BlackRock has added four high-level roles to its website in a bid to expand its corporate presence in the digital asset space.

The key positions are the following: Director of Digital Assets, Director Of Regulatory Affairs, Vice President for Digital Assets and ETF legal Counsel, and Associate for Digital Assets.

The first role was posted on March 5th, 2025, ending with the last role posted on March 24th, 2025. According to BlackRock’s website, the roles are based across New York and Atlanta.

These job postings have occurred around the same time the asset management company’s BUIDL token fund has grown considerably in value. The BUIDL token fund gives investors access to money market funds through blockchain technology.

Traditional money markets allow traders to only conduct transactions during business hours. Having a token in this space gives crypto investors the ability to quickly close and open positions whenever they like during the week.

Over a three week period, the BUIDL fund grew from $615 million to $1.87 billion.

Blackrock is one of many firms expanding its presence in crypto.

Apart from the BUIDL token fund, BlackRock manages one of the largest Bitcoin ETFs worldwide. Till date, Blackrock has issued two spot ETF products: iShares Bitcoin Trust and the iShares Ethereum Trust.

Alongside firms like MicroStrategy and individual holders such as Satoshi Nakomoto, ETFs—such as those created by BlackRock—continue to be the largest holders of Bitcoin.

BlackRock continues to expand its institutional token fund across multiple blockchain. recently added its BUIDL token to the Solana blockchain on March 25th. The BUIDL token was initially launched on the Ethereum blockchain in partnership with tokenization platform Securitize.

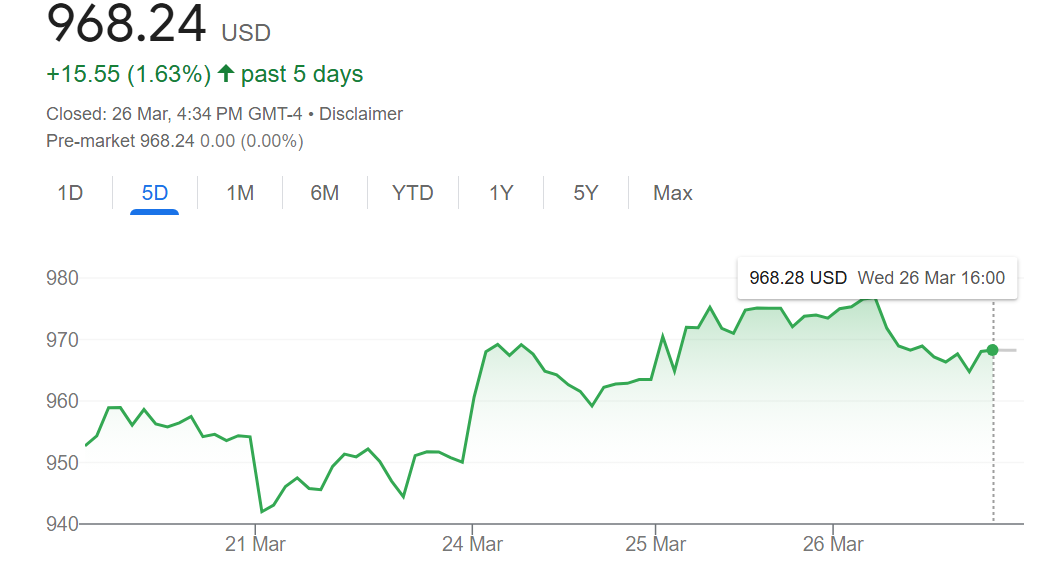

BlackRock’s share price has been holding steady over the last 5 days, ranging from $952.69 to $968.24.