Key Takeaways

- Bitcoin (BTC) slipped from the day’s high of $113.40, triggering $358 million in crypto asset liquidations.

- The market recorded $215 million in long liquidations and $139.8 million in short liquidations.

- A dip below $110,000 could trigger another 2.5% decline in BTC price.

The U.S. unemployment rate triggered selling in the cryptocurrency market, the top asset, Bitcoin (BTC), slipped 2.7% following the announcement, as an initial reaction.

The sudden drop in BTC’s price has shaken the market and triggered mass liquidations, creating fear among investors and traders.

U.S. Unemployment Fuels $360 Million Liquidation

As per the recent report, the U.S. unemployment rate for ages 16-24 has risen to 10.5%, triggering a mass sell-off. Data shows that this announcement caused BTC’s price to plunge from $113,300 to $110,280.

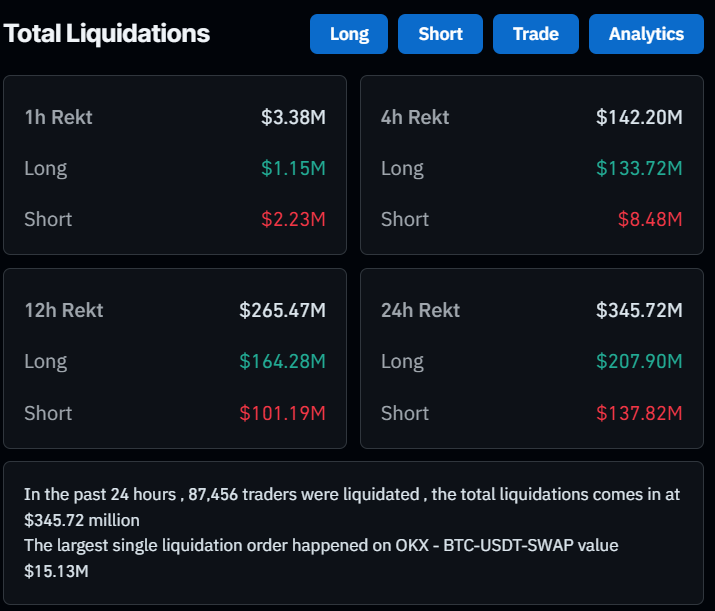

The on-chain analytics firm Coinglass reveals that a dip in the crypto market has triggered liquidations worth more than $358 million in crypto assets.

Traders using high leverage were the hardest hit, according to the data. Coinglass reveals that the majority of crypto liquidations came from traders holding long positions, accounting for $215 million, while $139.8 million worth of short positions were also liquidated at the same time.

Amid this liquidation, the asset hit hardest was ETH, followed by BTC, with $121.13 million and $119.80 million worth of crypto liquidations, respectively.

Also Read: Bitcoin Dips to 110K as Fed Cut Bets Build Despite Trump–Russia Clash

Current Price and Rising Volume

At press, BTC is trading at $110,700, holding a 1% gain in the past 24 hours. Meanwhile, its trading volume has also jumped by 6% during this period, suggesting increased participation from investors and traders compared to the previous day.

Bitcoin (BTC) Price Action and Upcoming Levels

Despite the positive gain, BTC’s price action has weakened following this dip but still found support near the $110,000 level from an ascending trendline that has been in place since September 1, 2025.

Based on the current price action, if this downside momentum continues and BTC fails to hold the $110,000 support, it could pave the way for a further decline. If this happens, BTC may see another 2.5% drop and reach major support near the $107,500 level.

On the other hand, a price reversal is only possible if the asset holds above the $110,000 level. If this happens, prices may rebound quickly.

Bearish Signals Emerge from Technical Indicators

In addition to the price action, the technical indicators Supertrend and Relative Strength Index (RSI) are flashing bearish signals.

At press, the Supertrend has turned red and moved above BTC’s current price, suggesting that the asset is in a bearish trend with strong selling pressure.

Meanwhile, the RSI stands at 44, indicating that the asset is in the bearish-neutral zone and may face further selling pressure if it fails to rebound.