Bitcoin underwent a significant price correction, which caused its value to drop between $82,000 and $83,000 after it experienced an intraday decline that reached below $81,000. The cryptocurrency market has seen liquidations that exceeded $1.68 billion within 24 hours with most of the traders that held long positions.

Market Overview and Liquidation Cascade

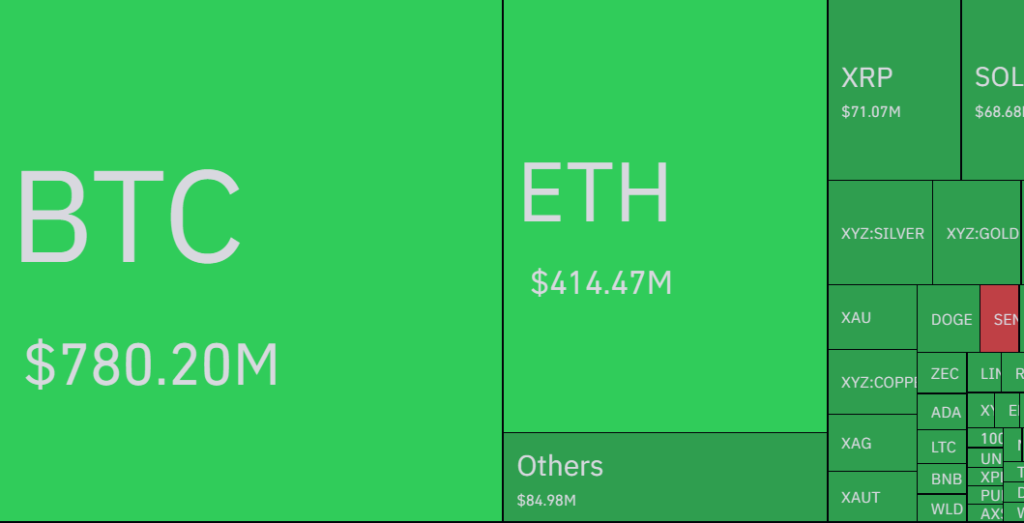

According to CoinGlass data, 267,372 traders went through forced closures of their positions, which led to total liquidations of $1.68 billion. The liquidation event included long positions, which contributed nearly 93% ($1.56 billion), while shorts stay minimal at close to $118 million. Bitcoin leads the losses with liquidations reaching close to $780 million, while Ethereum follows with $414 million in losses. The largest single forced position closure reached $80.57 million on HTX (BTC-USDT pair).

The current market situation demonstrates that traders who participated before the price decline showed excessive optimism. In a situation where huge numbers of traders make upward price predictions, even minor developments could trigger a selling frenzy, which leads to increasing selling activity that prompts more traders to close their positions. The liquidation mechanism functions to eliminate excessive market speculation while it establishes new funding rates and solves open interest problems. The current sell-off situation does not necessarily suggest that the prices of the relative assets will reach their lowest, but it wipes out the weak hands from the market and establishes a new period where actual market demand will determine price changes instead of forced selling.

Bitcoin Technical Analysis

The daily chart of Bitcoin on Binance presents a clear breakdown from the consolidation range that held between close to $97,000 and $100,000 recently. The relative asset has now reached a vital structural breakdown point after it lost the prior daily support zone between $90,000 and $92,000. The respective level served as a key demand zone throughout the late-2025 consolidation period. At the time of writing, BTC is changing hands near $82,818 after the price surpassed its lowest point of $81,200 while showing strong bearish market behavior.

Key Support Levels:

- Immediate support sits close to $83,000 (highlighted as daily support in green), aligning with the November 2025 low and a structural floor from earlier corrections.

- A sustained breach below $80,600 may trigger weakness and can push toward $74,500–$75,000 (prior cycle reference from 2025 lows) and potentially deeper if momentum persists.

- The recovery will need to regain the price level of $90,000, which serves as former support that now functions as resistance to end the bearish market pressure. The next resistance points appear between $85,000 and $87,000, which represents previous range low points and between $97,000 and $100,000.

- Momentum Indicators: The lower panel displays the daily RSI diving below 40 and standing at 31.06, signaling oversold conditions but also confirming loss of upward momentum. Divergences remain absent, with price and momentum aligned to the downside.

- Volume Profile: The increased trading volume during the breakdown period indicates market participants’ confidence but in a bearish way.

The Bitcoin market structure shows a failed retest attempt that occurred after the October 2025 high, which was close to $126,000. The bearishly positioned traders enjoy the edge until the bulls take control with strong support for the $80,000 to $82,000 price range.

Drivers and Broader Context

Instead of new fundamental downturns, the decline was driven by the leverage unwinding. In the financial market, when one side (buyers or sellers) starts to dominate their position on one side, it results in triggering a leverage flush like this. The market experiences increased risk aversion because investors speculate about a possible shift to hawkish policies by the Federal Reserve chairman. The combination of ETF outflows and today’s $8.8 billion options expiry dynamics creates short-term market fluctuations while investors maintain bullish positions in longer-term contracts.

This event flushes excess leverage accumulated during prior rallies. Post-liquidation phases often lead to stabilization or mean reversion when forced selling exhausts, though macro uncertainties delay any immediate reversal.

Outlook and Implications

The current phase of Bitcoin shows correction movement, which exists within the larger upward trend that began at the 2025 market lows. The price demands the range between $80,600 and $82,000 to function as a support zone, which could push a relief rally with the extended target range of $85,000 to $87,000. The market is likely to test its next support level once the largest cryptocurrency closes below $80,600, since this circumstances may lead to both extended market consolidation and further price declines.

Traders monitor liquidation heatmaps, funding rates, and open interest for signs of capitulation completion. The removal of overcrowded longs improves market health by reducing future cascade potential, though sustained recovery requires renewed inflows and resolution of macro headwinds.