Key Takeaways

- Coinbase introduced “The Blue Carpet,” a new issuer-facing listings program aimed at improving transparency and accessibility for token projects.

- Minutes after the announcement, Coinbase added Binance Coin (BNB) to its official listing roadmap, signaling potential plans to list its rival’s flagship token.

- BNB recently hit a new all-time high with a market cap peaking above $190 billion, briefly surpassing Tether to become the world’s third-largest crypto.

On Wednesday, Coinbase created two shockwaves within the crypto community when it announced a significant upgrade of its asset listings system and at the same time gave hints that it intends to add Binance Coin (BNB) to its platform. The transition would be an uncharacteristic recognition of a competing exchange native token and may redefine the market competition between the two largest crypto exchanges.

Coinbase Announces Binance Coin Listing

At approximately 4:12 p.m. UTC, Coinbase announced a new issuer-focused listing program, “The Blue Carpet.” The purpose of the program is to make the process of evaluations and onboarding of new assets easier and standardized in the ecosystem of Coinbase.

The company claims that the initiative provides direct communication with the team of listings at Coinbase, a request to update the token page on both its two exchanges. It also offers bonuses like service referrals, market-making collaboration, and limited Coinbase One membership to the qualified project teams. Coinbase stressed that the listing is free and there is no necessity that the projects should buy optional services.

Just a little bit more than half an hour after announcement Coinbase Markets announced that BNB was added to its official roadmap. This move indicates intent to list but does not mean that it can trade at that time. The listing helped to understand that to be placed on the roadmap, the asset must be under consideration and can be listed only after fulfilling certain technical, liquidity, and regulatory criteria. Coinbase will attest to trading schedules upon fulfillment of such requirements.

The BNB roadmap addition timing attracted focus all over the industry. Less than a week before, the Chief Investment Officer of Arca Jeff Dorman described the token selection policy of Coinbase as one that tends to pass over fundamentally sound projects, like those of competitors, in favor of less-established ones. Dorman singled out BNB, LEO, TRX and HYPE as examples of tokens that had solid revenue support and robust buyback systems that should have wider exchange coverage.

Since it was introduced in 2017, as a discounted token that customers can use to pay trading fees on Binance, BNB has developed into the currency that drives the BNB Chain network. It is currently the main gas token used to undertake on-chain transactions, staking, payments, and governance services. Its addition to the Coinbase roadmap indicates that it is more open to serving nonnative ecosystem tokens, assuming the compliance and infrastructure needs are met.

BNB vs. Tether: The Dethrone Game Starts

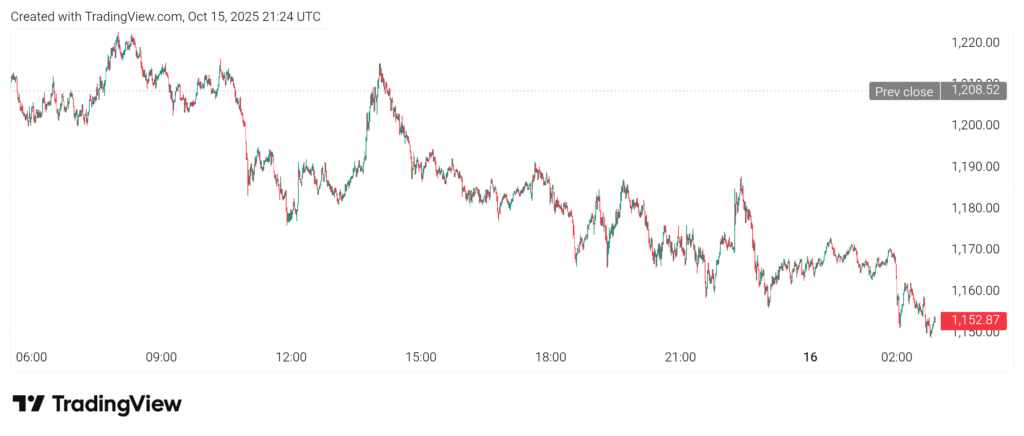

The relevance of BNB has also been strengthened by its performance in the market. The token is making a fresh all-time high on October 13, 2025, after a severe drop that had previously occurred due to a flash crash. Market capitalization spiked to over $190 billion and dropped within a short time to approximately $184.5 billion, making BNB the third-largest crypto in the world: behind Bitcoin and Ethereum but ahead of Tether and XRP.

BNB was trading at a price of 1,164.33, down by 4.7% in the past 24 hours with a market cap of 163 billion. As Coinbase is set to go public soon, traders are keeping a close eye on whether the market might rebound in terms of demand to enable BNB climb up the rankings once again above Tether.

Read More: Binance News Today: BNB Flips XRP, Technicals Point to $1,504 Target