In a surprising strategic shift, Coinbase announced Monday, it will pause all services involving the Argentine Peso, halting local currency deposits, withdrawals, and trading just one year after its high-profile market entry.

A Swift Reversal on Local Fiat Rails

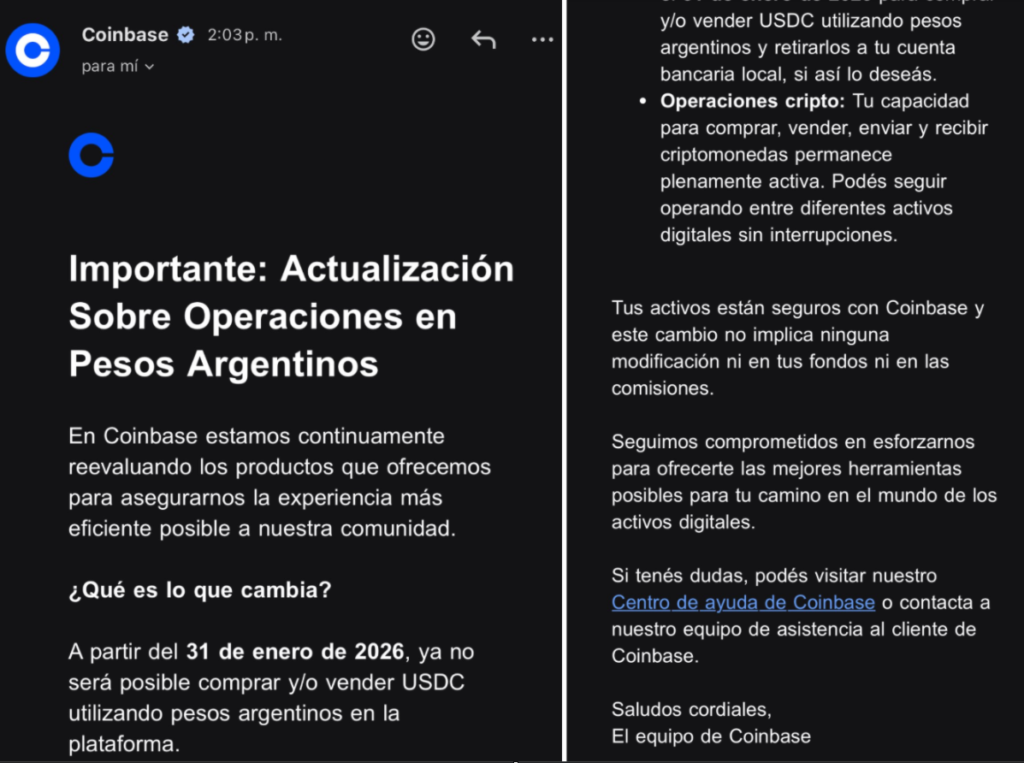

In a move that marked crypto exchange Coinbase making a swift retreat from direct fiat operations in Argentina, the company notified its users that as of January 31, 2026, it will suspend all services tied to the Argentinian Peso, including buying or selling the USDC stablecoin with ARS and withdrawing funds to local bank accounts.

The company has given users a 30-day window to complete any pending peso transactions. The crypto exchange described the move as a “deliberate pause” to “reassess and strengthen” its approach aiming to return later with a more sustainable product offering.

Read also: Global Crackdown on Crypto Tax Evasion Now in Force

Crypto Services Remain, But Fiat Access Narrows

While the pause on Argentinian Peso services is a meaningful setback for easy on-ramps, Coinbase emphasized that core crypto functionality remains intact. So far, Argentine users can continue trading cryptos against each other on the platform, and all customer funds are Secure Asset Fund for Users (SAFU).

The surprising decision highlights the huge operational, and regulatory complexities global exchanges face when integrating with volatile local currencies and banking systems, particularly in markets with high or variable inflation and evolving financial rules.

Read also: Coinbase 2026 Outlook: Crypto’s Future Hinges on Derivatives, Prediction Markets, and Stablecoins

A Market in Flux

This pullback comes amid a very turbulent period for crypto in Argentina, following the political memecoin scandal involving President Javier Milei and the crash of the LIBRA token.

Although the firm didn’t cite this directly, the atmosphere underscores the main challenges of operating in this part of the world.

The crypto exchange stated that Latin America remains a central focus, suggesting this is more like a tactical withdrawal rather than a full exit, and possibly awaiting clearer regulations or more stable banking partnerships before re-engaging with the peso.

So far, Argentina has become one of the main crypto hubs in the region, where the Web3 community is pushing adoption and developments to another level.

FAQs

Can users still trade crypto on Coinbase in Argentina?

Yes. The firm stated that this pause will only affect services directly involving the Argentine Peso (ARS). So far, the trading between different cryptos (example: Bitcoin for Ethereum) on the Coinbase platform remains fully operational for Argentine users.

What happens to the user’s pesos (ARS) or USDC in their account?

Users have until January 31, 2026, to sell any USDC for pesos and withdraw those pesos to their local bank account. After that date, the peso withdrawal function will be disabled. User’s crypto assets are unaffected.

Is Coinbase leaving Argentina completely?

No. The company calls this a “pause” and states it plans to return with a stronger and better offerings. It will also maintain a presence through its Layer-2 network, Base, and partnerships with local entities like Ripio exchange.

Read also: Isolated Turkmenistan Legalizes Crypto Mining and Exchanges