Key Takeaways:

- The crypto market cap fell 1.96% to $3.99T, with BTC, ETH, and XRP all declining

- Despite a 2.6M ETH unstaking queue, staking inflows remain strong, showing long-term confidence.

- Fundamentals for Ethereum remain robust, with potential for a rebound if $4,500 support holds.

The broader crypto market is currently trading in the red, with the market capitalization (cap) decreasing by 1.96% going from $4.07 trillion to $3.99 trillion. Moreover, the top three crypto tokens by market cap, such as Bitcoin (BTC), Ethereum (ETH) and XRP have decreased by 0.79%, 3.11% and over 3.4% respectively.

According to Ted Pillows on X, who is a crypto investor, entrepreneur and key opinion leader (KOL), ETH just attempted to break over the $4,650 mark, which is a significant barrier (a price level where sellers tend to appear), but it failed to do so. This indicates that purchasers were not yet strong enough to drive up the price.

The next region to examine is $4,500, which is a support level, a zone where buyers have previously entered. If ETH pulls back, this level may be tried again.

On the other hand, if buyers (bulls) regain control and Ethereum closes over $4,650 on significant trading volume, it might pave the way for a new all-time high (ATH). That is because breaking above major resistance with momentum typically indicates fresh market strength and confidence.

If bulls push Ethereum above $4,650 with strong volume, a new ATH could happen.

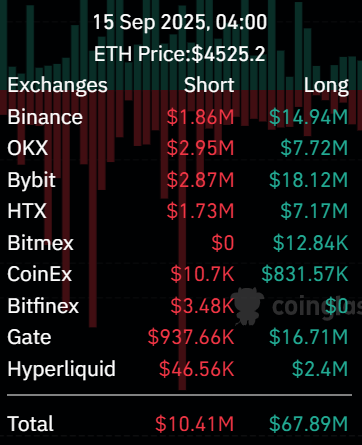

However, since the tweet, ETH has fallen by over 3% and continues to decline. At $4,525, Ethereum had a dramatic increase in liquidations, with $67.89 million in longs wiped out vs only $10.41 million in shorts, indicating a textbook long squeeze.

This shows that many traders were too bullish and overly leveraged, and when prices fell, forced liquidations occurred on the long side. While this shows short-term suffering, it has the potential to reset the market for a stronger rebound, provided support levels hold.

What Does On-Signals Say About ETH

ETH is experiencing an increase in unstaking, in which users want to remove previously staked ETH coins they locked up to help secure the network in exchange for rewards. Currently, 2.6 million ETH is in the exit queue and will take around 45 days to process.

While this may cause anxiety, many investors are still staking ETH, demonstrating long-term faith in the network. Furthermore, the majority of the unstaked ETH has yet to be transferred to exchanges; thus, sell pressure remains modest. In conclusion, despite the headlines, this appears to be profit-taking rather than panic, and the fundamentals of Ethereum remain robust.

Conclusion

ETH’s latest drop exemplifies short-term volatility, with massive liquidations boosting pressure. However, strong stake inflows and modest sale pressure show that its fundamentals remain strong. If ETH maintains support near $4,500, it may reset for another try to breach $4,650 and even reach a new all-time high.