Key Takeaways

- Binance founder Changpeng Zhao reignited the Bitcoin vs. gold debate, predicting that Bitcoin will eventually “flip gold” and surpass its $30 trillion market value.

- Billionaire investor Anthony Scaramucci backed CZ’s view, forecasting Bitcoin could reach $1.5 million and achieve “gold parity” as institutional adoption accelerates.

- Gold advocate Peter Schiff countered that gold remains the safer hedge, claiming it poses “the biggest threat to Bitcoin” amid renewed strength in the metal’s market.

Binance founder Changpeng Zhao, widely recognized as CZ, has rekindled one of the crypto world’s oldest debates on whether Bitcoin can ultimately overtake gold in total value. His recent remarks on social media have once again thrust the “digital gold vs. physical gold” comparison into the spotlight.

Binance’s CZ Reignited Gold vs. Bitcoin Debate

In a post that quickly circulated across X, CZ made a bold statement: “Prediction: Bitcoin will flip gold. I don’t know exactly when. Might take some time, but it will happen. Save the tweet.” The comment has stirred discussions among traders, analysts, and industry figures, many of whom see it as a reflection of renewed optimism around Bitcoin’s long-term trajectory.

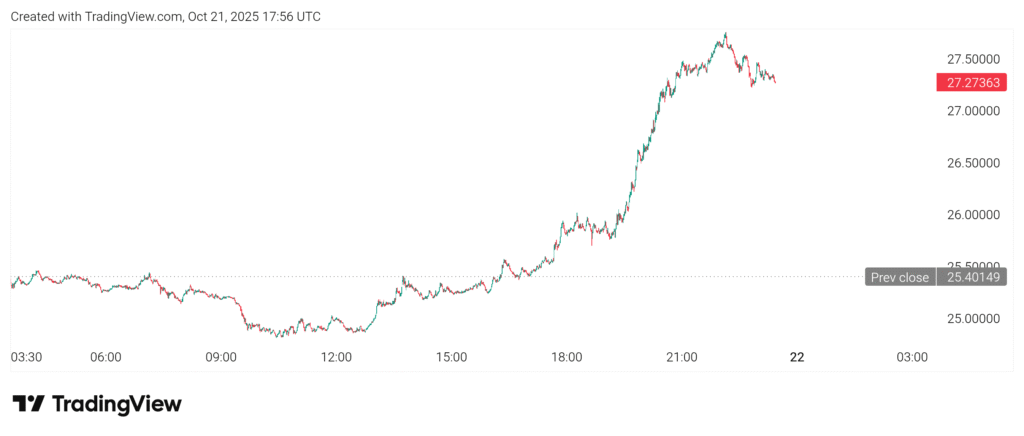

Currently, gold remains the world’s largest-valued asset, boasting a market capitalization near $30 trillion. Bitcoin, by contrast, holds an estimated value of about $2.23 trillion, ranking eighth among global assets. With BTC trading above $112,000, many market observers believe it is only a matter of time before the leading cryptocurrency narrows that gap.

The crypto community reacted swiftly to CZ’s remarks. Market commentator CryptoGao noted that while gold continues to touch record highs, Bitcoin may soon catch up. According to him, “Bitcoin will catch up and surpass gold,” emphasizing that CZ’s predictions have “historically been accurate.” His view reflects a broader belief that Bitcoin’s fundamentals, combined with increasing institutional participation, could eventually propel it to gold-like status.

Analyst Ben Todar echoed that perspective, describing Bitcoin as “harder, faster, and borderless, a superior form of money for the digital world.” He drew a contrast between gold’s tangible nature and Bitcoin’s digital advantages, adding that “gold is a symbol of the physical age and Bitcoin its internet-age successor.”

Todar also highlighted Bitcoin’s technological edge, noting that it can be “transferred instantly and verified on-chain,” a feature that has no parallel in traditional assets. The debate intensified further after billionaire investor Anthony Scaramucci publicly aligned with CZ’s prediction.

Read More: BlackRock Launches Bitcoin ETP Following UK Regulatory Shift

Anthony Scaramucci Supports The Narrative

Speaking during a CNBC interview, Scaramucci expressed confidence that Bitcoin could reach price levels comparable to gold’s total valuation. “Ten years from now, we’ll look back and realize Bitcoin reached parity with gold,” he said, estimating a potential price of “$1.5 million” per BTC.

Scaramucci attributed this projected surge to increasing institutional involvement, pointing to BlackRock’s Bitcoin ETF as a signal of accelerating mainstream adoption. He compared the current digital asset landscape to the early stages of the 2000s technology boom. “Institutional adoption is accelerating,” Scaramucci said as he described Bitcoin as an asset that represents the future of money.

Recent moves by major corporations appear to validate that trend. Firms like Strategy have continued to expand their Bitcoin holdings, viewing it as a hedge against inflation and as part of a modernized portfolio strategy. Scaramucci also noted generational differences in investor preferences. He observed that “younger generations prefer Bitcoin over traditional hedges.” Moreover, he suggested that capital will increasingly flow from gold to digital assets as wealth transfers occur.

Describing Bitcoin’s resilience, he called it “a cockroach that survives everything,” implying that even sharp downturns fail to derail its long-term potential. However, the gold camp remains unconvinced. Veteran investor Peter Schiff dismissed the enthusiasm around Bitcoin, asserting that “gold is the biggest threat to Bitcoin.”

He argued that the cryptocurrency sector seeks to undermine gold’s role because it challenges Bitcoin’s status as “digital gold.” Schiff added that gold’s renewed strength leaves “no reason for anyone to buy Bitcoin instead,” positioning the precious metal as the more stable refuge during times of uncertainty.

Read More: Bitcoin, Ethereum Crash to Worsen? Peter Schiff Warns of 2008-Style Financial Crisis