Key Takeaways

- Amundi has introduced a tokenized share class for its AMUNDI FUNDS CASH EUR money market fund, with the first transaction completed on November 4.

- The fund can now be accessed through its traditional structure or as a digital unit recorded on the Ethereum network.

- CACEIS supplies the infrastructure for ledger registration, investor wallets and the processing of subscription and redemption instructions.

- Amundi and CACEIS expect blockchain-based distribution to support faster order execution and broaden access to new categories of investors.

Amundi, Europe’s largest asset manager, has tokenized a share class of its AMUNDI FUNDS CASH EUR money market fund, as it aims to bring blockchain based processes into the heart of its distribution model.

The project was developed with CACEIS, which provides the infrastructure needed to record fund units on a distributed ledger and manages the digital wallets used by investors. The group also operates the system that handles subscription and redemption instructions in the tokenized environment.

The initial issuance of the tokenized unit took place on November 4 and forms part of a hybrid setup that keeps the fund accessible through conventional channels while adding a digital option on the Ethereum network.

Amundi said using a public blockchain creates an auditable trail of unit movements and allows transactions to be processed immediately. The approach also enables continuous access to the fund, a feature the firm expects will appeal to younger clients and investors seeking round-the-clock flexibility.

Jean Jacques Barberis, Head of Institutional and Corporate Clients, said interest in tokenized assets is rising quickly across global markets. He added that the initiative shows the company’s ability to apply the technology to practical investment products, with further projects planned in France and abroad.

CACEIS chief executive Jean Pierre Michalowski said the service opens a new digital distribution route for client funds. He noted that the longer-term goal is to offer uninterrupted subscriptions and redemptions settled in electronic money tokens or a future central bank digital currency.

Why Tokenized Funds Are Drawing Interest Across Global Markets

Tokenized funds are traditional investment products whose units are recorded on a blockchain rather than within the closed systems used by conventional transfer agents.

The structure does not change the underlying assets or the rules governing the fund. Instead, it shifts the way units are issued, transferred and tracked.

By storing transactions on a shared ledger, managers can offer improved transparency, as every transaction appears in real time, giving investors the ability to see how their orders are processed.

For users, tokenized structures offer quicker settlement, continuous access outside usual trading hours and fewer administrative steps that can slow or complicate fund transactions. The model can also draw in younger or digitally native investors who prefer managing assets through blockchain-based wallets rather than through traditional accounts.

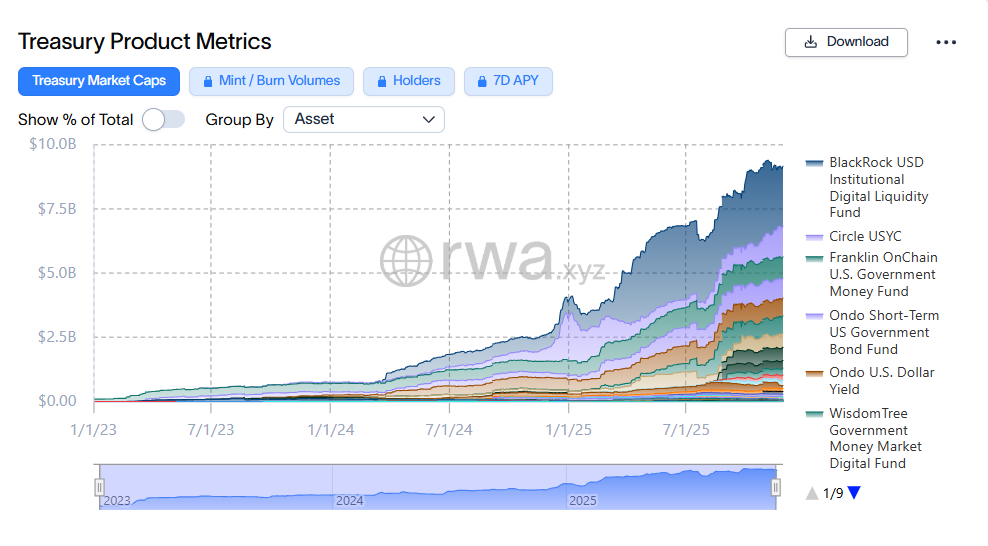

Asset managers and financial institutions are moving steadily toward this approach. BlackRock, Franklin Templeton, WisdomTree and Hashdex have issued tokenized versions of money market or bond products over the past two years. Their launches have been followed by trials from banks looking to streamline internal settlement processes and lower operational costs.

These developments show that the wider industry views tokenization as a way to modernize market infrastructure without changing the regulatory framework that underpins the products themselves.

Read More: Visa Expands Stablecoin Settlement to Europe, Middle East and Africa with Aquanow Deal