Crypto market sentiment has dropped to its most depressed levels in years, with one proprietary model and CoinMarketCap’s Crypto Fear and Greed Index both flashing “extreme fear”, as analysts caution that prices could still fall further.

In a “Chart of the Day” tweet posted on February 17, 2026, by Matrixport, a crypto financial services platform, independent analyst Markus Thielen said his Greed and Fear Index, which tracks bitcoin’s price and maps repeated cycles of euphoria and fear, has fallen into extremely pessimistic territory, reflecting broad risk-off positioning in the crypto market.

Thielen argues that “durable bottoms” in bitcoin tend to form when the 21-day moving average of this sentiment indicator drops below zero and then turns higher. According to the commentary, that transition historically signals that selling pressure is becoming exhausted and that market conditions are starting to stabilize.

The latest reading suggests that this process may already be underway, with the sentiment line on the chart having plunged deep into negative territory and now starting to rebound higher even as price remains under pressure.

Thielen notes that such deeply negative readings have, in the past, offered “highly attractive” entry points for longer-term investors, given what he describes as a cyclical relationship between sentiment and Bitcoin’s price action.

At the same time, Thielen stresses that prices can still decline further in the near term despite the contrarian signal, saying the current backdrop is one where caution remains justified, but investors should also be preparing for the kind of conditions that have often preceded a meaningful rebound in previous cycles.

CMC Fear and Greed Index echoes “extreme fear” signal

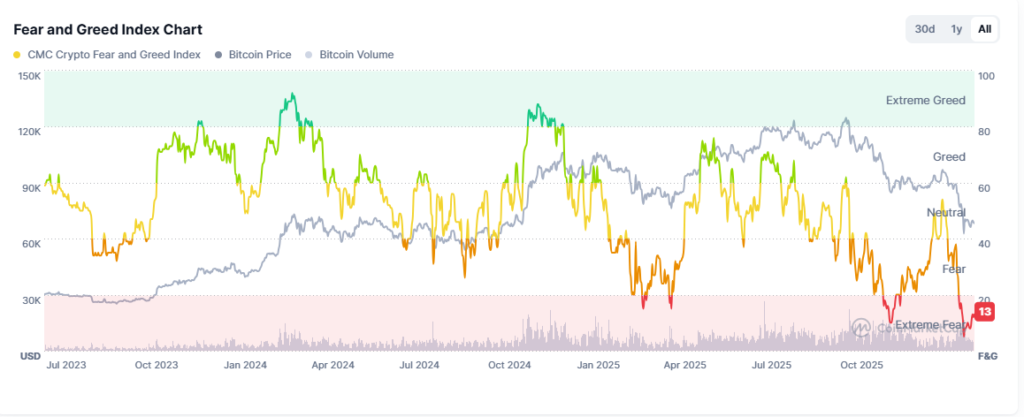

Data from CoinMarketCap’s Crypto Fear and Greed Index tells a similar story of sharply weaker sentiment across the broader digital asset market.

The index currently sits at 13, firmly in the “Extreme Fear” level at the bottom of the scale. Yesterday’s value was 12, and last week’s was 10, indicating that fear has been entrenched for several days.

However, one month ago, the same gauge read 50, a neutral level, highlighting how sharply sentiment has deteriorated over the past few weeks.

Over the past year, the index has swung from a high of 76 in late May 2025, when it signaled “Greed,” to a low of 5 in early February 2026, marked as “Extreme Fear.” The current reading sits close to that low, showing how defensive investors still are.

On a longer view, this kind of extreme fear has only shown up a few times on the CMC gauge, including on November 21, 2025, when the index dropped to 11 during a broad sell-off, and on February 6, 2026, when it briefly touched 5 as bitcoin logged its sharpest fall since 2022.

Taken together, Thielen’s Greed and Fear model and CoinMarketCap’s index both show sentiment is heavily tilted to the downside, a pattern that has often appeared in the later stages of past bitcoin corrections. Whether this cluster of extreme readings marks a lasting bottom will depend on how fundamentals, liquidity, and broader macro conditions develop, but sentiment now looks similar to periods that have previously been followed by stronger recoveries.