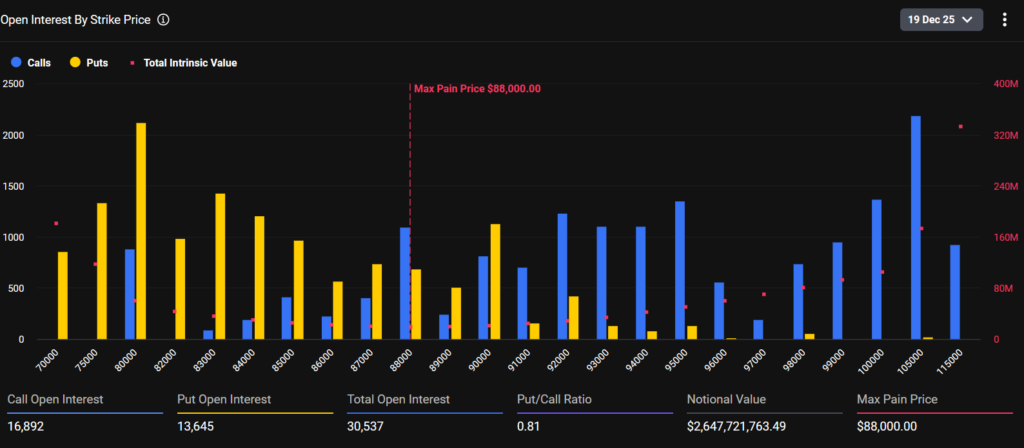

Bitcoin (BTC) approaches Friday’s weekly options expiry following a 3.2% pullback that pushed BTC down to around $87,000. The recent dip has brought back attention to the options market, with traders increasingly adopting defensive positioning. The max pain price, where the maximum number of options would turn out to be worthless, stands at $88,000.

The upcoming expiry is relatively modest compared to the forthcoming quarterly settlement on December 26; however, market participants are still monitoring the situation closely, as dealer flows and max pain dynamics may influence the price throughout this period.

The point serves as a temporary attraction as dealers may be adjusting their positions through gamma hedging. This could result in volatility in the lead-up to Friday’s expiration.

According to the data provided by Deribit, a total of 30,537 Bitcoin options contracts are set to expire this week. Among these, the contracts are broken down into 16,892 calls and 13,645 puts. It is estimated that the whole set of these contracts has a total notional value of about $2.65 billion and a put/call ratio of 0.81.

The mentioned trend indicates an optimistic market sentiment. However, the overall positioning is cautious due to the small size of this weekly expiry.

Call (CE) options allow traders to buy assets at a strike price.

Put (PE) options allow the right to sell and are mainly used for hedging against potential price fall risk during uncertain market conditions.

Option Positions Distribution: In-the-Money (ITM) vs. Out-of-the-Money (OTM)

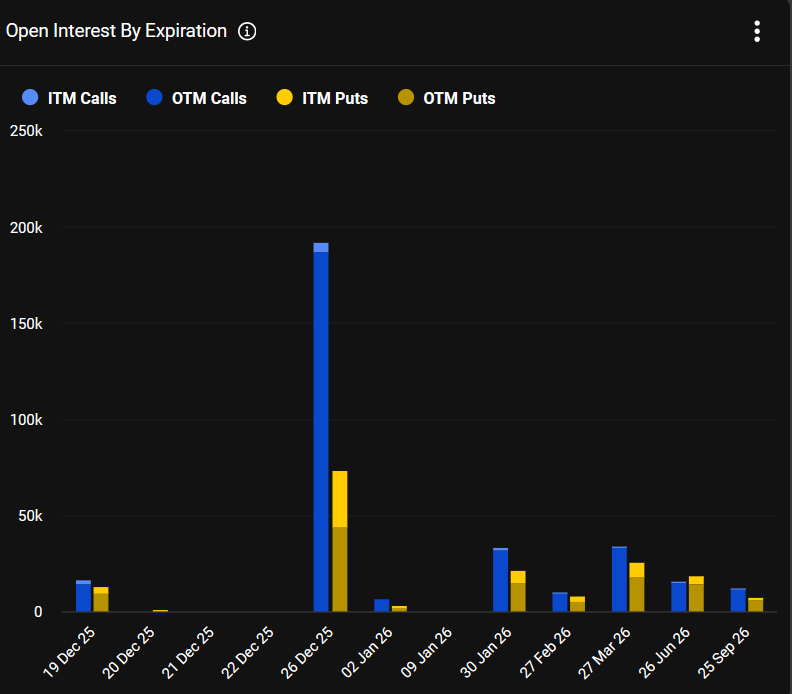

The in-the-money (ITM) and out-of-the-money (OTM) positioning reflect market sentiment. In this weekly option expiry, the total amount of in-the-money contracts is approximately $518 million. This presents 19.6% of the overall position size.

Whereas, the remaining $2.13 billion, or 80.4%, is positioned out-of-the-money, predominantly in calls

Strike Price Concentration and Market Implications

Accumulation of call interest between the $100,000 and the $105,000 strike levels suggests upside momentum can be expected in the short to medium term. The max pain level at $88,000 implies the maximum number of calls and put options will expire worthless around this area.