Key Takeaways

- $4.5B worth of Bitcoin options are set to expire on Friday.

- The PCR (put/call ratio) is 0.84; that implies a slight bullish market sentiment.

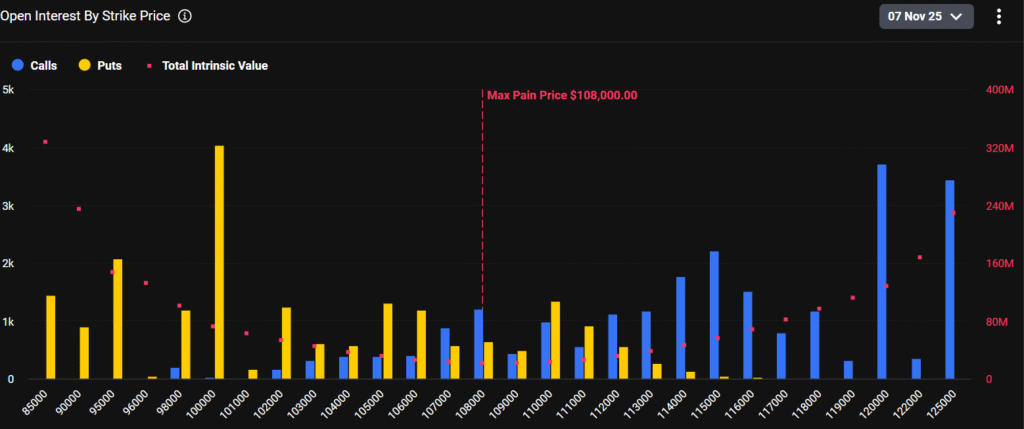

- Deribit data reveals that the max pain price stands at $108,000.

Bitcoin trends near $103,000 as traders prepare for the weekly options expiry on Friday. The largest cryptocurrency gained 0.44% in the past 24 hours. According to Deribit, there are 43,636 total open contracts composed of 23,695 calls and 19,942 puts.

Options Positioning Analysis

In-the-Money (ITM) Calls

The ITM calls metric suggests that about 761.10 ITM call contracts are worth $78,487,569.85 (3.21%) of total notional. These positions are substantially in-the-money based on current spot prices, showing that there is underlying bullish conviction despite the recent pullback.

Out-of-the-Money (OTM) Calls

There are 22,933 OTM calls worth $2,364,980,730.92 (96.79%). The cluster of open interest is centered around the bitcoin’s price range between $110K and $120K, which suggests that traders are looking for a rebound or increase in volatility that could push the price higher.

Total Notional Value for Calls: $2,443,468,300.77

In-the-Money (ITM) Puts

ITM puts consist of 8,191.3 contracts worth $844,718,474.42 (41.08%). The significant ITM put exposure suggests that there is still hedging against short-term downside risk by institutions or large traders.

Out-of-the-Money (OTM) Puts

OTM puts consist of 11,751 contracts worth $1,211,767,229.32 (58.92%) that are well concentrated in the $100K to $105K strikes. It would indicate that there is a defensive position for mild corrections rather than expecting a crash.

Total Notional Value for Puts: $2,056,485,703.73

ITM vs OTM Overview

Overall, 20.52% of open contracts are in the money (ITM), while 79.48% remain out of the money (OTM).

ITM Total: 8,952.4 contracts, $923,206,044.26

OTM Total: 34,684 contracts, $3,576,747,960.24

The following distribution highlights a speculative setup, with OTM options being dominant with open interest at 79.48%. The trend toward OTM calls above $110,000 conveys optimism for a rally, whereas OTM puts below $105,000 act as a hedge against pullbacks. In comparison to monthly expiries, the weekly volumes are more strategically driven and often amplify intraday swings.

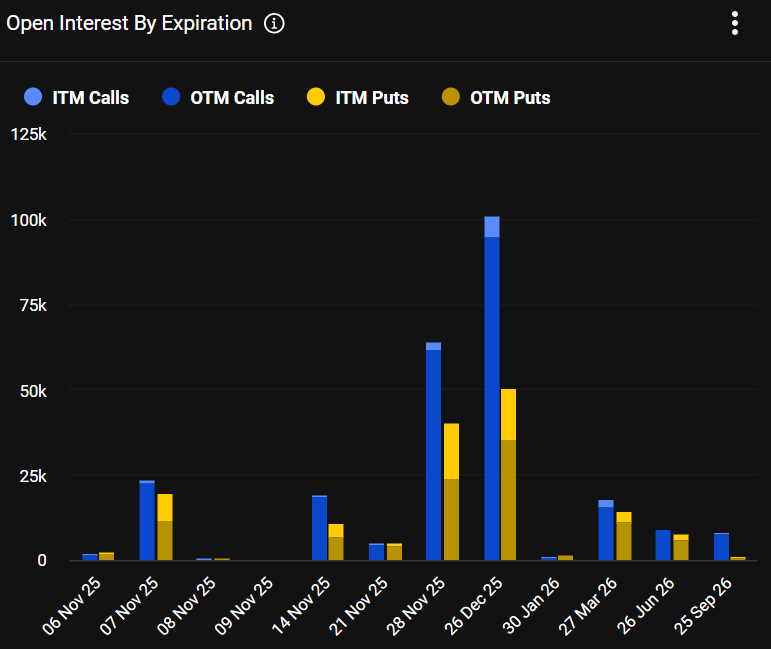

Open Interest in Expiration

The November 7 expiry dominates with 43,636 contracts, $4.5 billion notional, up sharply from prior weeks. ITM exposure here is 20.52%, with calls at 3.21% and puts at 41.08%. Longer-dated expiries such as December show lighter activity with combined open interest under 10K contracts.

Market Outlook

The $108,000 max pain price indicates the strike price where the largest number of contracts become worthless and is likely to keep BTC pinned to the current level leading up to expiry. The current weekly occurrence is sized at approximately $4.5 billion notional amount, which is smaller than monthly rolls but can lead to gamma squeezes.

In a macro context, Bitcoin ETF inflows have been steady for $1.19 billion over the past month, which strengthens the market sentiment. Given the 63.8% OTM positions and PCR below 1, it is reasonable to expect volatility to pick up. If Bitcoin breaks above $110K, a wave of call delta hedging could ultimately push prices higher. Likewise, if the relative asset falls below $106K, it could lead to a selling pressure as well.