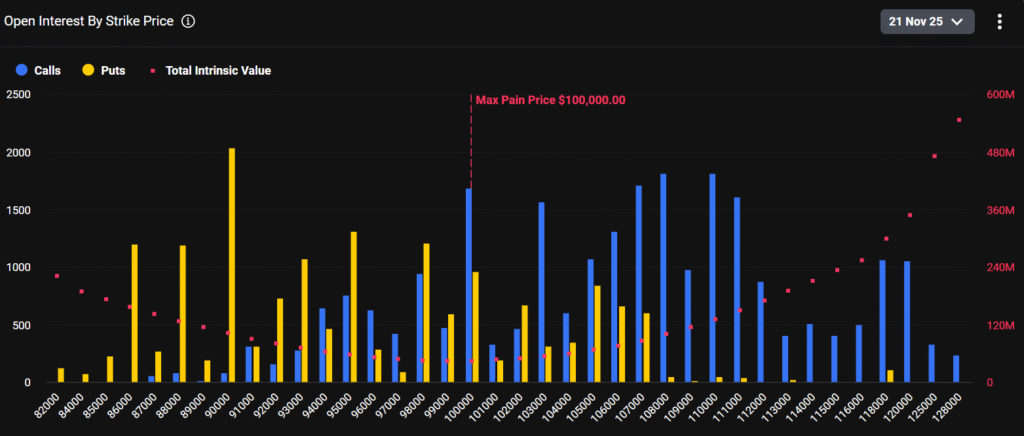

- $3.83B worth of Bitcoin options are set to expire Friday, 21 November.

- Deribit statistics indicate the maximum pain price is at $100,000.

- The put/call ratio stands at 0.65, which indicates a bullish market bias.

Bitcoin has fallen below $90,000 and continues its trend closer to $87,000 as major weekly options approach expiry. The largest cryptocurrency has fallen over 11% in the past 7 days amid broader market weakness. Market participants prepare for the $3.73 billion notional expiry on Deribit, which functions as the primary trading platform for Bitcoin and Ethereum options.

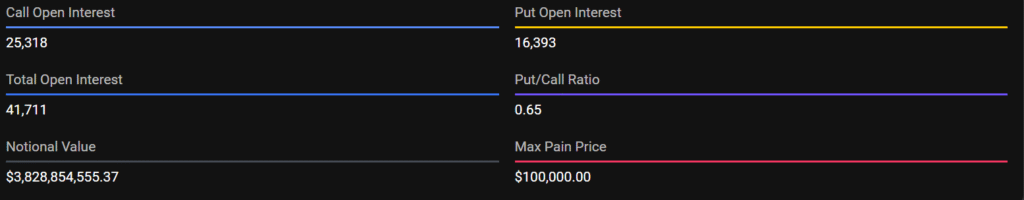

Deribit currently indicates 41,711 total open contracts for the expiry, which consist of 25,318 call contracts and 16,393 put contracts. The drop has pushed a significant portion of put positions deeper in-the-money, which amplifies hedging patterns.

Options Positioning Analysis

In-the-Money (ITM) Calls

The metric has 566.40 contracts valued at $51,989,057.38, which amounts to 2.24% of the total call notional. The ITM calls represent that some traders choose to hold profitable long positions and remain confident in a possibility of price rise from the recent lows.

Out-of-the-Money (OTM) Calls

A total of 24,752 contracts are valued at $2,271,914,464, which makes up 97.76% of the call notional. The overall notional in calls is $2,323,903,521.62. OTM interest is concentrated between the price range of $105K and $120K strikes, which indicates traders believe in a post-expiry rally or a gamma-driven push higher, even though the current dip has widened the gap to these levels.

In-the-Money (ITM) Puts

ITM comprises 10,731 contracts worth $984,955,822.71. The values account for 65.46% of the put notional and point towards large-player hedging against downside risk.

Out-of-the-Money (OTM) Puts

OTM puts are composed of a total of 5,661.8 contracts valued at $519,688,638.86, which corresponds to 34.54% of the put notional. The total notional in put position is $1,504,644,461.58. The aforementioned contracts, clustered between $80K and $95K, offer additional protection as the market trends toward lower levels.

Puts Dominate ITM, Calls Rule OTM

In total, 27.15% of the total notional value is currently in-the-money (ITM) and 72.85% is still out-of-the-money (OTM).

- There are 11,300 contracts totaling $1,038,355,864.24 in ITM.

- There are 30,320 contracts totaling $2,786,036,975.95 in OTM.

The vast majority of positions are speculative OTM bets (72.92%): calls speculate on upside north of $105K and puts, which are hedging for moderate pullbacks. The most recent sell-off has increased the value of the ITM puts, providing a protection layer against volatility spikes.

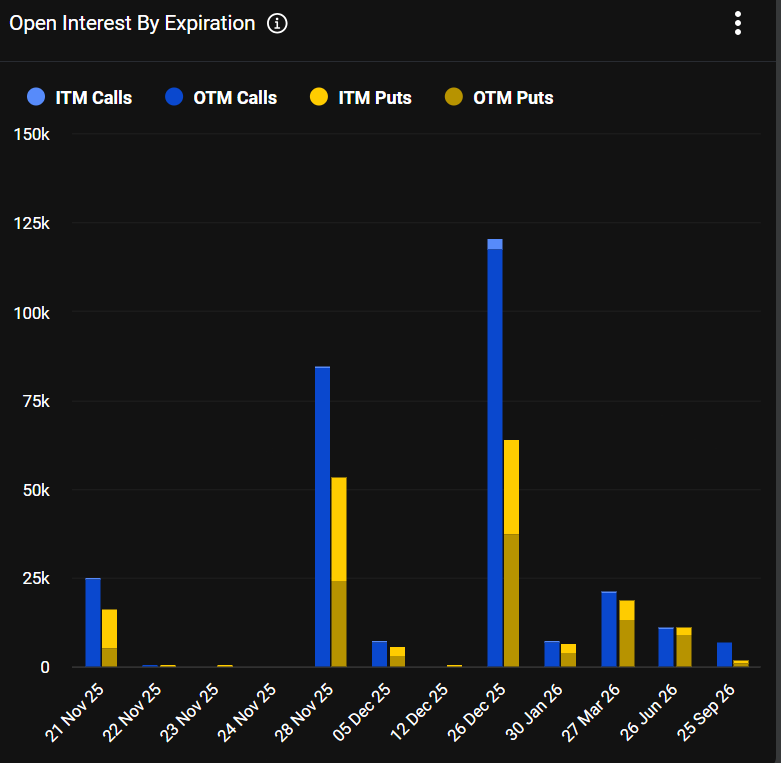

Open Interest by Expiration

The 21 Nov 2025 expiry dominates with nearly $3.8 billion in notional value and over 41K contracts. Longer-dated expiries remain significantly smaller, keeping market focus squarely on Friday’s expiry.

Market Outlook

The $100,000 max pain level is the strike at which the highest number of contracts expire worthless. However, with BTC trends below that threshold at $87,000, the price may face upward pressure from dealers breaking down hedges in the final hours. It can potentially trigger a price movement toward $92K–$95K.

With the put/call ratio of 0.65, base sentiment stays constructive despite the decline. A steady move towards the bitcoin price of $93,000 or above could trigger call delta-hedging. Additionally, the case could support a climb towards the next potential targets of $95K–$98K. On the other hand, failure to hold $88,000 may activate deeper put hedging and accelerate selling toward $85K–$80K support.

It becomes crucial for the traders to monitor increased volatility, as the expiry could either stabilize the dip or trigger the next leg of momentum.