Table of Contents

Key Takeaways

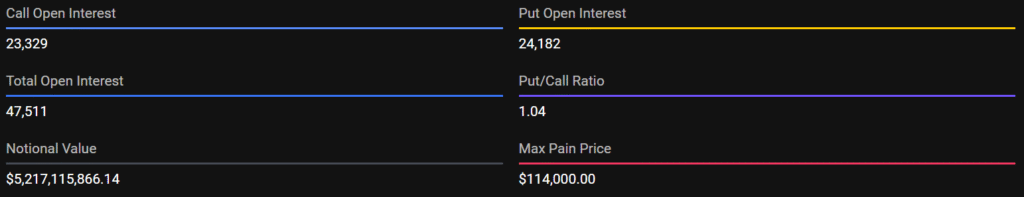

- Bitcoin options worth $5.2 billion are set to expire on Friday, October 24.

- The Put/Call Ratio (PCR) at 1.04 indicates a slightly bearish-to-neutral outlook.

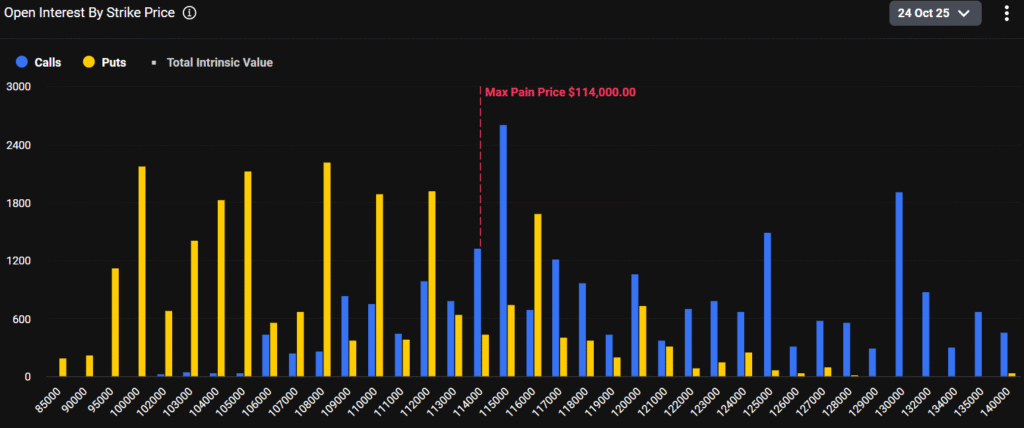

- The max pain level is at $114K, the price at which the most options contracts expire worthless.

At the time of writing, Bitcoin hovers near $110K and a total notional value of $5.21 billion in BTC options is set to expire on October 24, 2025. Deribit data suggests that there are a total of 47,511 open contracts comprised of 23,329 call options and 24,182 put options. A PCR of 1.04 shows a bit of a bearish tone as traders hold more puts than calls going into expiry.

Calls Breakdown

In-the-Money (ITM) Calls

The total In-the-Money (ITM) Calls include 1,965.4 contracts, with a total value of $215.8 million (8.42%), that are in the money. The above positions are currently profitable for holders at the current spot price.

Out-of-the-Money (OTM) Calls

There are currently 21,364 contracts, with a total value of $2.34 billion (91.58%), that are out of the money. Most are bunched up around the strike levels between $122K and $128K, which suggests that traders expect moves to either side and potential upside.

The total notional of call options is $2.56 billion.

Puts Breakdown

In-the-Money (ITM) Puts

There are 10,553 contracts valued at $1.16 billion (43.64%) that are currently in the money. These show strong demand for downside protection.

Out-of-the-Money (OTM) Puts

A total of 13,628 contracts worth $1.49 billion (56.36%) remain out of the money that are mainly concentrated between the price levels of $110K and $114K, showing traders are hedging against short-term price drops.

The total notional value of put options stands at $2.65 billion.

ITM vs OTM Overview

In total, 26.35% of contracts are in the money, with the remaining 73.65% out of the money. The distribution of contracts indicates that the market is suggesting most traders are looking for possible price shifts around expiry times instead of holding deeply strong directional bets. The larger supply of out-of-the-money calls suggests an expectation of near-term upside, while the out-of-the-money puts indicate hedging activity below the $114k level is more likely to continue.

Market Outlook

The max pain level at $114,000 suggests that the large number of option sellers would benefit if Bitcoin closes near this level. With ETF (Exchange Traded Funds) inflows continuing to rise from the past 3 months with $226.7M in inflows and October historically being a strong month for Bitcoin, with an average gain of 18% in nine of the past ten years, the broader sentiment remains cautiously optimistic.

Bitcoin may experience short-term volatility below $120K, but seasonal strength and sustained institutional inflows could help stabilize price action after expiry.