Table of Contents

The European Central Bank plans to launch a 12-month digital euro pilot in the second half of 2027 and will begin selecting payment providers for the pilot in the first quarter of 2026, as it moves from design work to real-world testing of a potential central bank digital currency.

Executive Board member Piero Cipollone told an Italian banking audience the pilot would be run in a controlled Eurosystem environment with real transactions and a limited number of payment service providers (PSPs), merchants, and central bank staff, with the aim of fine-tuning the design and checking technical readiness before any broader roll-out.

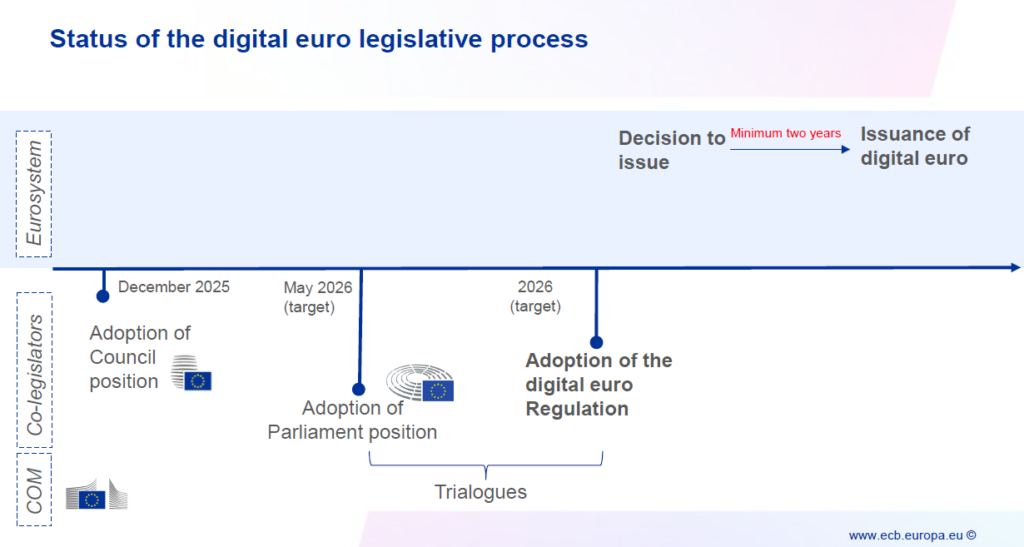

The ECB still assumes that European Union lawmakers will adopt a regulation establishing the digital euro in 2026, allowing the central bank to be ready for a possible first issuance in 2029, according to a timeline in the official presentation.

Pilot to run for 12 months and test 4 use cases

The pilot is planned as a one-year exercise starting in the second half of 2027, with four yet-to-be-specified use cases to be tested. The Eurosystem intends to collect and apply feedback throughout the exercise “to further optimize the digital euro,” focusing on readiness checks, improving the value proposition, refining its go-to-market strategy, and preparing for a subsequent market roll-out.

Banks and PSPs that join the pilot are promised what the ECB describes as an “early readiness advantage,” including experience with onboarding, settlement, liquidity management, incident handling, and refunds, as well as clearer visibility on future costs, infrastructure, and staffing needs.

Banks positioned at core of distribution and fee model

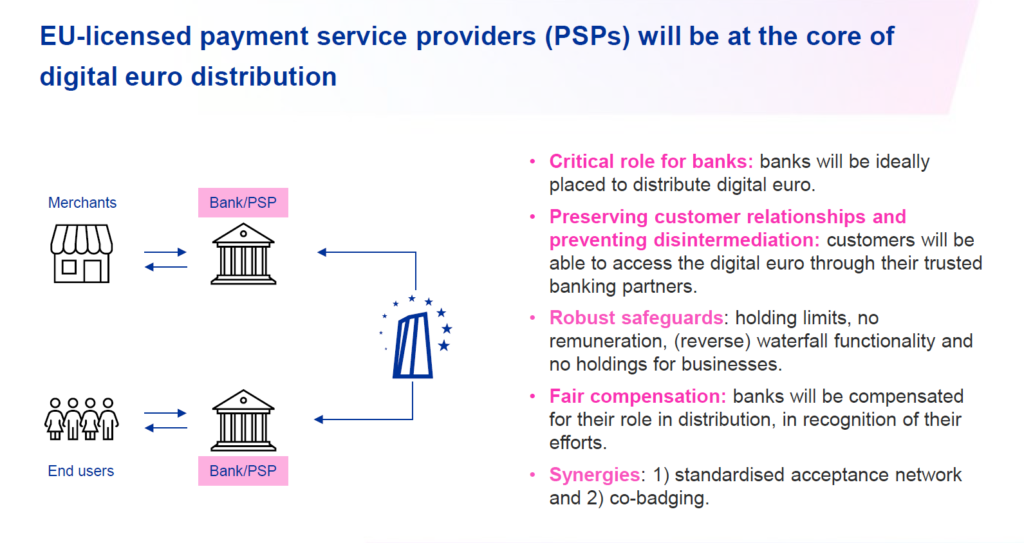

The ECB reiterated that EU-licensed payment service providers (PSPs), particularly banks, will sit at the center of digital euro distribution, allowing customers to access the new instrument through existing banking relationships and limiting the risk of disintermediation. Safeguards under discussion include holding limits, no remuneration on digital euro balances, waterfall and reverse-waterfall functionality, and a ban on business holdings.

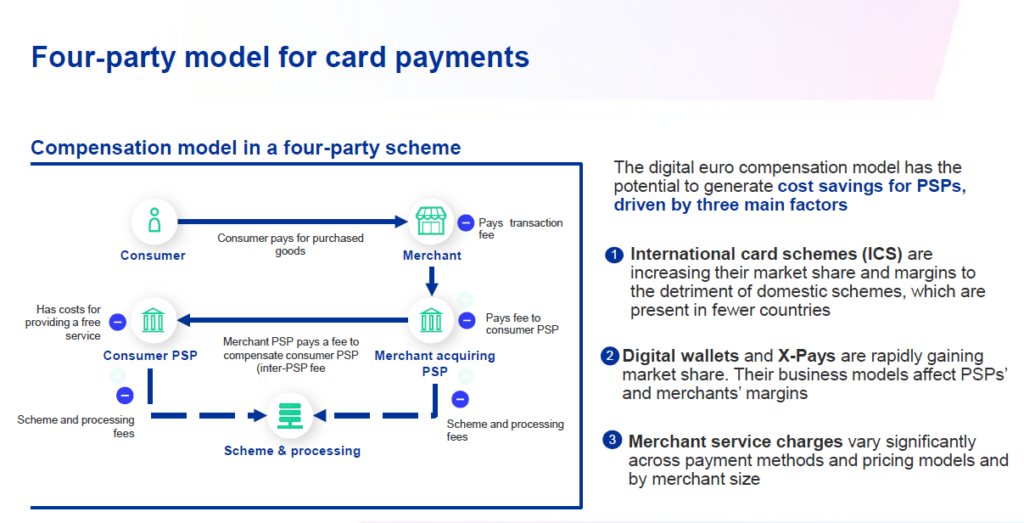

To address the industry’s cost-related concerns, the central bank outlined a compensation model in which issuing and acquiring banks would not pay scheme and processing fees, while both merchant service charges and inter-PSP fees would be capped. The ECB argues this structure could generate cost savings compared with current card and wallet arrangements, where international card schemes and “X-Pays” are gaining share and squeezing margins.

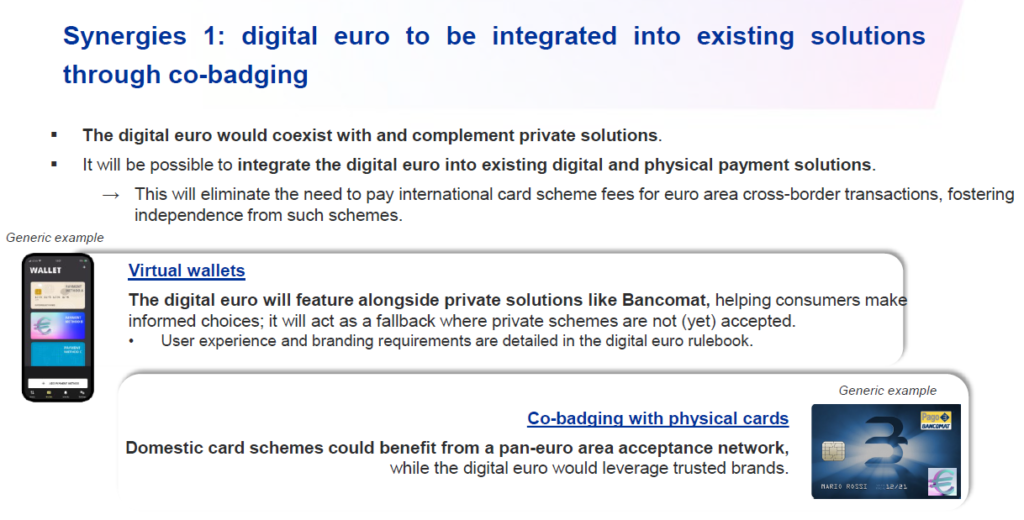

Digital euro payments are designed to coexist with domestic schemes and private digital wallets, with options for co-badging on physical cards and integration into existing virtual wallets. The ECB says a standardized euro-area acceptance network would let domestic solutions achieve pan-European reach without large additional investment.

Legislative track and Council changes to address banks

According to a legislative timeline, EU co-legislators aim to adopt their positions in 2025 and 2026, with trialogue negotiations leading to a final regulation on the digital euro later in 2026. The ECB would then wait at least two years after any formal decision to issue before bringing a digital euro to market.

The Council of the European Union adopted its position in December 2025, backing key pillars of the European Commission’s proposal, such as legal tender status, online and offline use, mandatory distribution by banks, fee caps, and free basic services for consumers. It also proposed several changes reflecting banking-sector demands, including setting fee caps at levels comparable to average debit-card fees during at least a five-year transition, clarifying that banks are not obliged to fund digital euro accounts held elsewhere, and limiting mandatory cash-conversion services.