Key Takeaways:

- CaliberCos Inc. stock (Nasdaq: CWD) went up over 2,500% after announcing a LINK Treasury Strategy.

- The real estate firm made an undisclosed purchase of Chainlink’s LINK token for its Digital Asset Treasury (DAT) Strategy.

- This event highlights the growing trend of businesses diversifying their treasuries with crypto assets.

Table of Contents

The Announcement That Lit the Fuse

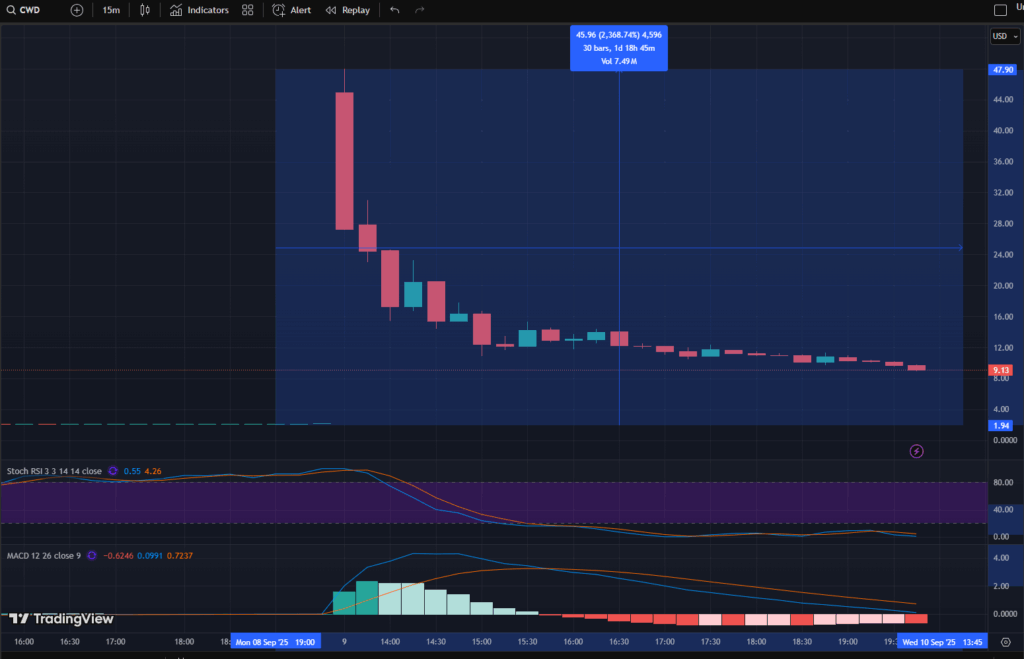

In an outstanding market event, shares of the Nasdaq-listed CaliberCos Inc. (CWD) shot up by over 2,500% one day after announcing a new focus on digital assets and its new LINK treasury strategy.

The remarkable surge, which saw the penny stock temporarily touch $56, shows both the level of investor euphoria and volatility that companies face in adopting crypto into their corporate treasury, even as shares subsequently corrected to $9.13 at market close.

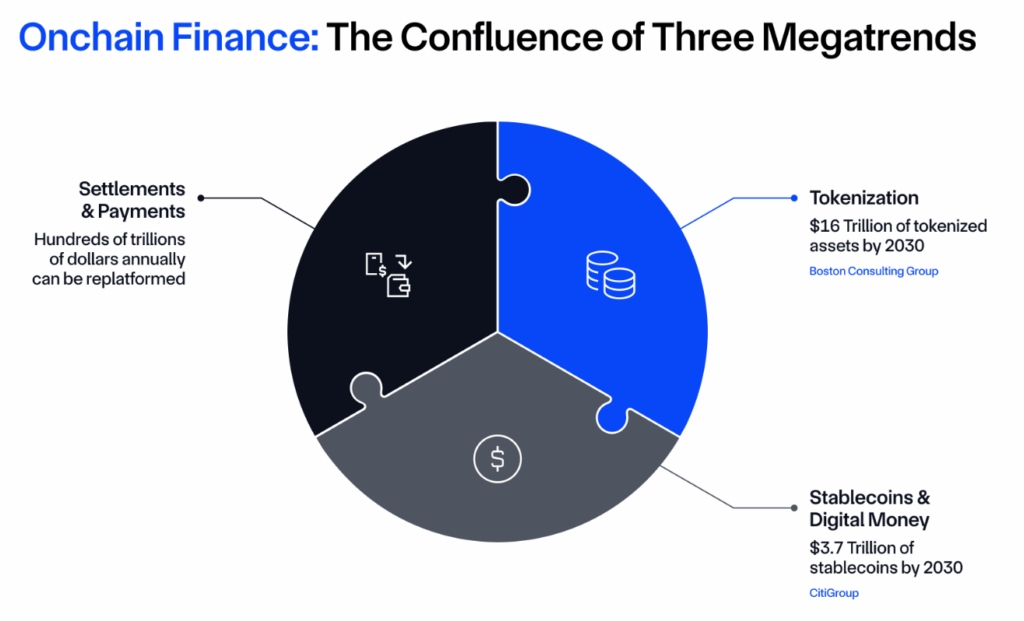

The excitement initiated when CaliberCos Inc., a real estate and investment company, announced it had made its first purchase of Chainlink’s LINK tokens. This initial allocation of funds into digital assets is where companies are heading in a model shift in how companies think about treasury reserves, where the traditional cash and bonds are positions of the past. For a smaller company than Caliber, the bet on a leading crypto asset like Chainlink was viewed as an overwhelming, high-conviction bet on the future of blockchain technology.

Read also: Why 70% Traders Remain Bullish on Chainlink (LINK)? Know the Reasons Here!

A Meteoric Rise and Inevitable Correction

CWD shares, which were trading for pennies at the time, increased in value exponentially as traders sought to acquire stock, driven by speculative investor interest. This exponential price increase continued until showing little downside, and then a significant retracement once early investors took profits.

On the other side, LINK saw an 8% increase in its price following the news, trading at $23.22 at the time of writing.

Implications for Ecosystem

Caliber’s actions are an important endorsement of Chainlink and its oracle technology that provides vital real data capabilities to smart contracts. More broadly, it indicates that the LINK Treasury Strategy trend, started by companies like MicroStrategy with Bitcoin, is trickling into alternative coins and targeted Web3 infrastructure projects.

The LINK Treasury Strategy: A High-Risk, High-Reward Blueprint

CaliberCos Inc. is showing the powerful market narrative behind corporate crypto adoption. While the sustainability of such price moves is still debatable, it is clear and undeniable that it brings mainstream attention to the strategic role of digital assets on corporate balance sheets.

Final Thought: Will Caliber’s bet cheer other micro-cap companies to pursue similar aggressive crypto treasury strategies, or will it serve as a tale of caution of extreme volatility?

FAQs

What is a treasury strategy?

How a company manages its cash and investments. A LINK Treasury Strategy means buying Chainlink’s token as a reserve asset.

Why did the stock correct?

Extreme, rapid price increases often lead to profit-taking, where early sellers cause the price to drop.

What is Chainlink (LINK)?

It’s an “oracle” blockchain project that provides real-world data to smart contracts, making it a key Web3 infrastructure.

For more Chainlink-related stories, read: Goodbye CEXs: Mastercard’s 3.5B Cards Go Onchain with Chainlink’s Crypto Bridge