Crypto markets are often seen as high risk, high reward assets. As the market starts to mature, there is still space for improvement in terms of retracement or corrections, making this one of the largest corrections the cryptocurrency market has experienced in a long time. The market’s total value dropped from about $4.27 trillion in October 2025 to about $2.22 trillion in early February 2026. This drop is a loss of over $2 trillion in a timespan of just four months. The continued plunge in the market triggered panic selling from the retailers. As a result, investors lost faith after experiencing a prolonged period of rising market value, during which Bitcoin had surpassed $126,000.

The market is acting accordingly since the largest cryptocurrency has seen a drop, followed by Bitcoin dominance at 58.84%. In the last 24 hours, Bitcoin’s price dropped to about $60,000, forming a quick wick. This level of value is about 48% lower than the highest point it reached in October 2025. The current 24-hour downside movement of 8% shows that there is still a lot of selling pressure in both the spot and derivatives markets.

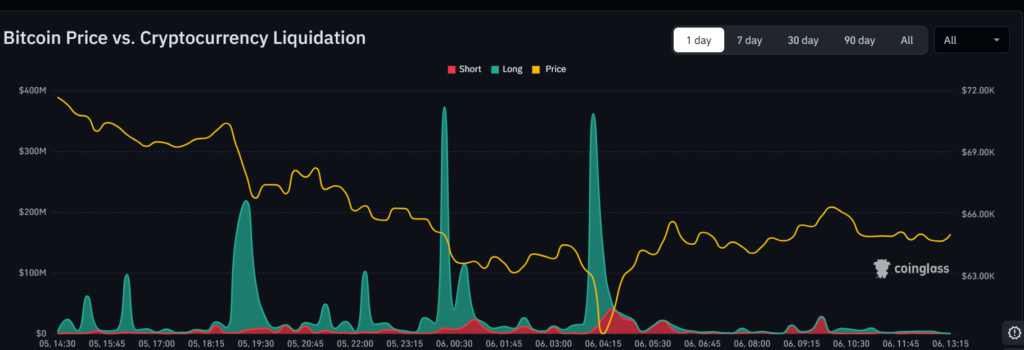

Aggressive Long Liquidations

Considering the derivative side of crypto, more than $2.6 billion worth of liquidations took place in the last 24 hours. This data from Coinglass suggests that people are deleveraging. Bitcoin had the most, with $601 million in long positions and $247 million in short positions sold. Long liquidations are more than 2.5 times higher than short liquidations. This shows that a lot of the recent drop is because people had to sell their bullish bets that were too leveraged.

When prices go down, margin calls happen, forcing leveraged positions to close. This means the market participants need to sell long positions that were opened using the borrowed funds and this may create further downside pressure. These closures make prices go down even more, which starts a chain reaction that makes it accelerate. The loop keeps going until traders who are using leverage either close their positions completely or the market gets new support.

In this case, altcoins have also gone down, and many of them have followed Bitcoin’s lead. Some smaller tokens lost a bigger percentage of their value, but the overall trend shows that the market is getting less leveraged, not just a few sell-offs. The fact that selling on the spot market and closing derivatives affect each other demonstrates how much the crypto world has grown.

Market Cap And Investor Sentiment

Over the past week, charts of market capitalization show a classic pattern of reversal. The market has lost more than half of its value since it hit a high of about $4.27 trillion back on 6 Oct. 2025. The current value of $2.22 trillion is down about 13.5% from last week. This above chart shows how quickly and strongly the correction is taking place.

Investor sentiment is now very close to the lowest points of the bear market in 2022. The market participants are experiencing extreme fear, reflected by a crypto sentiment score of 5, which is the lowest level since 2022. There have been times in the past when people were in the same sentiment and followed cautious practices to scale into positions because there was heavy volatility and leveraged selling going on at the same time. This is what is happening in the market for Bitcoin and other digital currencies right now.

Institutional investors have been cautious, either pulling back on their investments or staying out of the market altogether. On the other hand, retail traders don’t seem to be as willing to take risks anymore. The market is still unstable because there aren’t as many individuals who want to scale to the buy side, as the respective liquidity is still silent. This data shows that having loaded bullish positions and high leverage in one place can make the market more likely to experience sharp retracement.

Key Support Levels And Future Outlook

Bitcoin is still in its risky investment stage, as the price needs to create a base for price structural change. The market participants are keeping a close eye on the $60,000 to $65,000 range because it could be a support region for the near term. If the asset trades above these levels, it could mean that the selling trend is experiencing a cooldown. Prices could continue the downtrend if it doesn’t hold strong in this zone, especially if there are a lot of derivative liquidation flows.

The selloff is likely to continue until the sell-side liquidity builds up. Following this case, the FOMO traders tend to scale into shorts and later the market can catch up to that liquidity as a fuel to make an upside move, triggering a relief rally.

The Market Structure

The correction shows how much leverage can change the crypto markets. Having a lot of liquidity in one place can make the move to experience heavy volatility. The feedback loop illustrates the systemic risks associated with excessive trading activity, particularly in derivatives markets, following the closure of a trade. The overall market structure remains bearish until any major inflows from institutions take place.