Key Takeaways

- CryptoPunks’ floor price has returned to early 2024 levels, crossing $200,000 for the first time in over a year.

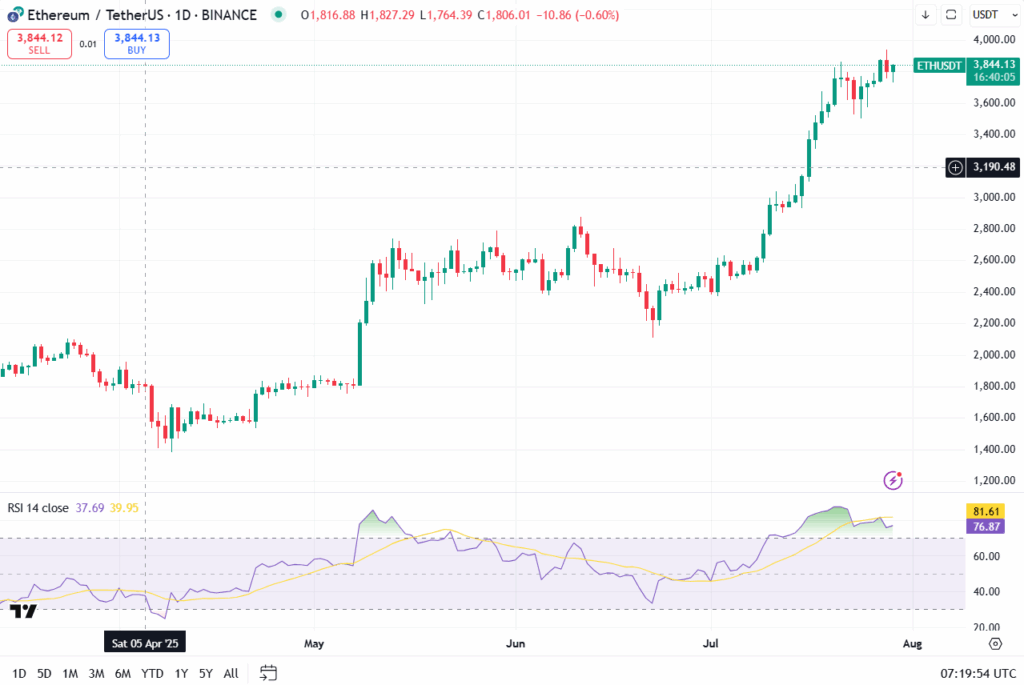

- Ethereum has rallied from below $2,600 to nearly $3,850 in July, reaching a new multi-month high.

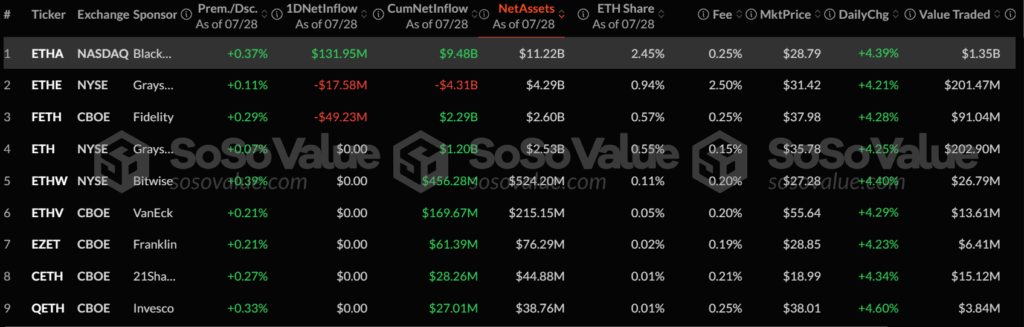

- Spot Ethereum ETFs in the U.S. attracted $1.85 billion in inflows last week, the second-highest weekly total since their launch.

- SharpLink Gaming has accumulated over 438,000 ether, reflecting growing corporate confidence in Ethereum’s role as a treasury asset.

The floor price of CryptoPunks, one of the earliest and most prominent non-fungible token (NFT) collections, has risen 163% since August 2024, reaching 53.85 ether ($202,000), marking the highest level since February last year.

CryptoPunks, launched in 2017 by Larva Labs and later acquired by Yuga Labs, consists of 10,000 pixel-art characters and is widely regarded as a cultural cornerstone of the NFT market.

The increase marks a sharp reversal from months of declines, during which CryptoPunks’ floor price fell below 25 (ETH) in mid-2024.

According to data from NFTPriceFloor, the collection last peaked at 59.69 (ETH) in February 2024, before entering a prolonged downturn. Prices bottomed during the summer, ranging between 20 and 30 (ETH), before experiencing a steady recovery through July.

Why now?

CryptoPunks’ sharp rebound coincides with a broader recovery in Ethereum, the backbone of the collection. Ethereum (ETH) has climbed from below $2,600 in early July to nearly $3,850 by the end of the month, marking its highest level since early 2024

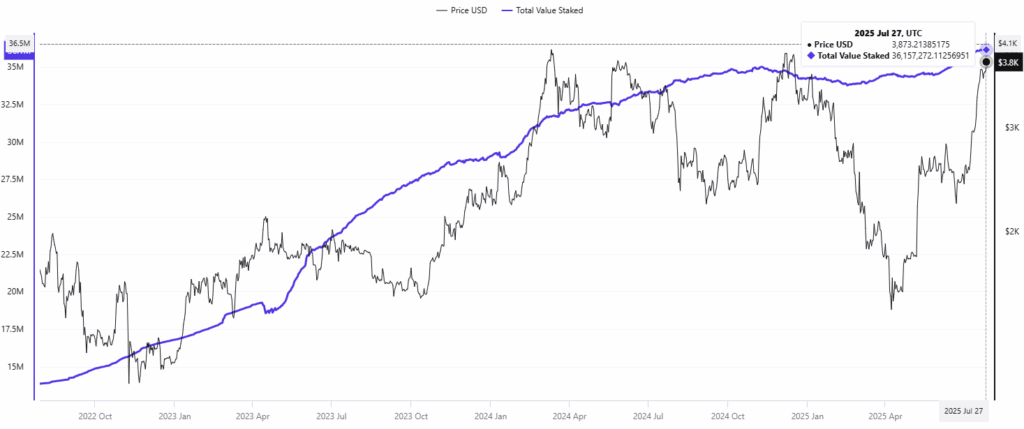

Ethereum’s rally has been supported by accelerating institutional flows, robust staking activity, and renewed confidence following key network upgrades.

Spot Ethereum exchange-traded funds in the U.S. recorded $1.85 billion in net inflows during the week of July 21 to July 25, marking the second-largest weekly inflow since the products launched, according to data from SoSoValue.

On-chain metrics also support Ethereum’s bullish outlook. BlackRock’s iShares Ethereum Trust (ETHA) has crossed $10 billion in assets under management within a year of its launch.

Additionally, more than 36 million Ethereum are now staked – roughly 30% of the total supply – highlighting sustained long-term commitment and the continued maturation of Ethereum’s proof of stake model.

On the technical level, the recent Pectra upgrade, implemented in May, introduced a range of improvements, including expanded validator limits and enhanced developer tooling, and has been positively received by the Ethereum community.

The new upgrade followed the Dencun hard fork in 2024, which focused on reducing transaction costs for Layer-2 scaling solutions. Combined, the upgrades aim to deliver a faster, cheaper, and more scalable experience for users interacting with decentralized applications, NFTs, and other tokenized assets on the Ethereum network.

The rally has also been fueled by corporate moves to adopt ether as part of their treasury strategy.

BitMine Immersion Technologies, a crypto infrastructure firm chaired by investor Tom Lee, now holds more than $1 billion in ether after expanding an earlier $250 million position.

Similarly, SharpLink Gaming has emerged as one of the most aggressive corporate accumulators of ETH, with holdings surpassing 438,000 ether, valued at approximately $1.7 billion at the time of writing.

Are NFTs Eyeing a Comeback After Years in Hibernation?

After reaching peak popularity in 2021, NFT markets saw a steep decline in both trading volume and investor interest as speculative enthusiasm faded. Collections once valued in the millions struggled to retain demand amid broader crypto market volatility.

The recent surge in CryptoPunks, alongside renewed activity in Ethereum-based assets, has sparked cautious optimism that interest in NFTs may be stabilizing, and potentially entering a new phase marked by more focused demand and stronger ties to blockchain infrastructure.

Read More: Trump Media Goes All-In: $2B Bitcoin Buy Makes It Top 5 Corporate Holder