Key Takeaways

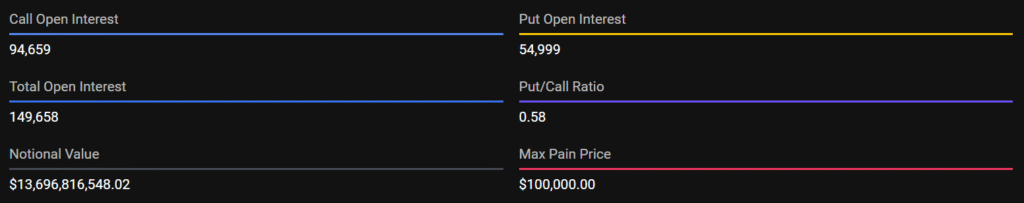

- Bitcoin’s (BTC) call-heavy options indicate bullish bias ahead of the November monthly expiry of $13.68 billion.

- The Max pain level is at $101,000, capping the downside risk for the largest cryptocurrency.

- BTC trades near $91,000 after testing the short-term low of $80,537.

Bitcoin (BTC) traded green on Friday and continued gains around $91,000 mark. Market participants brace for volatility amid a huge Bitcoin monthly option expiry of $13.68 billion. The

Max pain area, the level where maximum calls and puts expire worthless, is at $101,000, suggesting limited downside risk, despite a lot of exposure to in-the-money puts.

Bitcoin options see total open interest reach 149,692 contracts. Call options account for 63% of the total market share. The imbalance demonstrates strong market confidence in potential upward moves as Bitcoin hovers near the price levels of $91,500 ahead of the November expiry.

Call Options Hold Dominance with 93% OTM Contracts

The put/call (PCR) is 0.58, indicating a bullish bias among traders. There are a total of 94,694 contracts for calls and 54,998 contracts for puts, worth $8.65 billion and $5.03 billion, respectively.

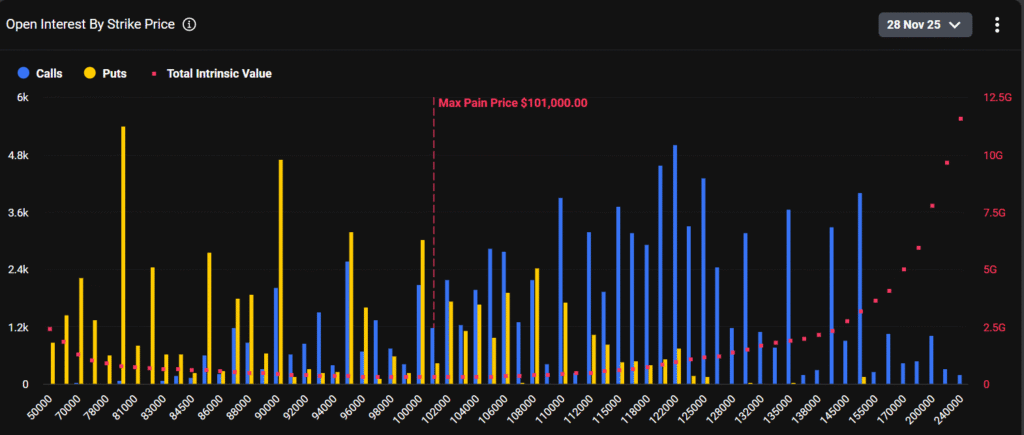

Out-of-the-money (OTM) calls account for 93.2% of all call notionals, or 88,256 contracts. These are bets on a rally that are worth $8.06 billion. The value of in-the-money (ITM) calls amounts to $588 million, representing 6.8% of the total contracts.

Puts show equilibrium, with 47.2% ITM ($2.37 billion, or 25,965 contracts) and 52.8% OTM ($2.65 billion, or 29,033 contracts). Overall, out-of-the-money positions take up 78.35% of the book, or $10.72 billion, which means there is room for volatility.

Max Pain at $101K Guides Dealer Flows

Max pain theory identifies $101,000 as the strike at which most options expire worthless, exerting a gravitational pull on price action. Strike distribution data indicate that call open interest peaks above $100,000, whereas put options cluster at lower strike prices, which favors bulls if momentum builds.

Extreme rallies still carry fewer chances as the liquidity declines sharply beyond $120,000. In the case of low liquidity at high strike levels, the market has less fuel to push the asset’s upside moves. Total ITM value stands at 21.65% ($2.96 billion across 32,403 contracts), establishing a base against major dips.

Market Outlook

The market structure suggests a potential rise toward $103,000-$105,000 if the spot price for Bitcoin maintains support levels near $88,000 in the short term. The call-heavy profile and max pain factors could trigger a 4-6% gamma squeeze near expiry, especially in the case of a breakout above $100,000.

On the downside, ITM puts at $2.37 billion offer a buffer against macro headwinds such as Fed announcements. December’s balanced book points to a consolidated range of $92,000 to $108,000, with the quarterly dates contributing to stability.

FAQ

Why Does Option Expiry Matter?

The option expirations are crucial, as they can influence the short-term price shifts. A big concentration of options at specific strike prices can impact the spot price as market participants try to hedge or reduce the risk of their positions with the upcoming expiries. The situation potentially leads to noticeable short-term volatility even in the absence of any major news.