Key Takeaways

- Bitcoin whales added 2,333 BTC worth $284.85 million amid a market correction.

- Price action hints at a potential new high if BTC closes above the $125,000 level.

- Bitcoin active addresses surged from 809.34K to 839.90K, indicating growing trader participation.

Bitcoin whales’ accumulation has brought BTC back into a bullish range, suggesting that a new all-time high could be on the horizon. Today, as BTC hovered near the local support level of $122,000, crypto transaction tracker Lookonchain recorded hundreds of millions of dollars in accumulation, resulting in a notable price pump.

Whales Drive Bitcoin’s Bullish Momentum

According to a post shared by Lookonchain, whale wallet addresses bc1qr9, 35usdJu, and 1EPzzK collectively accumulated 2,333 BTC worth $284.85 million. Meanwhile, this massive accumulation was recorded within the last 12 hours.

The impact of whale accumulation is evident, as BTC’s price jumped 1.95% following the buying activity. At press time, the asset is trading near $123,750, while investors and traders appear hesitant, resulting in a 15% drop in trading volume. However, the price uptick has improved BTC’s current market sentiment, giving investors hope for a potential continuation of the rally.

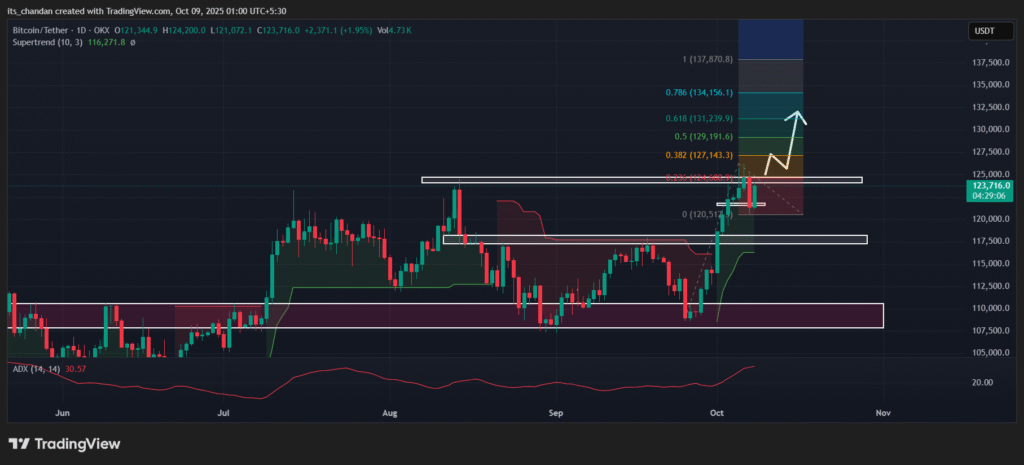

Bitcoin (BTC) Price Action and Technical Analysis

TimesCrypto’s technical analysis indicates that BTC is in an uptrend and appears to be preparing for its next leg up. On the daily chart, the asset is approaching a key resistance level at $125,000. Since October 5, 2025, BTC has tested this resistance level three times, and each time it has failed to sustain above it.

This time, BTC is once again approaching the $125,000 resistance level. If the asset successfully closes a daily candle above this level, it could experience significant upward momentum and potentially register a new all-time high.

According to the trend-based Fibonacci Extension, if BTC closes above the $125,000 level, the new potential highs could be $127,143, $129,191, and $131,239 in the coming days. BTC’s bullish outlook is further supported by technical indicators, including the Average Directional Index (ADX) and Supertrend, both signaling strong bullish momentum.

At press time, the ADX value has reached 30.57, indicating a strong directional trend. Meanwhile, the Supertrend continues to hold a green signal below BTC’s price, suggesting that the asset remains in an uptrend.

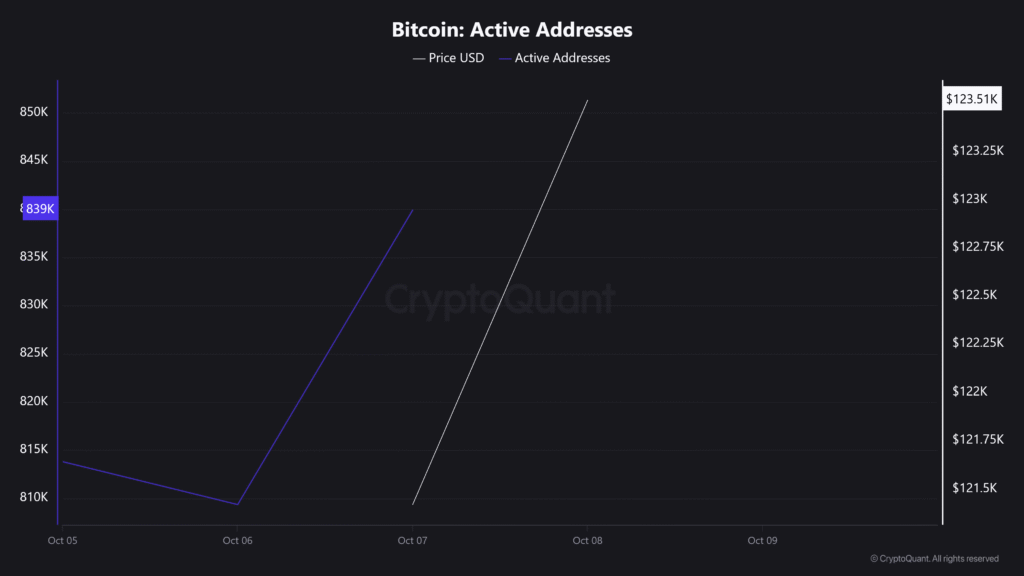

On-Chain Signal Bullish Outlook

Adding to the bullish momentum, on-chain analytics platform CryptoQuant reveals that Bitcoin active addresses have recorded a notable jump, rising from 809.34K to 839.90K over the last 24 hours, indicating increased network activity and growing trader participation.

Today, the major liquidation levels that traders should focus on are $120,642 on the lower side and $124,366 on the upper side, according to Coinglass. At these levels, traders are over-leveraged, with $1.91 billion in long positions and $576.28 million in short positions built up, respectively.

Read More: Bitcoin Whale with $10B Moves $363M BTC, What’s Happening?