Key Takeaways

- Coinbase forecasts a structural market shift, with price action driven more by institutional factors than retail hype.

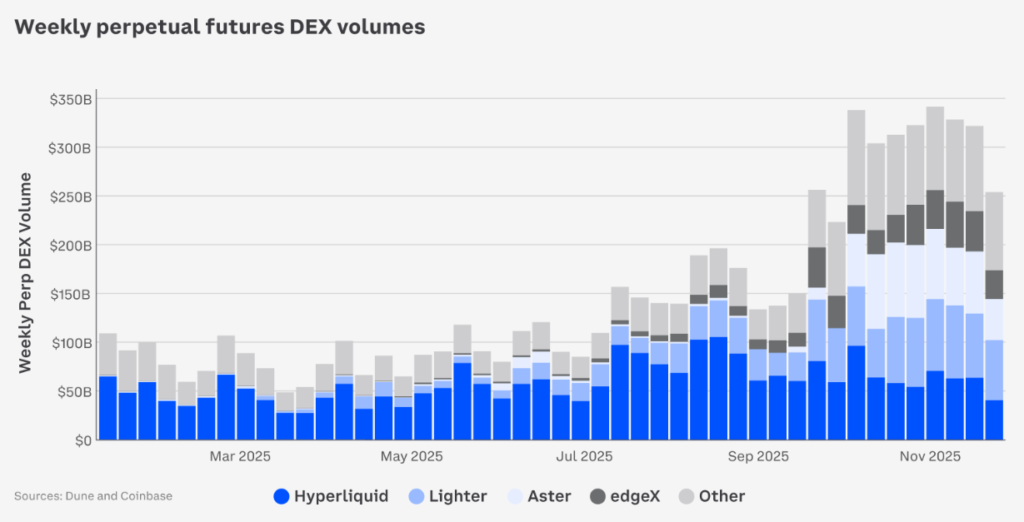

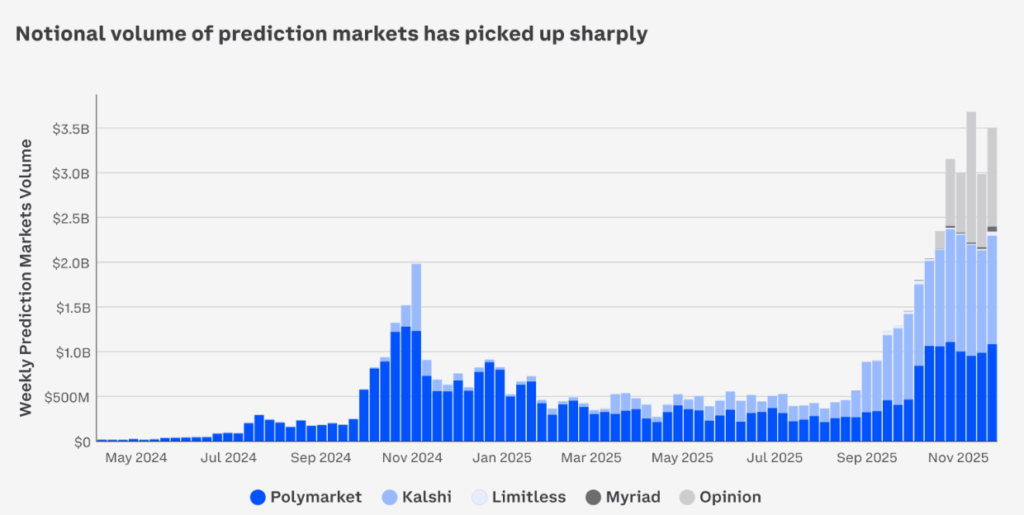

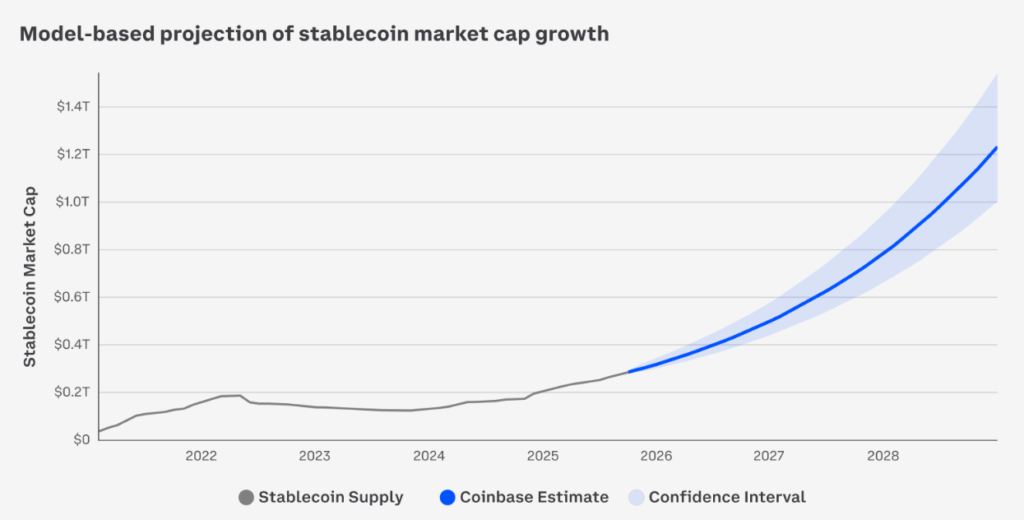

- The crypto exchange identifies perpetual futures, prediction markets, and stablecoin payments as the three dominant growth areas for 2026.

- Coinbase believes improved risk controls and regulatory clarity are creating a more mature, resilient foundation for the next growth phase.

Table of Contents

A New Marketplace Framework is About to Emerge

According to Coinbase, a leading crypto exchange, the crypto market is going through a fundamental transformation in 2026. Analysts believe that the boom-and-bust cycles of retail investors are transitioning into a cycle where institutional-level technology will dominate in how the market operates and how crypto assets are used.

Three aspects of this new marketplace framework coincide:

- Perpetual Futures are shaping the future price of crypto

- Prediction Markets are maturing into a stable infrastructure for information discovery

- Stablecoins are widely utilized for payment and settlement of real-world transactions.

Read also: Mirae Asset Group Pursues Major Crypto Foray with $100 Million Korbit Acquisition

The Foundations of the Next Cycle

As stated by Coinbase’s analysis of Perpetual Futures, they are no longer viewed as just a highly speculative instrument, but rather as an essential tool for determining the price of crypto and providing greater market resiliency through controlled risk.

Also critically, Prediction Markets have changed from being “niche” services to important financial markets with active participation from institutional investors.

Most importantly, Stablecoins have quickly become the most utilized crypto asset, driven by their association with cross-border payments, payroll, and the increasing level of integration with emerging technologies (like AI agents), rather than speculation.

Read also: Uniswap Governance Passes Historic ‘UNIfication’ Proposal, Triggers 100M Token Burn

From Hypothesis to Integration

Coinbase’s main point is that crypto is moving “from an idea to the real world.” They think that by 2026, the key segments within the ecosystem will be able to grow thanks to stricter financial requirements and a better understanding of regulations.

For Coinbase, what matters most moving forward is not what goes viral but rather how well they execute on product quality, maintaining compliance with regulations, and creating the infrastructure and technology necessary to fully integrate into the global economy.

FAQs

What are perpetual futures?

They are a type of derivatives contract that allows traders to speculate on an asset’s future price without an expiry date, using leverage. Coinbase notes that they now account for most crypto trading volume and are central to price discovery.

Why are prediction markets important?

Coinbase sees them evolving beyond gambling into platforms for information discovery and risk transfer. As volumes grow and aggregation improves, they could become a significant new financial interface, especially with potential regulatory changes.

What is the outlook for stablecoins?

Coinbase is highly bullish, calling them crypto’s top use case. The firm forecasts the total stablecoin market cap could reach a target range centered around $1.2 trillion by the end of 2028, driven by payments, remittances, and integration with other technologies.

Read also: Euro Stablecoin: Banking Giants Forge Alliance for 2026 Launch