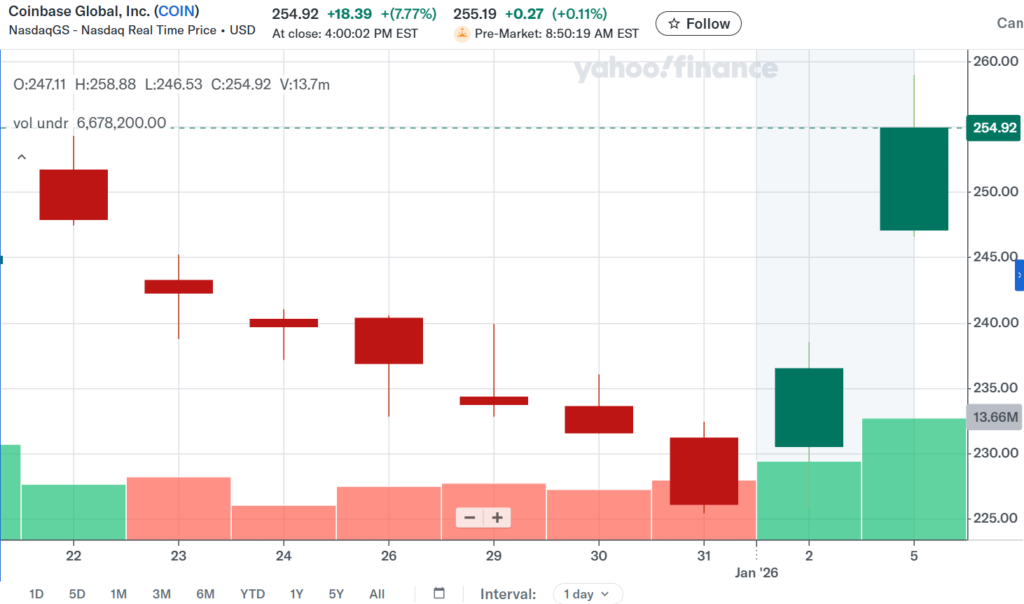

Coinbase shares jumped 8% on Monday after Goldman Sachs upgraded the stock from “neutral” to “buy”. The move signalled growing confidence in the crypto exchange’s future at a time when Bitcoin’s price has been volatile for weeks.

With one of Wall Street’s biggest banks saying that it believes Coinbase is better positioned than before, investors interested in crypto stocks will likely have more room to grow in the short-term.

The upgrade in stock rating comes just days after Coinbase announced an expansion of its services in Singapore. Interestingly, the optimism stays in tandem with Coinbase CEO Brain Armstrong reaffirming the exchange’s future goals and working structure.

Goldman’s Coinbase Stock Upgrade Diversifies Crypto Stock’s Position

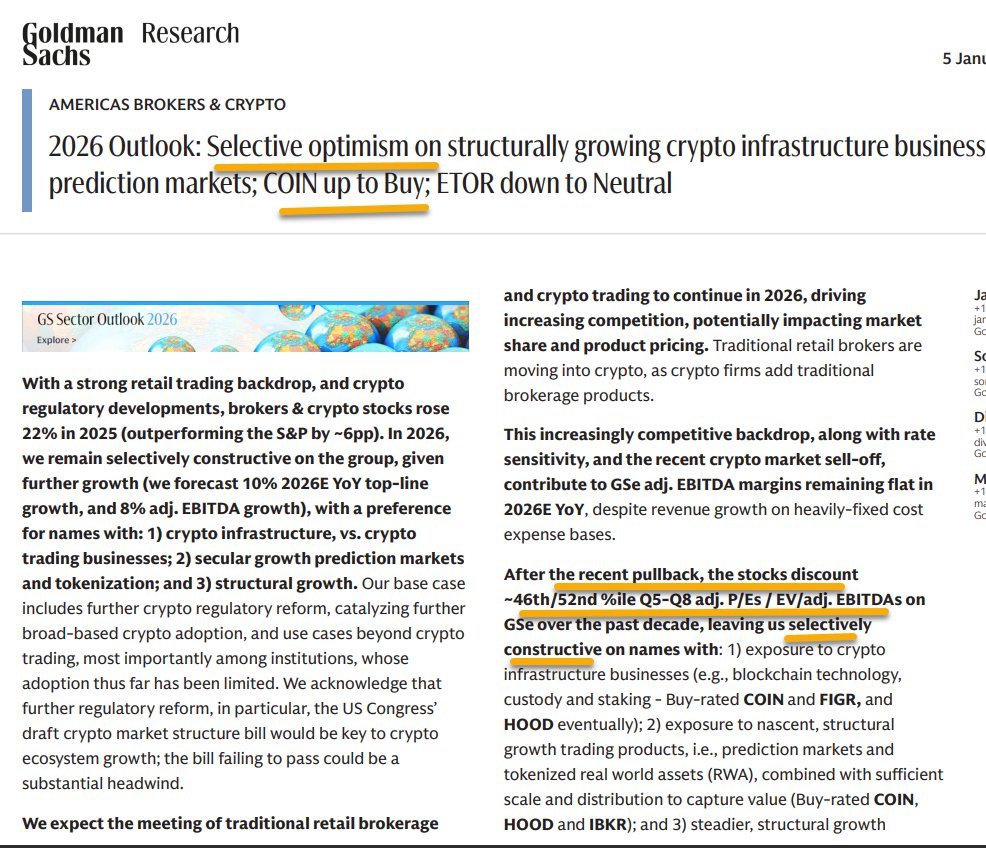

Goldman Sach’s upgrade isn’t just about short-term price movements. Goldman Sachs sees Coinbase changing from a company that mainly makes money from crypto trading into a more diversified financial platform.

In the past, Coinbase’s performance rose and fell sharply with crypto market cycles since trading fees were its main source of revenue. However, the trend is starting to change now.

Coinbase has been diversifying itself in other sectors, such as custody services for institutions, staking, stablecoins, subscriptions, and blockchain infrastructure. Such businesses usually generate relatively constant revenues and are less dependent on daily changes in the markets.

The bank has likely upgraded the rating due to the fact that the firm is now more prepared for the next level of the cryptocurrency market.

Goldman has also increased the 12-month price forecast on the number of Coinbase shares to $303, which indicates they feel the stock continues to move higher.

Regulation is another reason for the positive outlook. The bank thinks that over the next few years, especially in the US, there will be clearer and more helpful rules for cryptocurrencies. More clear rules could make more institutions and traditional investors want to get into the crypto space. This would be good for a regulated exchange like Coinbase.

Looking ahead, the bank also expects 2026 to be an important year for crypto adoption, driven by better stronger infrastructure and more real-world use cases.

The key message for investors is that Coinbase is now a long-term investment in the development of digital assets and blockchain-based finance rather than merely a wager on fluctuations in cryptocurrency prices.

Coinbase’s Rating Upgrade Comes After Brian Armstrong’s Outlook Reaffirmation

Brian Armstrong, the CEO of Coinbase, recently reaffirmed the platform’s approach, outlining the company’s goal of becoming an “everything exchange.”

Armstrong said Coinbase intends to continue growing its Ethereum layer-2 network, Base, until 2026, expand its exchange capabilities, and give stablecoins priority.

The business has already made progress in that area. In an effort to capitalize on one of the fastest-growing cryptocurrency marketplaces in 2024, Coinbase partnered with Kalshi earlier this year to incorporate prediction markets across its platform.

Coinbase Shares Extend Rally on New Singapore Business

Interestingly, Coinbase has launched “Coinbase Business” in Singapore, which marks the company’s inaugural foray in launching such services overseas. This service benefits startups and small organizations in handling cryptos in a convenient manner, as it enables instant USDC payments, international money transfers, and automated bookkeeping solutions for daily business transactions involving cryptos.

The launch builds on Coinbase’s work with the Monetary Authority of Singapore under the BLOOM Initiative, which aims to improve safe and compliant cross-border digital payments.

With features like USDC-based global payouts, lower-cost international transactions, and APIs for payroll and vendor payments, the platform is supported by real-time SGD banking access via Standard Chartered.

Coinbase says the move is designed to support Singapore’s growing innovation ecosystem by combining fiat and crypto services within a clear, regulated framework.