Key Takeaways

- Bitcoin price crashed to the $105,000 level as the crypto market suffered with a gigantic crash today.

- Ethereum, XRP, Solana, Cardano, and other altcoins also plummeted massively.

- The crash is attributed to U.S. President Donald Trump’s proposal to impose 100% tariffs on China, according to analysts.

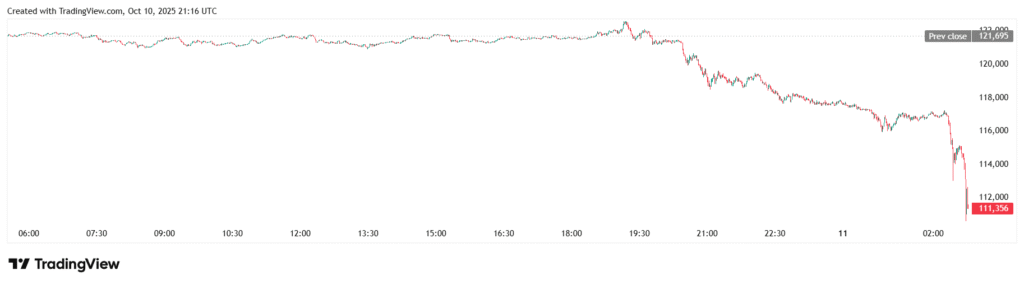

The crypto market tumbled heavily on Friday, October 10, eliminating the value of more than $540 billion within hours. Bitcoin (BTC) price crashed to the $105,000 level after previously achieving an all-time high at $126,000. The downturn came after U.S. President Donald Trump announced the intention to introduce a 100% tariff on Chinese goods and canceled the planned visit to China with its President Xi Jinping.

Bitcoin Price Plunges to $105,000 Amid Trump’s China Tariff

Investors moved at a rapid pace out of risk assets following the announcement, which shook global markets. Digital currencies, which have become more reflective of the traditional market mood, experienced large-scale falls against large equity indexes.

CoinMarketCap data indicated that the overall market capitalization of cryptocurrencies has dropped to around $3.76 trillion as a result of the comments made by Trump. BTC price slumped 12.89% to $105,680.59, while Ethereum price was down 18.08% to a low of $3,567.65.

Other altcoins had greater losses. Both Solana and XRP dropped by 18.41% and 41.45% in the sell-off, and the traders attributed this to the increase in macroeconomic uncertainty and the loss of risk appetite among institutional investors. Furthermore, Cardano (ADA) price plummeted over 55%, reaching $0.3612.

This sudden decline in prices caused a massive forced selling in the largest crypto exchanges. Statistics generated by Coinglass revealed that over $2.66 billion of leveraged positions were sold out in the last 24 hours. Long traders (traders who bet on the price increase) bore the full impact of the damage, and they had about $2.52 billion in losses.

The positions linked to Bitcoin saw the largest percentage of the liquidations with $839 million liquidated. This fiasco highlights the speed with which market sentiment changed after the geopolitical shock.

Read More: Bitcoin News: Elon Musk’s SpaceX BTC Holdings Surge to $B

Spillover Impact on International Financial Markets

The crisis did not limit itself to the crypto industry. On Wall Street, the market capitalization of the S&P 500 index fell by approximately $1.2 trillion within 40 minutes when investors exited portfolios to de-risk. Analysts claimed the sudden rise by Trump brought back the speech of the 2018-2019 trade war, where tariffs between the two largest economies in the world had upset the international supply chain and triggered the fear of the world slowing down in regard to international trade.

The new tension is untimely, and already, markets are struggling with not knowing what the Federal Reserve will do next. The risk assets had been recently boosted by expectations of a reduction in interest rates, but the announcement on Friday turned the tables on the hopes and spurred volatility across asset classes.

Industry observers pointed out that the concurrent fall of equities and cryptocurrencies points to the fact that digital assets are becoming the subject of geopolitical and macroeconomic pressures. The entry of institutional players, which now constitute an increasing proportion of crypto trading volumes, seemed to have approached the asset class as they do equities, i.e., de-exposing during global risk aversion.

Read More: Dogecoin News Today: DOGE Price Under Pressure, 20% Crash Possible