Key Takeaways

- The recent crypto market crash instigated a record $19 billion liquidation event, impacting over 1.6 million traders.

- Bitcoin (BTC) plummeted 12% from its latest $125,000 peak following Trump’s announcement of 100% tariffs on Chinese imports.

- Suspicious activity from whales shows massive short positions were opened before the policy reveal, with potential insider trading job.

Table of Contents

Tensions Over World Politics Fuel Historical Sell-Off

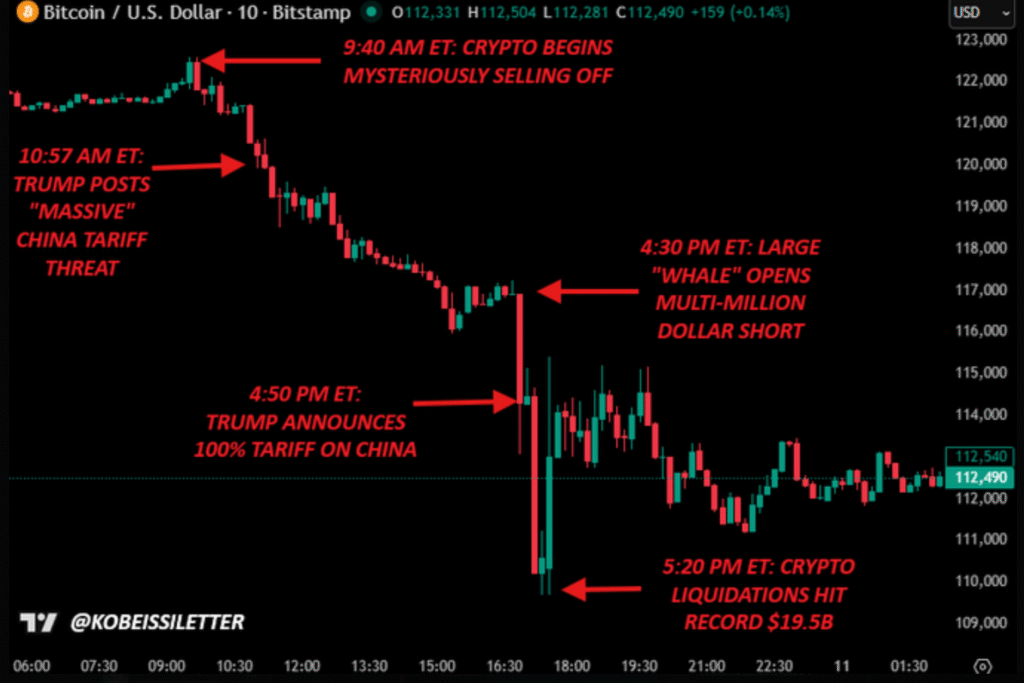

Financial markets just witnessed one of the biggest crypto market crash events in its history, with liquidations exceeding $19 billion after President Donald Trump threatened to impose 100% tariffs on all Chinese imports. In just one day and within a matter of hours, billions of dollars in value evaporated from markets, with Bitcoin (BTC) dropping from a recent all-time high (ATH) of over $125,000 to a price of about $108,000.

Ethereum (ETH) dropped a massive 16% too, along with other major cryptos. One of the biggest losers was the IP Story (IP) token, going down around 50%.

On the other hand, $1.65 trillion was wiped out from Wall Street, with U.S. stocks having their worst day since April.

This crypto market crash portrays the largest single-liquidation event ever recorded in the digital asset markets, and it is unprecedented, surpassing all previous records for liquidations during significant market downturns.

Suspicious Trading Activity Develops

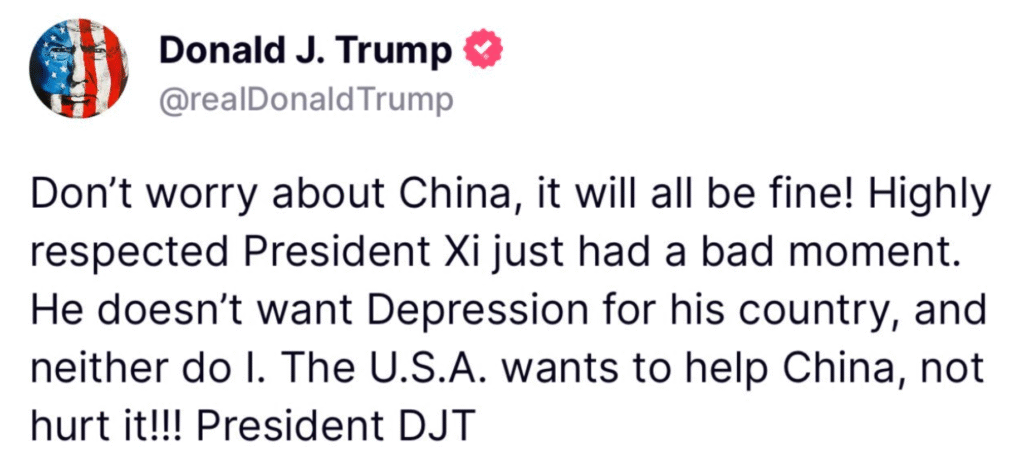

The severity of the crypto market crash has raised suspicions about potential insider trading after blockchain analysts noted suspicious whale activity ahead of Trump’s official announcement. According to market investigators, one of Bitcoin’s oldest wallets opened massive short positions worth billions just days before the tariff revelation, then doubled these positions 30 minutes before Trump’s formal White House announcement. Such behavior suggests the possibility of traders having advanced knowledge about the policy announcement that resulted in the crypto market crash.

Making over $88 million profit in just 30 minutes before major news is not coincidental or accidental, but rather looks like an orchestrated financial collapse. You see, the announcement dropped minutes before the Asian markets opened, kind of perfect for insiders to short on crypto and cash in on chaos.

Moreover, according to investigators, these same addresses were active during the Taiwan tension during 2024, the BlackRock Exchange Traded-Fund (ETF) ‘fake approval’, and the Iran oil sanctions leak. Same wallets, same actors, same scheme.

But a 100% tariff is not just about fighting China; it’s about control. For instance, the crypto market crash forces capital back to U.S. bonds, weakening the Chinese over-the-counter (OTC) crypto balances. Also, pushes the FED into cutting rates, which fuels Trump’s campaign narrative.

Read also: Time to buy? Crypto Whales Are buying PEPE, ETH, and HYPE like Crazy

Recovery Amid Ongoing Uncertainty

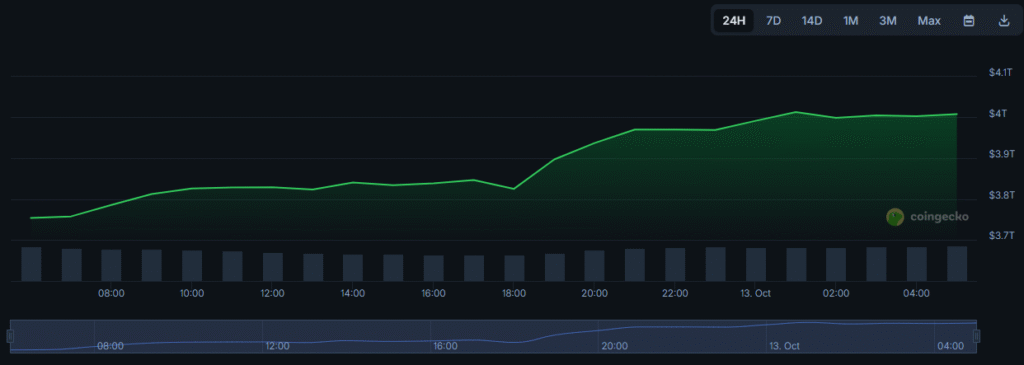

Despite the dramatic crypto market crash, markets showed resilience as tensions eased following China’s clarification that their rare earth export controls weren’t a complete ban. Today, Monday, 13, the entire crypto market capitalization has recovered from the low watermark, reaching a gain of $180 billion on Sunday, moving back to approximately $4 trillion.

However, this situation reiterates the extent to which crypto is still sensitive to geopolitical events and the ability of the market to manipulate around major policy announcements, leaving regulators and investors alike examining the circumstances behind this historic volatility event.

FAQs

What set off the giant liquidations in the most recent crypto market crash?

Trump’s announcement of 100% tariffs on Chinese imports triggered panic selling, forcing leveraged positions to be automatically closed when prices fell rapidly.

How much value did Bitcoin lose?

Bitcoin went down about 12% from its $125,000 peak to around $108,000 at the lowest point during the sell-off.

Are there investigations into insider trading?

While no formal investigations have been announced, but blockchain researchers and investigators have identified suspicious trading patterns that suggest some market participants may have had advance knowledge of the tariff announcement.

For more Trump-related news, read: Trump Backs $600 Minimis Crypto Tax Exemption