Key Takeaways

- Ethereum (ETH) and major altcoins entered a correction phase after strong gains.

- XRP futures open interest declined by 14.1% from 440 million to 378 million.

- Indicators like RSI suggest ETH and XRP may correct further.

Ethereum (ETH) price initiated a pullback from the $3,850 zone on 21 July 2025. The price is now moving lower after surging over 40% from its tight range of July 9, 2025. However, it might find bids near the $3,345 daily support zone.

The ETH/USD pair could continue its uptrend if it remains supported above the $3,200 zone in the near term due to support from the 50% Fib. retracement level.

On 21 July 2025, the Ethereum price failed to break above the daily supply zone of $3,800-$4,000, extending gains above the $4,000 level to target its all-time high of $4,877. It then started a downside correction, aligned with Bitcoin.

The price is holding above the bullish crossover of the 50 and 200 EMA, which may signal that the price strength is still intact. Momentum indicators such as RSI (Relative Strength Index) above 70 suggest the overbought phase for the asset and could signal further correction.

Major Altcoin like XRP Falls

With Ethereum following a downside trend, other major altcoins like XRP went through double-digit corrections.

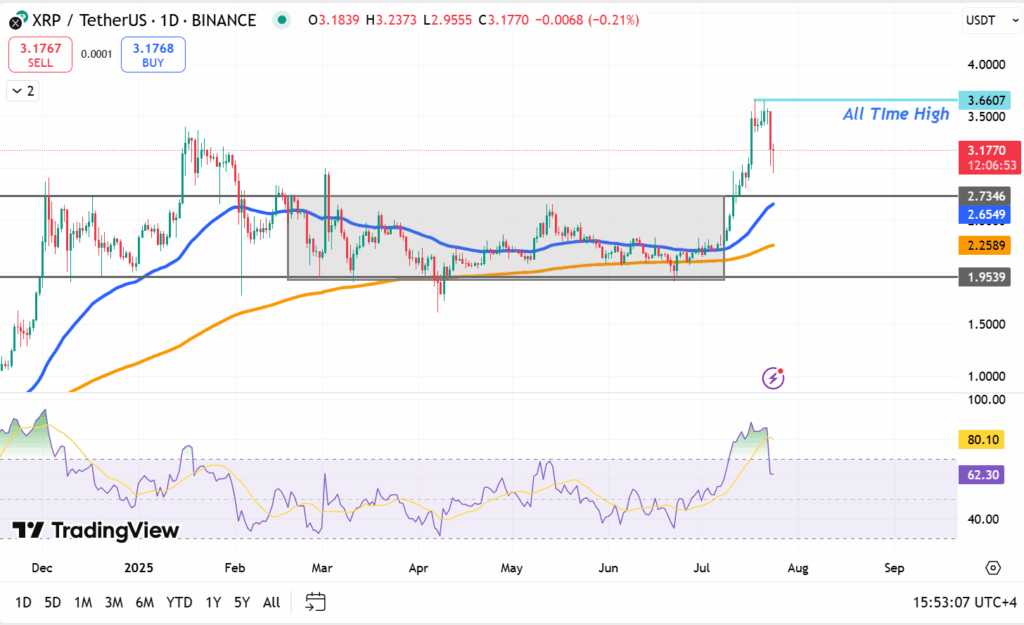

XRP price faces rejection after hitting the milestone of an all-time high of $3.66 on 18 July 2025. The price is currently trading at $3.17 above the consolidating range from mid-February 2025. The price soared over 60% from early July 2025 after breaking the February 2025 range and is now trending below its previous high of $3.66.

Momentum indicators like RSI suggest that it’s still trading in the overbought region, which may suggest an upcoming correction.

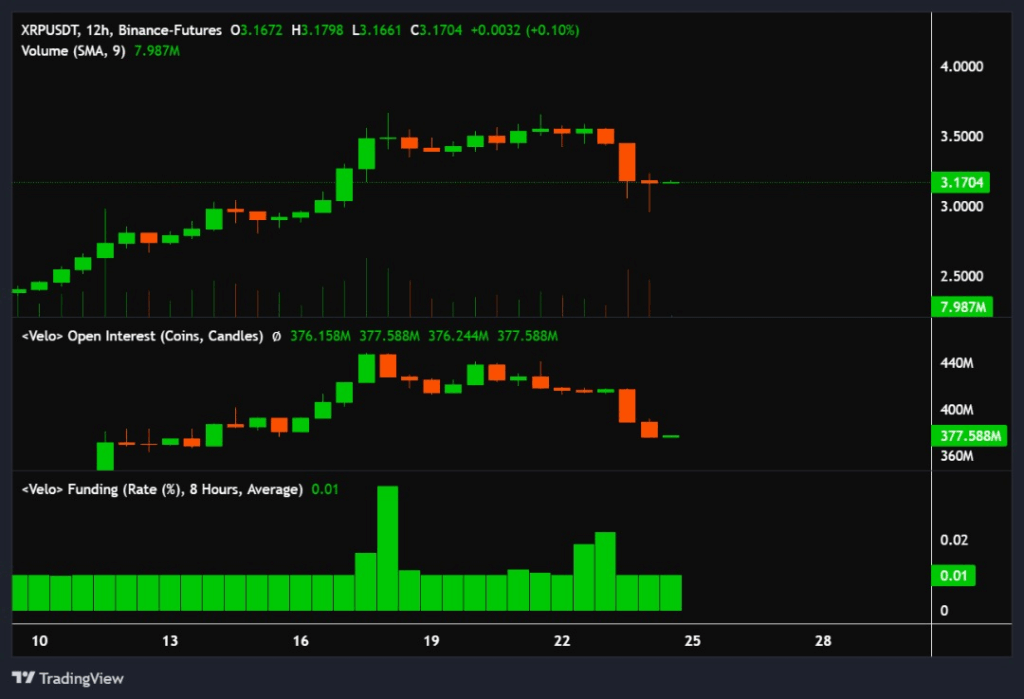

XRP’s decline was followed by a noticeable drop in open interest, from greater than 440M on 21 July 2025 to under 378M on 24 July 2025, which suggests that traders are exiting the market or closing their positions, a classic example of leveraged longs being liquidated.

The trading volume is still relatively consistent, with the funding rate holding on to a slightly positive value at 0.01%, indicating that the shorts have not entered the market yet. In that case, the funding rate would be negative, as the short holders would need to pay the longs.

The overall confidence in the asset appears to be fading. All of this together indicates cautious market behavior and uncertainty as XRP attempts to make a new support level.