Key Takeaways:

- A Bitcoin whale sold $76 million worth of BTC, took Ethereum (ETH) leveraged longs worth $295 million and switched to spot ETH buys.

- The whale has accumulated 19,794 ETH ($85 million), signaling long-term bullishness.

- The Market Value to Realized Value Ratio (MVRV) Long/Short Difference ratio stands at 27.60% showcasing that the market remains positive for ETH.

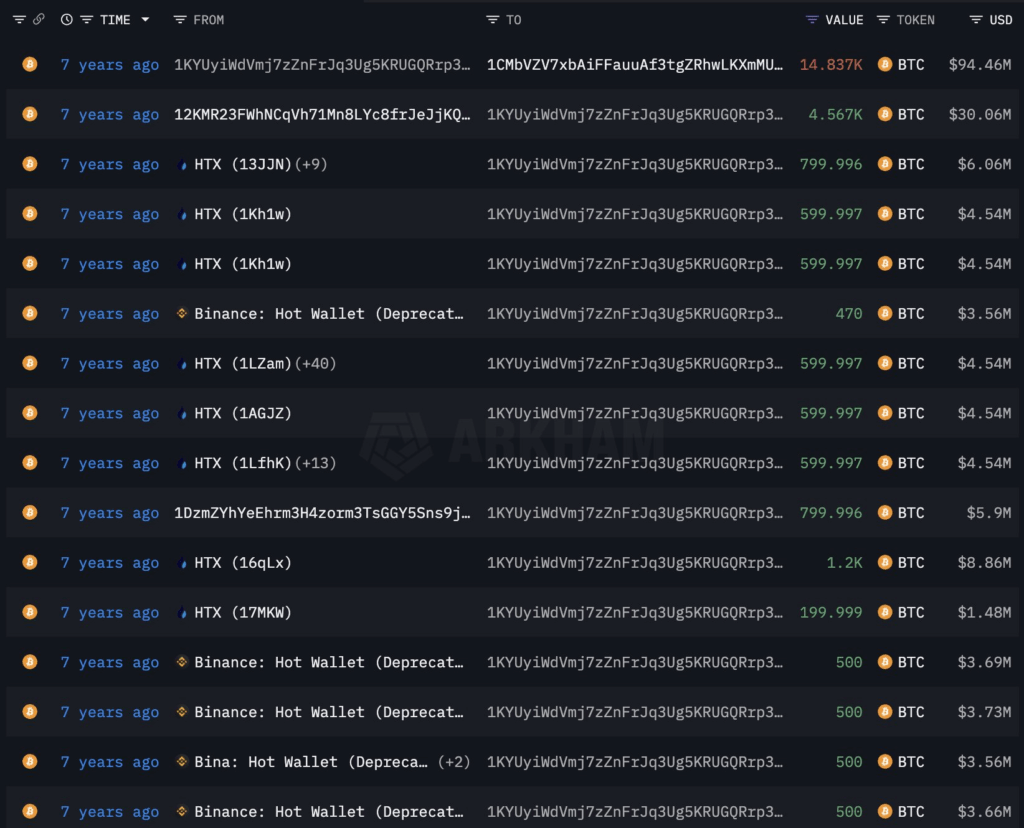

According to Lookonchain, a Bitcoin (BTC) OG or whale who had received 14,837 BTC 7 years ago, from HTX and Binance, valued back then at $94.46 million, is currently placing long-term bets on Ethereum (ETH) sending a bullish signal to the markets. The whale’s current BTC holdings are valued at $1.69 billion.

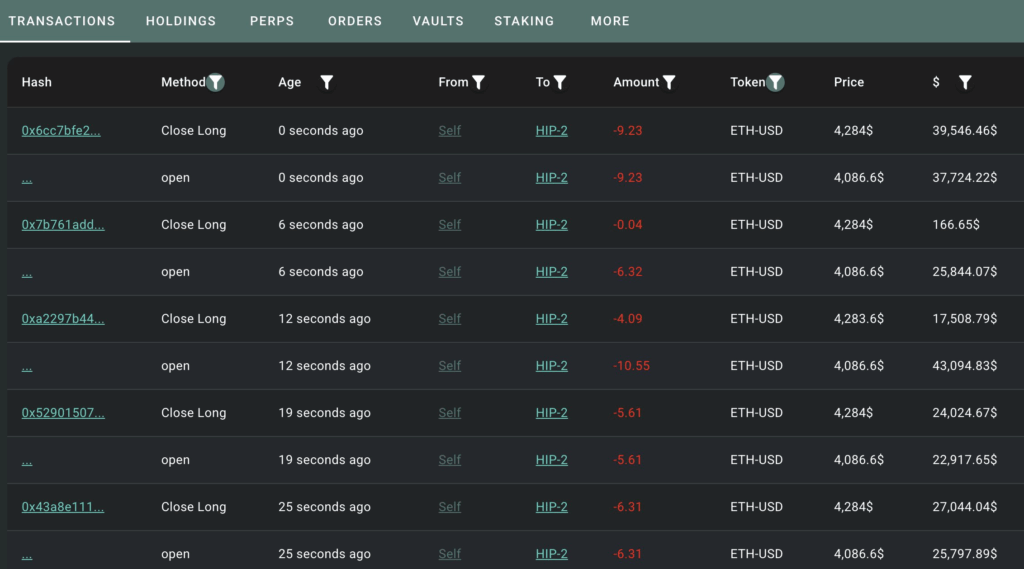

The BTC whale sold 670.1 BTC worth $76 million on Hyperliquid, following which it decided to open leveraged long positions across 4 wallets, totaling 68,130 ETH worth $295 million. Given the scope and risk of such concentrated ETH exposure, traders were quick to notice the shift.

However, just a few hours later, the whale shifted its holdings. It decided to close the highly leveraged positions, which consisted of ETH longs, and started accumulating ETH by placing buy orders in the spot market.

Additionally, the BTC whale deposited an additional 1,000 BTC worth $113.95 million to Hyperliquid to buy ETH. So far, according to Lookonchain, it has bought 19,794 ETH worth $85 million.

The BTC OG whale, who could also be called BTC maxi, with holdings worth 14,837 BTC or $1.69 billion, has sparked debate about whether the current price for ETH is undervalued. Moreover, the whale’s changed stance from leveraged longs to spot buys signifies that the whale expects ETH to face massive volatility but remains bullish on the long-term outlook for ETH.

Is ETH Undervalued or Overvalued?

The Market Value to Realized Value Ratio (MVRV) Long/Short Difference ratio shows if a project is above or below the average profitability of its traders. If the value of MVRV is high, it would indicate that a decent number of traders are in profit based on the ratio and vice versa.

According to data from Santiment, the MVRV Long/Short Difference ratio is currently at 27.06% which signals that ETH holders are in profit, which could potentially signal a profit-taking opportunity, and it could infuse selling pressure as well.

When the MVRV Long/Short Difference ratio is under zero, it signifies that ETH holders on average are in a loss and when it’s above 0%, it implies that on average, ETH holders are in profit.

As it is above 0%, this could potentially indicate that many investors may be inclined to take profits, resulting in selling pressure and short-term volatility.

Whale’s Stance Remains Bullish on ETH

Based on the on-chain data, the selling pressure amidst the potential profit-taking opportunity could lead to volatility in ETH’s prices, because of which leveraged positions could get liquidated.

While on-chain data suggests a potential profit-taking phase, the OG whale signals confidence in Ethereum’s long-term prospects by accumulating ETH and partially offloading BTC.