Key Takeaways

- DOGE price is near a critical edge, and a breakout above the $0.18 key resistance could trigger an upward rally for the meme coin.

- Dogecoin whales have accumulated 4.72 billion DOGE over the past two weeks, signaling strong long-term potential.

- Derivatives data reveal that current sentiment among traders is bearish, as they believe DOGE price won’t cross the $0.1785 level anytime soon.

Despite a recent downtrend, Dogecoin whales are showing strong confidence, accumulating a massive 4.72 billion DOGE over the past two weeks. According to a crypto analyst on X, whales holding between 100 million and 1 billion DOGE have been quietly adding these billions of tokens, signaling potential bullish sentiment.

This massive accumulation occurred while the DOGE price was hovering below the key support level of $0.18. Although the price continues to struggle under this support, it has been hovering near it over the past week.

Despite massive accumulation, the DOGE price hasn’t moved higher due to bearish market sentiment and high volatility, which are currently at peak levels. On top of this, DOGE price remains sideways, with no major ups or downs recorded.

Also Read: Scammers Impersonating Police Target Australian Crypto Users in Sophisticated Scheme

DOGE Price Action and Technical Analysis

According to the latest TradingView data, DOGE is currently trading at $0.176, posting a 3.50% price uptick today. Meanwhile, investors and traders have shown strong interest in the meme coin, as reflected in trading volume, which surged 22% to $2.07 billion.

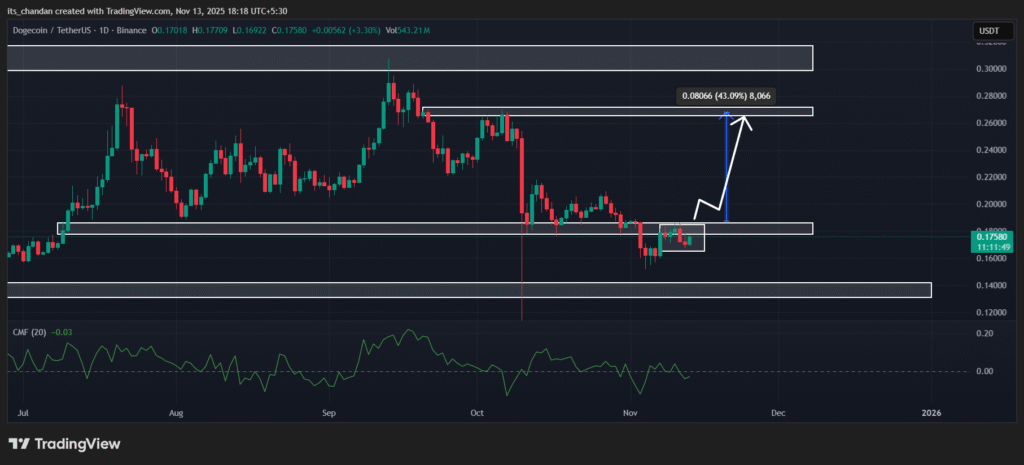

TimesCrypto’s technical analysis of the daily chart reveals that the DOGE price is currently on the edge, hovering near a key resistance level of $0.18.

The price has been near this resistance for the past seven consecutive days. The only factor that could trigger an upward rally is a breakout of this strong resistance, combined with a shift in the current market sentiment.

Based on historical momentum, if DOGE price continues to rise and breaches the key resistance, closing a daily candle above the $0.18 level, it could pave the way for a massive rally. In that case, DOGE could soar by 40% and reach the $0.267 level.

However, it may not be that easy, as there is resistance at $0.213 that could challenge upward momentum.

At press, DOGE’s Chaikin Money Flow (CMF) value still holds at -0.03, which suggests that selling pressure slightly outweighs buying, but the market remains relatively balanced for now.

Derivative Tool Hints Bearish Sentiment Among Traders

Today, the key levels in focus for traders are $0.1725 on the lower side, acting as support, and $0.1785 on the upper side, acting as resistance, according to the derivatives platform Coinglass.

Data further reveals that traders at these levels show strong interest on the upper side, as they appear to believe that the DOGE price won’t cross the $0.1785 level anytime soon. As a result, they have built $7.73 million worth of long positions and $14.15 million in short positions.

When combining derivatives data with technical analysis, it appears that traders are following the current trend, and short-term market sentiment is bearish. However, on the longer timeframe, the market remains bullish, which explains the whales’ accumulation.