Key Takeaways

- September options expiry favors bulls as Bitcoin trends above the daily support zone of $110,000.

- The $112,000 level for Bitcoin will decide momentum, with positions above this favoring the call holders.

- Bitcoin puts trading at a premium post U.S. economic data, favoring bears.

The Total number of Crypto options expiring is $22.6 billion today, with Deribit leading the way with $17.4 billion of open interest.

As Bitcoin’s September options expiration approaches, bullish positioning is performing well due to optimism that Bitcoin may remain above the $110,000 support level.

However, the upbeat U.S. economic data favored the U.S. Dollar Index (DXY) impacted Crypto sentiments negatively.

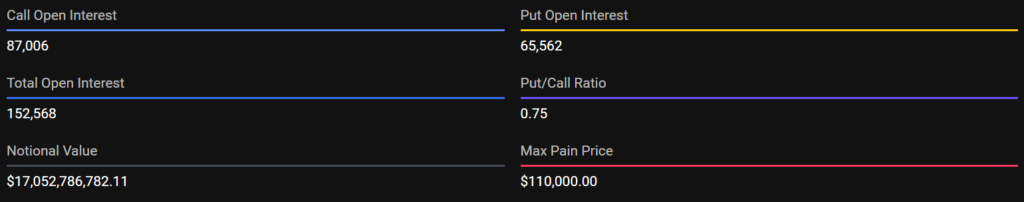

The latest data from Deribit shows a total open interest of 152,568 contracts for Bitcoin, with 87,006 call contracts and 65,562 put contracts, yielding a put/call ratio of 0.75, indicating a bearish to neutral bias. The current expiry underscores the growing participation of retail and institutional investors, amplifying the potential for sharp price movements.

Crypto Options: Bitcoin shows Downside Risks

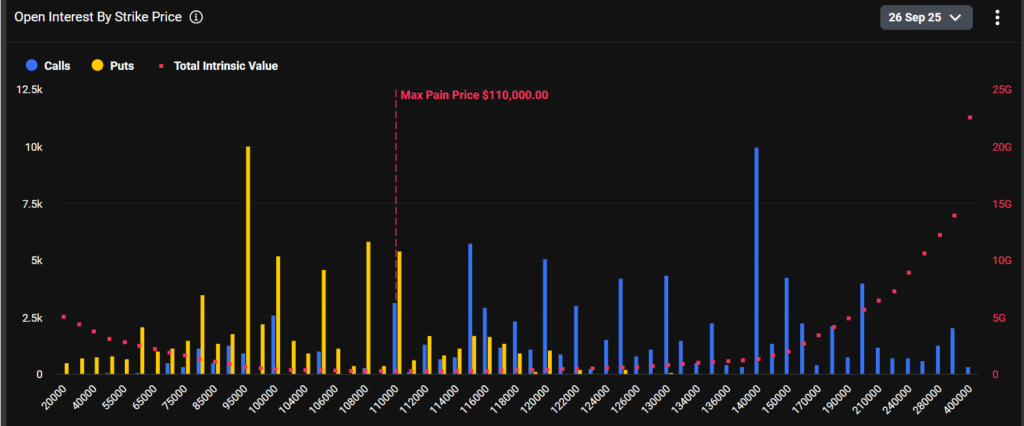

The Maximum (Max) Pain zone of $22.6B expiry is around $110,000, with call interest peaking at $115,000 and $120,000, and puts clustering around $95,000–$105,000.

The level of $110,000, where the most options would expire worthless, potentially pulls prices toward this point. Significantly, call open interest (OI) peaks are observed at approximately $115,000 and $120,000, while put open interest (OI) is heavily weighted around $100,000–$105,000.

What Does the Trend Highlight-Is Volatility Coming Ahead?

Traders on Deribit used to focus their neutral-to-bearish bets, targeting the price range of $95,000 to $110,000, but with Bitcoin moving higher, this price zone is being pushed further out of reach.

On the bullish side, there is a sizable amount of OI tied up in calls at extremely aggressive price levels near $120,000 and above, totaling more than $6.6 billion.

According to Velodata, an analytical platform, BTC’s current 24-hour put-call volume leans toward call contracts with 24.88K and puts with 15.65K contracts. However, realistically, only approximately half of that OI ($3.3 billion) is priced close enough to current levels to matter.

On the other hand, bearish protection looks far weaker yet. Approximately 81% of all put contracts are placed at $110,000 or below, meaning most of these positions are presently out of the money, leaving about $1.4 billion in active downside exposure. The distribution not only directs the parameters towards neutral to bullish outcomes, but also those upside bets are worth considerably more than those downside hedges.

But this macro view does not take into account more complex positioning, such as institutions selling puts in order to gain indirect bullish exposure. To accurately validate whether pro traders have a bona fide bullish bias, one of the things to examine closely is the options skew or the strangle structure (call vs. put demand).

Post-Expiry Outlook

The post-expiry could support continued volatility as positions unwind and new position strategies are created. In the short term, price action could still hinge on “max pain” levels ($110,000 for BTC) and macroeconomic developments. For the long-term time span, the upcoming expiry event could restore risk appetites for the conservative investors and traders, as they could make positions in the crypto market to capitalize on the upcoming opportunities.

In Nutshell

Overall, the current trend of the options positioning on Deribit highlights the market’s nature leaning towards neutral-to-bearish. Traders are advised not to open long bets before confirmation.