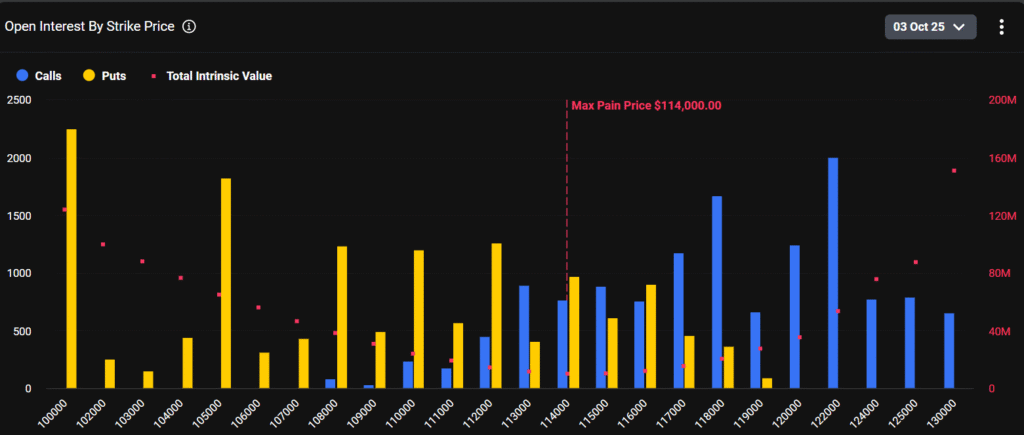

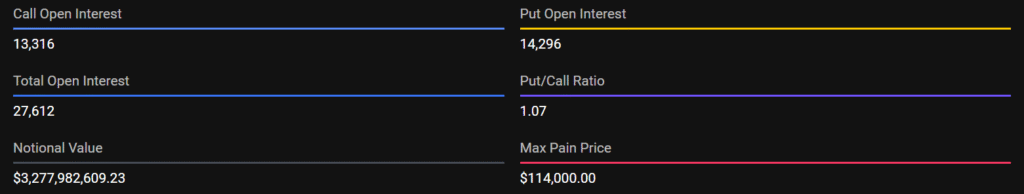

On Friday, Oct. 3, Bitcoin (BTC) options with a notional value of over $3.2 billion are expected to expire on all the major derivatives platforms, including Deribit. BTC is following an uptrend and is currently trading around $118,000 with the options data suggesting a put/call ratio(PCR) over 1. The ratio suggests bearish bias from the traders. Open interest (OI) reflects strong positioning for downside protection. The option expiry might have significant impacts on short-term price action for Bitcoin as the market shifts into what traders commonly refer to as “Uptober.”

The max pain price, the level where option holders would collectively suffer the most losses, sits at $114,000, roughly $6,000 below the current spot price. This could encourage a gravitational pull downward as market makers hedge their positions, though historical patterns suggest October’s bullish seasonality might limit any dips.

The Bitcoin options market is closely watched as traders position themselves ahead of this significant expiry.

Key Data For the Bitcoin Options

According to the data from Deribit, a total OI (open interest) of 27,612 contracts for the friday expiry is split between 13,316 calls and 14,296 puts. The put/call ratio (PCR) of 1.07 indicates slightly more interest in puts, often a sign of hedging against potential downside rather than outright bearishness.

- Calls Breakdown: Currently there are 7,176 contracts (notional value: $852 million or 53.89% of total calls) in the money (ITM), most of which are located under the existing price point. The remaining contracts are out of the money (OTM), with 6,139 contracts near $120,000 – $126,000 strikes (notional value of $728.8 million or 46.11%), and suggest some speculative bets that there would be an upside breakout.

- Puts Breakdown: Most puts are out-of-the-money (OTM), with 14,192 contracts, about $1.685 billion (99.27%), concentrated in lower strikes at about $100,000 to $110,000. Nearly 104 in-the-money (ITM) puts with a combined value of about $12.39 million (0.73%). According to data from Deribit, the total notional value of puts is $1.697 billion, which shows the OTM options are quite heavily represented for downside protection.

- Overall ITM/OTM Split: In-the-money (ITM) options amount to $864.4 million (26.37% of total notional) vs out-of-the-money (OTM) options held at $2.414 billion (73.64%). The relative flexibility indicates the market is tilted towards speculative behavior with OTM options, while overall there is a general lack of conviction in deep ITM placement.

Strike-Level Insights

Open interest (OI) clusters indicate possible support and resistance areas. There are OI peaks at $100,000 (2248 contracts), which could serve as a potential “put wall” for support in the event of rapid price declines. On the call side, $122,000 (2002 contracts) could act as a ceiling unless spot buying is strong enough to surpass the hedging flows.

Market Bias and Implications

The options data points suggest a more cautious position. A strong OTM position implies interest in hedging a downside risk due to macro risk in the market. The max pain theory implies some possible downside pressure to $114,000, where the maximum OTM options will expire worthless and the option sellers will benefit from holding those OTM options. Market makers (who are usually short gamma) will have to sell BTC futures to hedge against the price rise or buy back BTC futures if prices decrease, creating a reinforcing pinning effect.

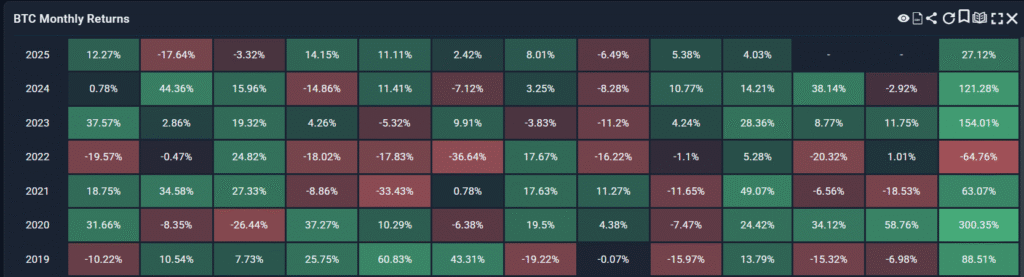

On the other hand, historical trends for the month of October lean positive. BTC maintains an average yearly return statistic of approximately 60% from year to year, which has been driven in part by post-summer liquidity and a reduction in selling pressure due to that same liquidity. Net inflows of the spot ETFs have been strong and have been supported by U.S. Bitcoin ETFs, which had a net inflow of $429.96 million (source: sosovalue) on September 30 and raise the potential of upside following the option expiry.

Positive catalysts include the possibility of the Federal Reserve cutting rates and the continued use of BTC in institutional adoption, such as the BlackRock IBIT options with $38 billion in open interest. On the negative side, continued geopolitical tensions or news like the U.S. government shutdown could have a negative impact.

What do the traders expect?

Traders believe the upcoming October 3 Bitcoin options expiry could create indicative short-term price volatility. There are considerable amounts of out-of-the-money puts along with a put/call ratio over 1, which indicates a large amount of hedging demand, and a significant cluster of calls around $122,000, which implies speculative upside bets.

Max pain is now around $114,000, which would lead to some downward price pressure as the market makers may start adjusting their delta down, but with this being October and seasonal patterns generally positive in October, along with healthy ETF inflows, this should allow for some recovery. Overall, the expiry grossly induces caution and volatility, which we will closely monitor moving forward.