Key Takeaways

- FTX Challenges 3AC’s $1.5 Billion Claim: FTX is aggressively disputing Three Arrows Capital’s massive recovery claim.

- Accusations of Inflated Losses: It alleges that 3AC exaggerated asset values and ignored significant debts to manufacture fake losses.

- Disputed Valuations and Debts: 3AC claims it held $1.6 billion on FTX, while FTX values it at $1.02 billion, with large discrepancies in debt amounts.

- Legal Battle with Broader Implications: The upcoming court hearing could set key precedents for handling claims and liquidation rights in crypto bankruptcies.

- A decision that may define the future: The final decision taken will set important precedents on how claims between failed crypto firms are handled, especially around leverage, liquidation rights, and loss allocation.

FTX Fights Back Against Bankruptcy Claim

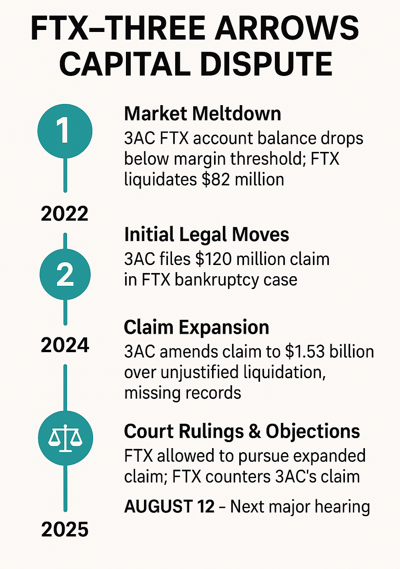

The collapsed crypto exchange FTX has launched a fierce legal battle against defunct hedge fund Three Arrows Capital (3AC), challenging the firm’s massive $1.5 billion recovery claim in Delaware bankruptcy court. The high-stakes dispute marks one of the largest creditor challenges in FTX’s ongoing bankruptcy proceedings.

Accusation of Manufacturing Fake Losses

FTX’s legal team has filed a brutal 94-page response, systematically attacking 3AC’s financial claims and accusing the hedge fund of fabricating losses. The exchange’s lawyers argue that 3AC deliberately ignored substantial debts while inflating asset values to create an artificial claim.

The crypto exchange collapsed in November 2022 after revelations that founder Sam Bankman-Fried illegally diverted billions in customer funds to cover losses at his trading firm Alameda Research. The fraud left approximately $8 billion in customer deposits missing. The bankruptcy proceedings continue to generate complex legal battles, including FTX’s current fight against Three Arrows Capital’s massive $1.5 billion claim.

Accounting Battle Reveals Massive Discrepancies

The dispute revolves around how much cryptocurrency Three Arrows Capital (3AC) actually held on FTX when both companies collapsed in mid to late 2022. 3AC claims its account balance was nearly $1.6 billion, while FTX asserts the net value was only $284 million after deducting $733 million in margin debt.

In a recent filing, FTX argued that 3AC is ignoring its liabilities and is now trying to shift the burden of its high-risk, leveraged trades onto other creditors. “FTX creditors should not serve as a backstop for 3AC’s failed trades,” the FTX estate stated.

3AC’s original claim, filed in mid-2023, sought $120 million, but by November 2024, that figure had ballooned to $1.53 billion. The hedge fund’s liquidators allege that FTX breached its obligations and delayed sharing key information about the liquidations. While Chief Judge John Dorsey has previously sided with the liquidators on certain discovery matters, the overall claim is still being reviewed.

FTX insists the liquidation was not a seizure, but a contractual action that converted volatile crypto assets into US dollars. The company argues this move protected 3AC’s holdings and preserved their value, rather than contributing to the losses.

Conflicting Valuations Deepen the Dispute

The two sides can’t even agree on simple numbers:

- FTX says 3AC’s crypto was worth $1.02 billion at most, but 3AC claims $1.59 billion

- FTX says 3AC owed $733 million, but 3AC says only $1.3 billion

These massive discrepancies underscore the complex challenge of reconstructing accurate financial positions from interconnected crypto failures. Both firms collapsed within months of each other during 2022’s market carnage, creating overlapping claims and competing narratives.

Future Hearings Could Set A Precedent

The scheduled August 12 court hearing represents a critical moment for cryptocurrency bankruptcy law. If Judge Dorsey accepts FTX’s arguments, 3AC’s claim could face complete rejection or reclassification as an unsecured obligation, dramatically slashing potential recovery.

The outcome will establish important precedents for evaluating claims between failed crypto entities, particularly regarding leverage, liquidation rights, and market loss allocation. With 3AC’s response due July 11, both sides prepare for what could become a defining moment in crypto bankruptcy proceedings.

Read More: FTX Begins $5B Payout, Creditors to Get Up to 120%