Key Takeaways:

- Lagarde warns stablecoins are bringing back familiar financial risks, including liquidity constraints and redemption pressure, despite their modern design.

- The EU’s MiCAR framework addresses some concerns but leaves regulatory gaps, especially in cross-border multi-issuer stablecoin arrangements involving non-EU entities.

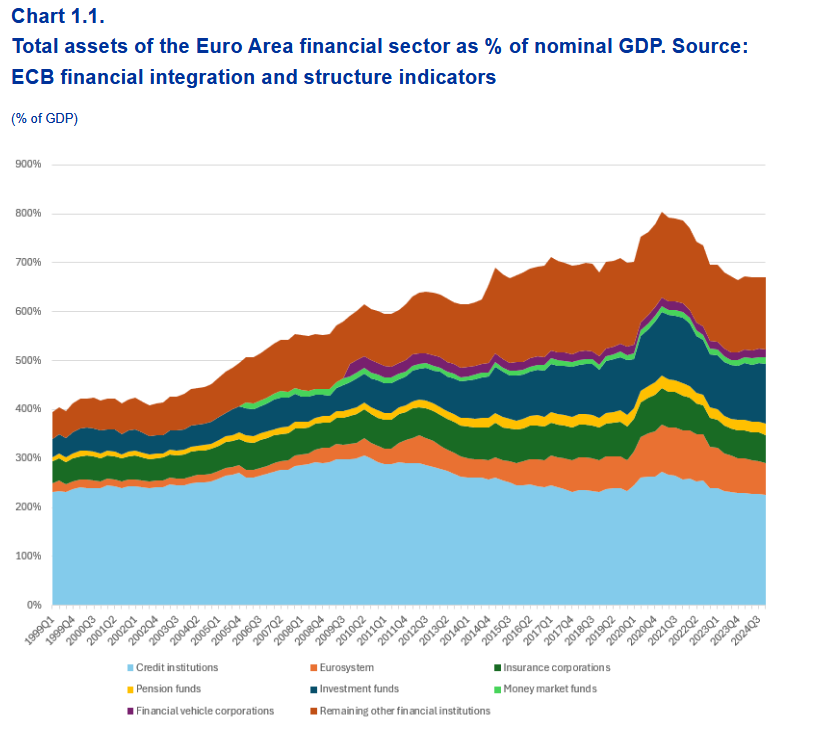

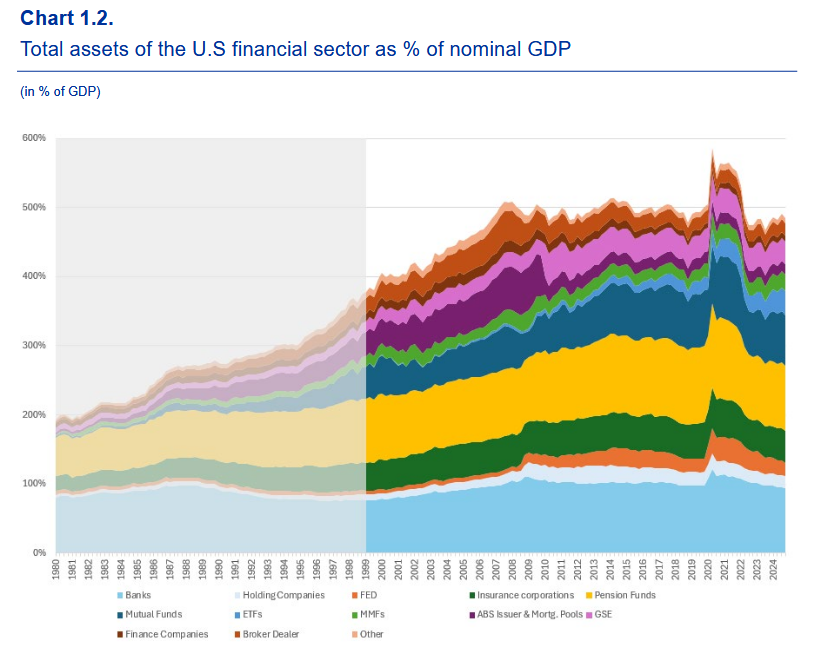

- Europe’s non-bank financial sector has outgrown its U.S. counterpart in GDP terms, adding layers of complexity to financial supervision.

- Lagarde urges an activity-based, system-wide regulatory approach, emphasizing the need to stay anchored in proven risk management principles amid rapid financial innovation.

European Central Bank President Christine Lagarde warned on Wednesday that stablecoins are reintroducing long-standing financial vulnerabilities “through the back door,” calling for stronger cross-border safeguards and urging global cooperation to avoid future liquidity crises.

Speaking at the ninth annual conference of the European Systemic Risk Board (ESRB), Lagarde said that while stablecoins may appear innovative, they carry well-known threats, such as liquidity constraints and the risk of sudden redemption pressure.

According to Lagarde, the EU’s upcoming (MiCAR) Regulation aims to address these issues by requiring stablecoin issuers to allow par-value redemption and maintain significant reserves. However, Lagarde cautioned that critical regulatory gaps remain, especially in multi-issuer arrangements involving non-EU entities.

“In such cases, MiCAR requirements do not extend to the non-EU issuer,” she noted, warning that if investors rushed to redeem their holdings, EU investors would likely seek redemptions under the bloc’s stronger protections. That, she said, could overwhelm reserves held within the EU. “We know the dangers. And we do not need to wait for a crisis to prevent them.”

Lagarde called for legislative action to close these loopholes, including the introduction of equivalence regimes and safeguards for asset transfers across jurisdictions. She stressed that international coordination is vital, as risks “will always seek the path of least resistance” in the absence of aligned rules.

She also pointed to the rapid growth of Europe’s non-bank financial sector, which now exceeds its U.S. counterpart in relative size, noting that this expansion has blurred the lines between traditional institutions and newer players like fintech platforms, complicating oversight.

Still, Lagarde emphasized that the underlying risks have not changed. Whether it is credit, liquidity, market, underwriting, or operational risk, the core challenges remain. So do the tools to manage them, including capital buffers, reliable data, and sound infrastructure.

What matters, she argued, is not the type of institution but the nature of its activities, calling for a system-wide approach to supervision that focuses on substance over form.

Lagarde concluded with a call to remain grounded in core principles, even as the financial system evolves.

“Our task is to cut through the noise of novelty while remaining anchored in the perennial principles of good risk management, supervision, and effective policy.”

Read More: Circle Launches Arc Blockchain, Reports 90% USDC Growth and $482M Loss; Read the Full Breakdown