The crypto market witnessed a considerable slide on Tuesday when Bitcoin and most major altcoins dipped due to the market participants who displayed a tendency to avoid risk. This also drove down tech-based stocks and precious metals. The digital assets movement demonstrates their solid connection to the traditional market, which consists of tech stocks that Nasdaq lists.

Bitcoin (BTC) was worth $68,000, down 1.25% since midnight UTC. Nasdaq futures were down 0.55%, and gold was down 2.4% to $4,928. The precious metal briefly rose above $5,600 on January 28 but then fell 21.5% over four days, which was a record. It is still having trouble staying above $5,000, which is a key support level.

Over the past two weeks, Bitcoin’s relationship with Nasdaq has changed a lot. BTC had a negative correlation of -0.68 with tech stocks on February 3, which means it was relatively independent. Today, the correlation is +0.72, which shows that Bitcoin is moving more and more in line with technology stocks. This alignment suggests that crypto investors are now more worried about risks in the economy and the tech sector than they were in early February.

Memecoins Lead the Way in Altcoin Losses

Memecoins have been the worst hit of all the altcoins. PEPE, DOGE, and TRUMP all dropped between 3.5% and 4.5% in the last 24 hours, which shows how sensitive they are to market sentiment. On the other hand, some niche tokens did better even though the market as a whole was going down.

Over the past week the tokens that leverage AI, such as MORPHO, rose 23.5% and the privacy-focused digital assets, such as ZEC (Zcash), soared 19%. These standout performances demonstrate that investors have confidence in categories like AI and privacy because they are considered more adaptable during short-term market volatility.

Not all altcoins did well. Layer 1 blockchain token ZRO fell 16%, continuing to be on the weaker side after the deal with Citadel Securities and DTCC was announced. Mid-cap tokens like HYPE, SUI, and ASTER also fell by 3–4.8% since midnight UTC. This shows that the altcoin market is still in the process of consolidating.

The State of Futures and Derivatives in Crypto

The derivatives market reflects traders’ cautious behavior. Total open interest in crypto futures went through a drop of 1.5% to $93 billion, crashing to multi-month lows. Throughout the same period, $229 billion in leveraged stakes were closed out, which involved the major portion of long positions, suggesting a dramatic reduction in bullish leverage amid constant market volatility.

The leading memecoins like DOGE saw a drop of 4% in open interest. The digital assets like PEPE, LINK, and AVAX have gone through a price correction in the range of 3-5%. The on-chain metric of open interest for the leading DEX’s native token HYPE fell to 44.45 million. This level was the lowest level since early December. The trend shift usually points toward less concentration on the speculation side and profit booking from the market participants.

Individuals in the market are feeling more defensive. Bitcoin and Ether implied volatility indices have pulled back from monthly highs, but options data shows caution remains. On the biggest derivative platforms like Deribit, the distribution of put options continue to trade above calls. The relative trend indicates that traders still look for downside protection. However, positioning is less extreme than two weeks ago, indicating that the panic has eased.

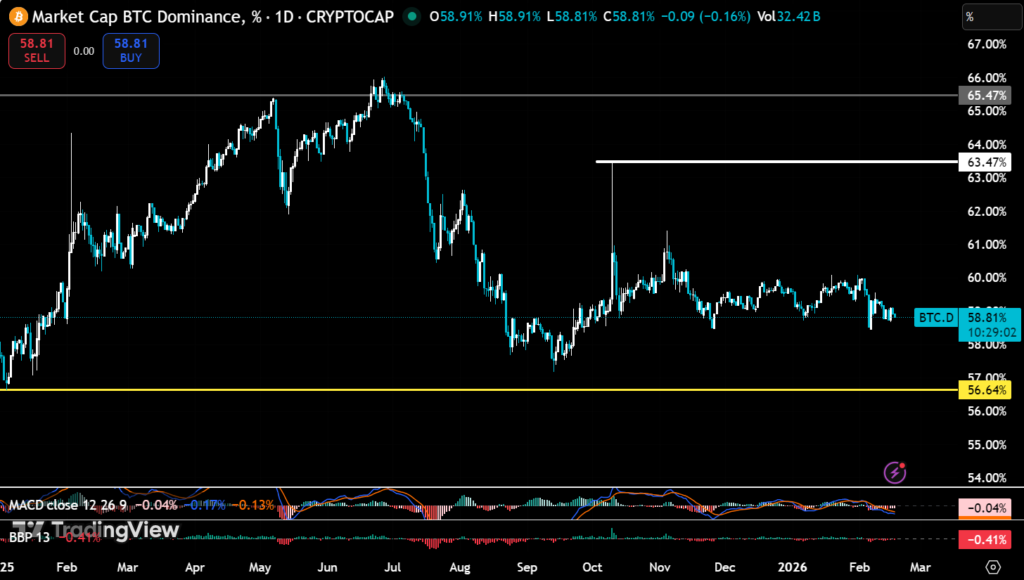

Bitcoin Dominance

Bitcoin dominance, which indicates how much of the crypto market BTC controls in relation to all other cryptocurrencies, has stayed in a consolidation phase and now stands at 58.81%. Additionally, it highlights that the market structure has been relatively stable. Altcoins are continuing to comply with Bitcoin’s movements due to high dominance. Despite some digital assets outperforming others, the overall market is still dependent on Bitcoin’s performance until the dominance starts a downtrend, triggering an altcoin rally.

Short-term technical trends still reflect the mixed signals. The fact that the largest cryptocurrency is holding steady around $68,000 shows that traders are waiting for a clear signal to move in a certain direction. Derivative flows and open interest shifts suggest that the market participants that are involved in leverage have pulled back, but retail and speculative activity could pick up if a bullish on-chain signal develops.

Macro Drivers and Tech Correlation

The tech selloff that is hurting the cryptocurrency space is due to fears about AI disrupting many industries. Investors appear to be reevaluating the risk associated with stocks, cryptocurrencies, and commodities simultaneously, leading to a widespread pullback. Such information is crucial for the individuals who actively trade or make investments in cryptocurrencies. Bitcoin is no longer just a speculative or independent asset. Its connection to Nasdaq and other tech-heavy indices means that macro and sector-specific news are becoming more important in determining short-term price changes.

Gold’s correction makes things even more complicated. When gold is trading below $5,000, safe-haven flows are less clear, which means that a traditional hedge is no longer available during times of market stress. Because of this, traders are dealing with a more connected and unstable market than they have in the past few months.

Future Outlook

The crypto markets are lately going through a consolidation phase. Some altcoins, like MORPHO and ZEC, have performed well in the short term, but most digital assets have not achieved positive returns. Leveraged positions have sharply dropped, futures open interest is at multi-month lows, and implied volatility has decreased, positioning the market defensively.

The experts believe that the next big change in crypto will probably need either a new flow of money or a big event that makes people feel safe again. Traders can expect movements in line with Nasdaq and other tech assets until then. Memecoins will be especially sensitive to changes in sentiment.