Key Takeaways

- The prospects of another rate cut in October for investors, possibly to 3.75%4 depending on the fed funds rate and possibly the lowest since 2022, may affect the direction of Bitcoin.

- Spot Bitcoin ETFs have already taken in $57.29 billion since its inception, where inflows amounted to $521.95 million on Sept. 29 alone, indicating the presence of robust institutional and retail demand.

- Bitcoin is trading at or over $113K, with support at around $110K and resistance at around 115K; MVRV and NVT ratios are also flashing signals that could guide short-term actions.

Bitcoin is set to enter the fourth quarter of 2025 with investors closely watching the economic indicators, market dynamics, and on-chain metrics to determine the direction BTC will take next. With possible changes in U.S. monetary policy, technical indicators, and ETF inflows, various forces are coming together to create the market story for Bitcoin.

Federal Reserve Expected to Cut Rates in October 2025

Markets are now preparing to face another possible policy change following the first reduction in benchmark rate by the Federal Reserve in September since 2022. Analysts project a second reduction in October, putting the fed funds target range between 3.75% and 4%. Moreover, the FedWatch tool of CME Group shows that futures traders are betting on a quarter-point cut that would take the rates to their lowest point since December 2022.

The Fed officials say that the cost of borrowing money should be reduced to offset declining economic growth. The officials pointed out that job growth has almost stagnated this summer as the tariffs have increased prices and tightened consumer budgets, and it is of concern that unemployment is increasing, as well as inflationary pressures. The quandary represents the two-fold mission of the Fed to control employment and inflation simultaneously when both indicators are raising red flags.

Bitcoin ETF Demand Remains Strong

The market direction is still determined by institutional demand in the form of spot Bitcoin ETFs. The flows have been at a record of $57.29 billion so far owing to robust interest from both the professional investors and the retail traders. Net inflows amounted to $521.95 million on September 29 alone, a turnaround from previous outflows. The FBTC of Fidelity had the largest subscriptions of $298.7 million in one day, and the GBTC of Grayscale attracted $26.9 million.

Large inflows are coming back, which has added pressure to the buy-side. BlackRock IBIT has also been able to outperform Deribit in terms of open interest in options, indicating the increasing importance of ETFs in the derivatives market to provide liquidity and influence movements. According to analysts, the ongoing momentum in the sector might continue to play a key role in driving the price of Bitcoin through the end of the year.

Technical Indicators To Watch

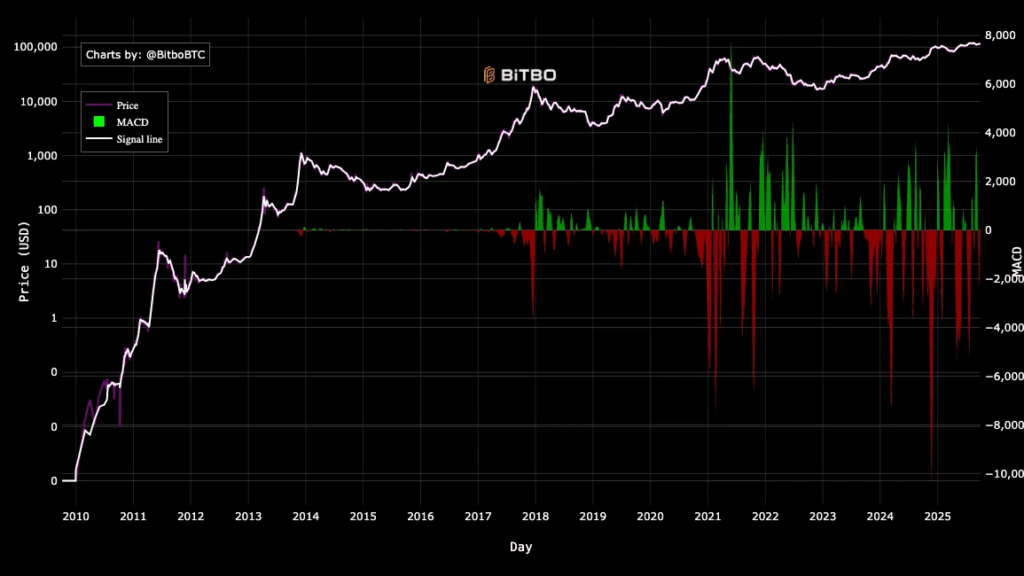

Market watchers are observing several on-chain and chart-based indicators:

- MVRV Ratio: Bitcoin market value to realized value (MVRV) is close to a value of about 3, which has been historically an indicator of short-term overvaluation, which can lead to corrective action.

- NVT Ratio: Network value to transactions (NVT) has been a good predictor of previous cycles. Bitcoin made major rallies when the ratio fell below 30 in 2020 and 2023. Another test in Q4 2025, along with an increase in transaction volumes, may be a sign of underpricing.

- Support and Resistance: This week, Bitcoin recovered from the level of $108,000, and now it is above its 50-day EMA of $113,396. The Relative Strength Index is 53.56, which suggests neutral momentum. The immediate resistance is $115,000, which corresponds to the 23.6% Fibonacci retracement. If this level is broken, BTC price could reclaim the $120,000 in the fourth quarter.

- Holder Metrics: The short-term holder MVRV has fallen into oversold territory, which is commonly viewed as a rebound setup.

Bitcoin has made a historic mark of over $124,000 in mid-August, but the price has not gone past the level of resistance of $120,000, as bulls have not been able to keep the momentum above this level. For now, it’s crucial that BTC price holds the $110,000 support for further upside as it rebounds.

Market Sentiment and Political Signals

Crypto analyst Lark Davis told his 1.4 million X followers, “The absolute worst time to get shaken out is now.” Meanwhile, Eric Trump recently described the outlook as “unbelievable,” citing global money supply expansion. He added, “Fourth quarter has always been the best quarter for cryptocurrencies.”

Other crypto enthusiasts, such as Zap founder Jack Mallers, have also called for a strong rally by the end of the year. Furthermore, large organizations like Standard Chartered and VanEck have revisited long-term predictions that forecast Bitcoin to be between $180,000 and $200,000 by 2026.

Read More: Bitcoin News Today: $394M BTC Shorts in Danger as Price Eyes $118K