Key Takeaways

- Circle revealed in its Q3 report that it is exploring a native token for its Arc blockchain, as part of a broader strategy to expand its blockchain infrastructure.

- Arc’s public testnet attracted over 100 major institutions, signaling strong institutional interest in Circle’s programmable, compliance-focused blockchain.

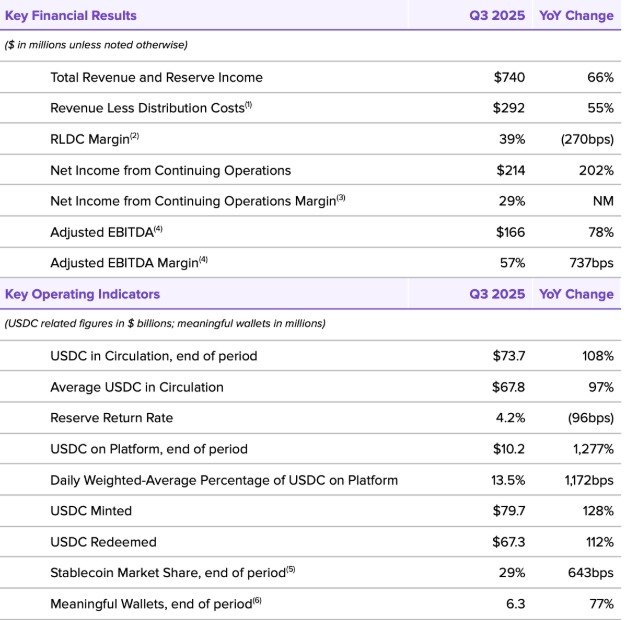

- USDC circulation surged to $73.7 billion, helping Circle post a 202% year-over-year rise in net income and strengthen its position as a leading issuer of regulated stablecoins.

- The Circle Payments Network expanded to eight countries with 29 enrolled institutions, while transaction volume hit $3.4 billion.

Table of Contents

Circle Internet Group Inc. (NYSE: CRCL), the issuer of the USDC stablecoin, said in its third-quarter results that it is exploring the launch of a native token for its Arc blockchain and expanding its global payments network, as part of a broader strategy to accelerate mainstream adoption of USDC and blockchain-based finance.

The company’s third-quarter report highlighted the launch of Arc’s public test-net, a programmable Layer 1 blockchain built for financial applications, noting that more than 100 major institutions took part in the rollout.

According to the company, Arc was designed to support developers and is already witnessing “extraordinary enthusiasm” from both traditional financial players and digital-native firms.

Furthermore, Circle said it is considering launching a native token to support network governance, encourage participation, and maintain long-term ecosystem growth.

The firm is also accelerating the rollout of its Circle Payments Network (CPN), which now includes 29 enrolled financial institutions and supports operations across eight countries, with an additional 55 firms undergoing eligibility reviews and about 500 more in the pipeline.

USDC Circulation Surges, Net Income Triples

According to the report, USDC, Circle’s core stablecoin, reached 73.7 billion dollars in circulation at the end of the third quarter, more than doubling from a year earlier. The average in-circulation supply was 67.8 billion dollars, which helped fuel a 60% year-over-year increase in reserve income.

Additionally, the company reported net income of 214 million dollars, marking a 202% rise from the previous year.

Although the reserve return rate fell by 96 basis points to 4.2%, this was offset by higher average balances. Circle also reported that 79.7 billion dollars worth of USDC was minted during the quarter, marking a 128% year-over-year increase.

Broader Adoption and Strategic Partnerships

The quarter saw a series of new or deepened partnerships across the digital asset, banking, and payment sectors. Collaborations include firms such as Brex, Visa, Deutsche Börse Group, Kraken, Finastra, Hyperliquid, Fireblocks, and Brazil’s Unibanco Itaú.

Arc Network Positioned for Institutional Finance

The launch of the Arc public testnet on October 28 was highlighted as a milestone in Circle’s transition from a stablecoin provider to a broader infrastructure platform.

According to the company, Arc was designed to bring real-world financial activity on-chain, targeting institutional users with a programmable blockchain built for speed and regulatory compliance.

Circle said the native Arc token, still under consideration, is aimed at fostering network participation, driving adoption, and supporting the long-term growth of the Arc network, adding that the development reflects a strategic shift toward building programmable financial infrastructure that integrates digital dollars into internet-based economies.

Payments Platform Gains Momentum

The Circle Payments Network has made significant strides since its launch in May.

According to the report, the network operates in eight countries with 29 institutions onboarded, while another 55 are under eligibility review and about 500 more are in the pipeline.

Furthermore, annualized transaction volume has already reached 3.4 billion dollars, driven by strong institutional interest in cross-border stablecoin flows and USDC-based settlements.

Tokenized Fund Sees Sharp Growth

USYC, Circle’s tokenized money market fund, has grown more than 200% since June 30 and now manages around 1 billion dollars in assets.

The product is part of Circle’s strategy to bring traditional capital market instruments onto blockchain infrastructure in a fully compliant manner.

Higher Costs Driven by Expansion and Stock Compensation

Operating expenses totaled 211 million dollars for the quarter, up 70% from a year earlier, including 59 million dollars in stock-based compensation.

Meanwhile, adjusted operating expenses, which exclude such items, rose 35% to 131 million dollars.

The company attributed the cost increase to a 14% rise in headcount and continued investment in platform capabilities, infrastructure, and global expansion.

Read More: Japan FSA Approves First Megabank-Led Stablecoin Under National Blockchain Initiative