Table of Contents

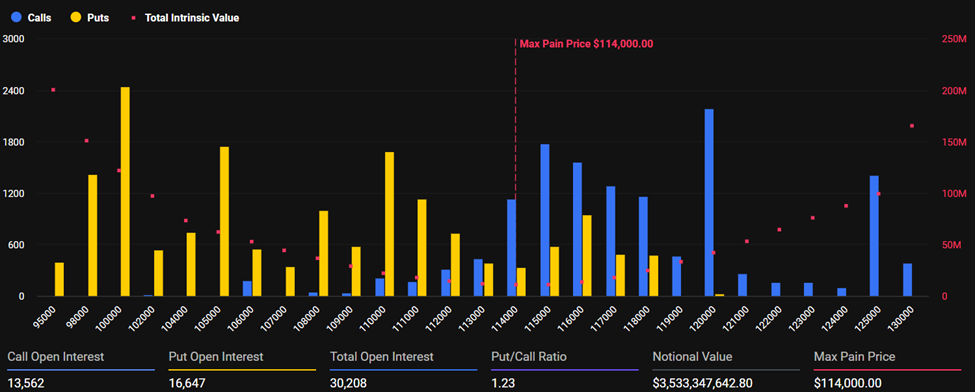

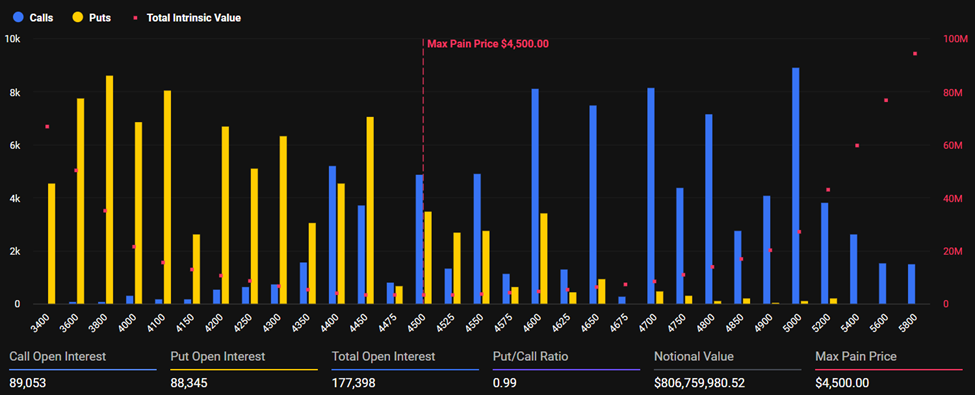

This week, roughly 30,000 Bitcoin options contracts expired with a notional value of $3.5 billion, and 177,398 Ethereum options contracts valued at $806.75 million. The total crypto options expiry of $4.3 billion represented a momentous moment in the derivatives market. However, the spot market remains mixed.

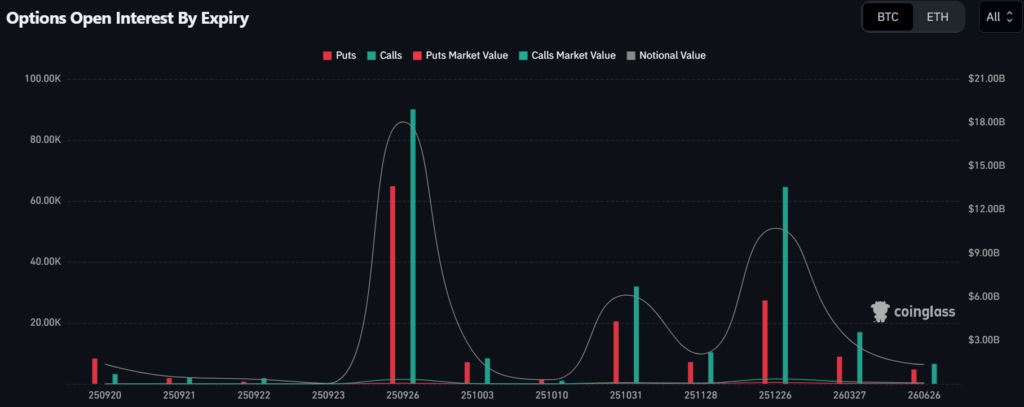

The next weekly expiry on September 26, 2025, is expected to stir the spot market, with over $18 billion in Bitcoin options alone, which may add short-term volatility to the market.

Crypto Options Expiry: Bitcoin

Bitcoin options that expired on Friday had a put/call ratio of 1.23, indicating bearish bias, as there are more put contracts (short) than call contracts (long).

The open interest (OI) is clustered at critical strike prices on Deribit:

- $140,000: $2.7 billion in OI, the largest cluster.

- $120,000: OI at $2.2 billion

- $114,000: Max pain price, resulting in the most expiring worthless options.

- $95,000: $2 billion in OI, a favored strike price for short sellers.

Bitcoin futures open interest traded at near all-time highs around $85.57 billion, suggesting strong derivatives activity despite a drop in spot market trading volume.

Crypto Options Expiry: Ethereum

The expiration of Ethereum options consisted of 177,398 contracts with a notional value of $806.75 million. The put/call ratio is at 0.99, suggesting slightly bullish sentiment, as opposed to Bitcoin, which may lean bearish.

The Max Pain, which tells about the maximum loss, is at $4,500.

Looking Ahead: September 26 Weekly Expiry

The scheduled options expiry on September 26, 2025, is expected to be the largest Bitcoin options expiry till date, with an estimated over $18 billion in notional value. Bitcoin futures open interest is currently around $85.57 billion, and Ethereum’s is about $64.15 billion, indicating highly volatile price movement.

Crypto Market Outlook

The cryptocurrency market is still experiencing high trade levels with a market cap of $4.17 trillion but has been trending lower since mid-July.

Currently, Bitcoin is approximately 5.6% away from its all-time high. On the other hand, Ethereum remained steady at around $4,600, or 7% below its all-time high price.

In terms of altcoins, the market performed well relatively, with Hyperlink (HYPE) reaching an all-time high along with Binance Coin (BNB).

Furthermore, Chainlink, Avalanche, and Sui were among the top three performers yesterday, while other major altcoins are holding flat.

FAQs

What is a crypto options expiry?

A crypto options expiry refers to the expiry date of options contracts that allow holders to purchase (or call) or sell (or put) a cryptocurrency at a specified price. At expiry, an options contract will either cash or crypto settle, or expire worthless, depending on the market price at expiry.

Why do crypto options expiries matter?

Expiries can create volatility in the short term as traders react, hedge, or close positions. Major expiries, like today’s $4.3 billion expiry or the September 26, 2025 expiry for $18 billion of Bitcoin, are just a snapshot into the sentiment of the market by looking at the put/call ratio, open interest, etc.