Key Takeaways

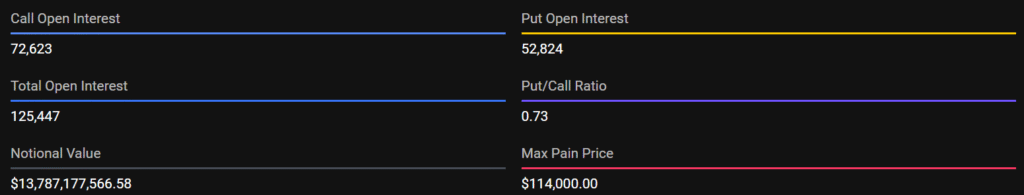

- Bitcoin options worth $13.8 billion will expire on Friday, October 31.

- The Put/Call Ratio (PCR) is at 0.73, which suggests a bullish market bias.

- The max pain level stands at $114K, the price at which the highest number of contracts would expire worthless.

Bitcoin trades below $110K ahead of monthly option expiry. An overall notional of $13.8 billion in BTC options expiring on October 31, 2025. Total exposure increases to approximately $17 billion in aggregate, with Ethereum options expiring on the same day. Deribit data shows a total of 125,272 open contracts consisting of 72,238 calls and 53,035 puts.

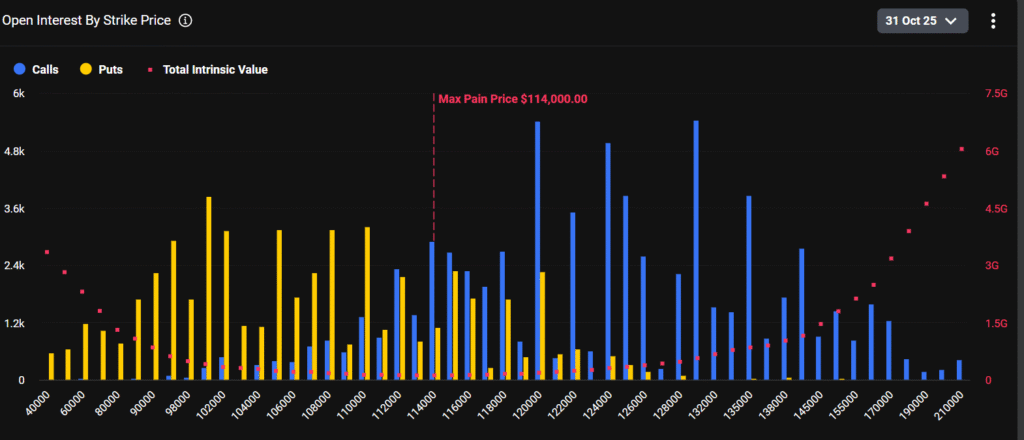

Open Interest By Strike Price

Calls Breakdown

In-the-Money (ITM) Calls

There are 5,641.6 call contracts that are currently in the money, valued at $625.7 million (7.81%). The positions are already profitable at the current spot prices.

Out-of-the-Money (OTM) Calls

$7.39 billion (92.19%) worth of total contracts remain out of the money. The majority are centered between $122K and $128K, which implies traders are looking for a potential upside breakout or increased volatility.

The total call options hold a value of $8.02 billion.

Puts Breakdown

In-the-Money (ITM) Puts

There are 16,487 put contracts currently in the money, totaling $1.83 billion (31.07%). It possibly suggests active downside hedging from institutional participants and larger traders.

Out-of-the-Money (OTM) Puts

The metric includes 36,547 put contracts valued at $4.05 billion (68.91%) that are out of the money, the majority being clustered within the price range of $90K and $100K. These measures indicate protection against moderate pullbacks rather than deep market declines.

The total notional value of put options is equivalent to $5.88 billion.

ITM vs OTM Overview

In total, 17.7% of the open contracts are in the money (ITM), while 82.3% of open contracts still remain out of the money (OTM).

ITM Total: 22,128.6 contracts ($2.45 billion)

OTM Total: 103,143 contracts ($11.44 billion)

The current arrangement illustrates how speculative positioning dominates, with 82.3% of the open interest in OTM options, which acts as a standard layout for traders looking for directional exposure and not to hedge risk. The concentration of OTM calls above 120K shows confidence in the upside, while the OTM puts below 100K hedge against drawdowns.

Market Outlook

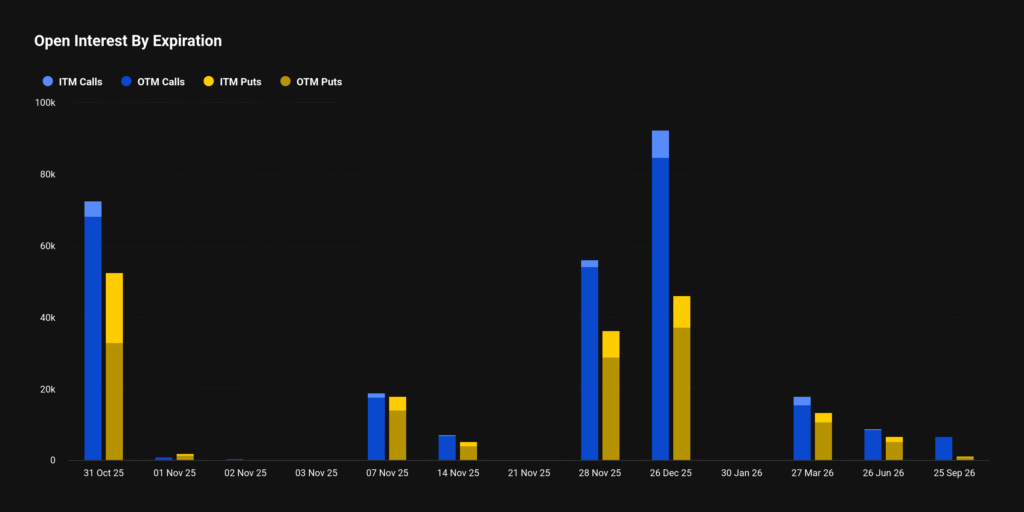

The max pain point at $114,000 corresponds to the price where sellers of options (market makers) would profit on their positions should Bitcoin expire at that strike price. There will be approximately $17 billion of notional exposure in options, including BTC options (approx. $13.8B) and ETH options (approx. $3.1B), expiring at the time, one of the largest quarterly expirations to date.

Additionally, Bitcoin ETF inflows increase by $4.1 billion in October. Seasonally, Bitcoin has seen an average price gain of +22% historically in October over the last 10 years and has finished positive in 9 of those 10 years.

With the price action and with 82.3% of options OTM, all of these factors may lead to increased volatility (the setup for a rapid gamma-driven price breakout). If Bitcoin can hold above $115K, it will be a scramble for call traders to cover their shorts and delta hedge; likewise, if it fails, it could involve selling pressure and a put unwind process below $108K.

Bottom Line

Bitcoin faces sharp two-way risk heading into Friday’s expiry. Significant bullish open interest and institutional inflow support a continuation towards $120K+, but the max pain zone at $114K, as well as overlapping macro events, imply that market forces could pin price in that vicinity or create sharp reversals. Watch the $110K and $118K area, as these price levels are gamma thresholds to monitor for a potential momentum shift in price after expiry.