Key Takeaways

- U.S. Fed keeps rates unchanged at 4.25%-4.50%.

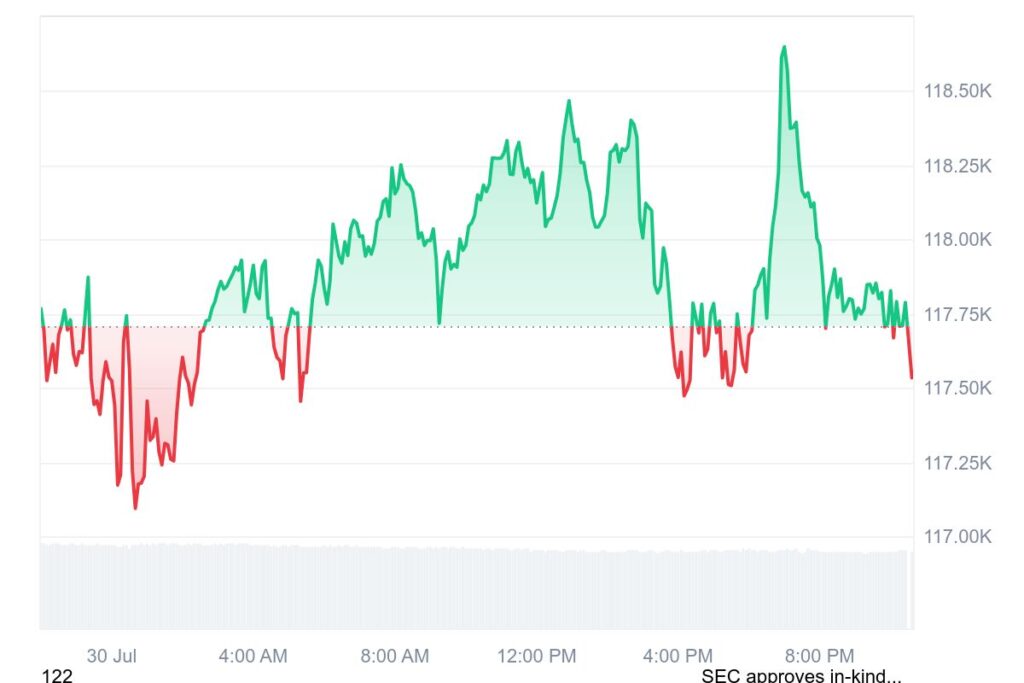

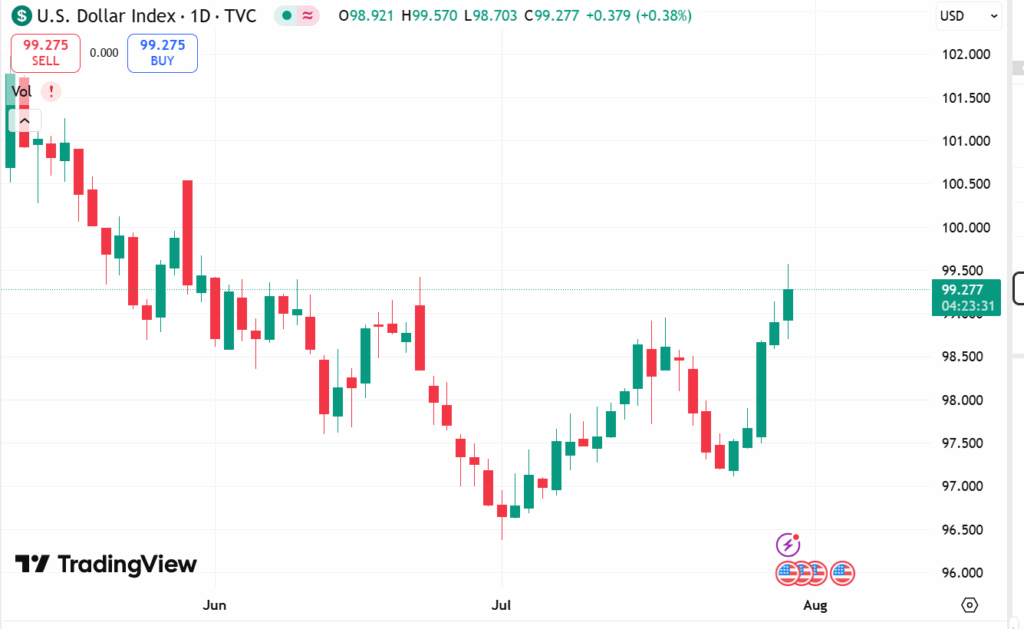

- Bitcoin inches lower to $117,533.80, whereas the U.S. Dollar Index (DXY) holds higher above 99.0.

- Markets are now focusing on upcoming data points to gauge September rate decision.

The U.S. Federal Reserve kept interest rates unchanged at 4.25%-4.50% on Wednesday, July 30th, stating that uncertainty about the economic outlook remains elevated.

The rate decision, being in tandem with larger market expectations, has dampened sentiments in the crypto markets. Bitcoin inched slightly lower by 0.11% to $117,533.80 soon after the rate decision was announced. Following the statement, other major digital currencies like in Ethereum and major significant altcoins also showed range-bound trading.

However, The U.S. Dollar Index (DXY) picks up the momentum above 99.357 after approaching its highest level since June 1. Strong GDP figures indicating the U.S. economy expanded at a 3% annualized rate in Q2 supported the dollar and bolstered views that the Fed will maintain interest rate stability for a fifth consecutive meeting.

The U.S. Fed’s decision to hold interest rates steady comes despite persistent pressure from the U.S. President, Donald Trump. The Fed’s view of keeping interest rates higher until economic signals improve has made Chair Jerome Powell face growing political scrutiny, despite inflation remaining a top concern.

Even with the decline, investors are now gauging about possible rate reduction later in the year as economic signs improve. Market participants are now hoping for a possible rate cut at the earliest in September 2025.

FED Rate Decision Disappoints Markets, But Analyst Predict Volatility For Bitcoin

Bitcoin’s price has historically chased favorable monetary policies, with higher risk appetite helping $BTC price surge. As TimesCrypto reported earlier, the 2024 and 2020 cycles of Bitcoin saw a bullish rally aligning with the backdrop of low interest rates. However, higher interest rates in 2023 had kept gains muted for Bitcoin.

Jonathan Hargreaves , Co-Founder of Web3 platform RAMM.ai expects that in the worst case scenario the July rate decision will add significant volatility to crypto markets.

He explains “If the threat of tariff inflation has deflated equities this year then a more benign inflationary environment is likely to see equities benefit potentially at the expense of crypto while even a crypto bull market will run its course which is likely to see a retreat to traditional investments.”

Additionally, if the Fed maintains a prolonged high interest rate environment, appetite for risk assets like crypto may remain subdued. For such a scenario, Dean Chen , Analyst at Bitunix Exchange states “Any signal of eventual easing could redirect capital back into more volatile markets. In the long run, crypto stands to benefit from rising institutional interest and broader ETF adoption, provided inflation remains under control and macroeconomic stability is achieved. Also, long-term bond yields will play a key role in influencing cross-asset capital allocation.”

FED September Rate Decision: What Crypto Market Expects in Near-Future?

With the July rate decision disappointing the markets, crypto investors are eagerly looking towards the future of monetary policies. While the political scenario of Tariffs and Trump’s statements influences broader sentiments, the Fed will likely keep crucial data points and inflation prints as key factors for future monetary decisions.

The last inflation data indicated that the Consumer Price Index (CPI) increased by 0.3% in June, raising the annual rate to 2.7%. Even while the numbers were in line with Dow Jones projections, the year-over-year rate is still the highest since February and is still higher than the Fed’s 2% target.

With the current data keeping policymakers worried, the upcoming inflation numbers and labor indicators will be key factors for crypto investors. Notably, Trump’s generally favorable stance towards crypto may influence the broader regulatory climate, but it is unlikely to override the Fed’s institutional framework.