Key Takeaways

- Philadelphia Fed President Anna Paulson said she supports more rate cuts this year, calling further easing “appropriate” as inflation cools and labor market risks rise.

- Paulson stated that the Trump tariffs will lift prices temporarily but “won’t leave a lasting imprint on inflation,” urging policymakers to look through short-term effects.

- Her remarks boosted optimism across risk assets, with expectations of lower rates driving renewed bullish momentum in the crypto market.

Philadelphia Federal Reserve President Anna Paulson said she supports further monetary policy easing this year. To support her view, she cited progress on inflation and rising labor market risks. Thus, crypto market participants eye a major rebound after Bitcoin (BTC) and altcoins took a bit, plunging to record lows on Friday after U.S. President Donald Trump proposed a 100% tariff plan on Chinese goods.

Anna Paulson Supports More Fed Rate Cuts

Speaking at the National Association for Business Economics (NABE) Annual Meeting in Philadelphia on October 13, Paulson said she views “easing along the lines of the median Summary of Economic Projections policy path as appropriate.” She noted that the Federal Open Market Committee’s (FOMC) decision to reduce interest rates by 25 basis points in September “made sense.”

Moreover, she described the move as suitable given the current economic outlook. The Fed’s September meeting marked the first rate cut of the year, with officials signaling expectations for two additional 25-basis-point cuts before year-end.

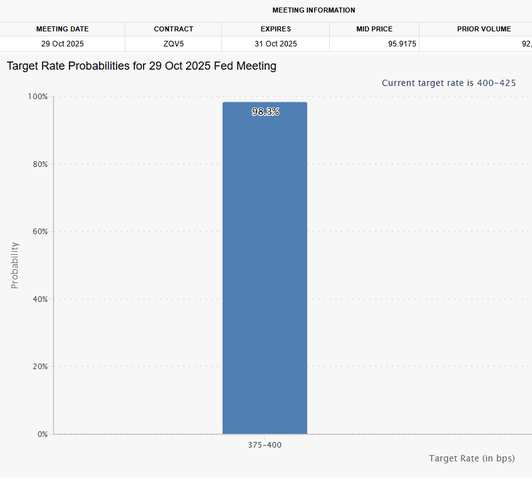

According to the CME FedWatch Tool, traders are assigning a 98.3% probability of another quarter-point rate reduction at the upcoming FOMC meeting, which would bring the federal funds rate to a range of 3.75–4.0%. Paulson’s remarks further strengthened market expectations that the central bank will maintain its easing trajectory in the months ahead.

The Philadelphia Fed President said her outlook is shaped by “progress on underlying inflation” and by concerns that “labor market risks appear to be increasing.” She further added that overall employment momentum is “going in the wrong direction.” Paulson highlighted that while the economy remains relatively strong, the slowdown in hiring and the softening of business sentiment justify a gradual policy adjustment.

For context, Paulson’s comments place her among a growing number of Fed officials: Michelle Bowman, Chris Waller, and Stephen Miran among them, who have voiced support for additional easing this year. While Governor Waller recently suggested that “25-basis-point cuts were just fine” and urged caution about moving too quickly, Paulson emphasized that a careful but continued adjustment is necessary to maintain balance between the Fed’s dual mandates of price stability and maximum employment.

Read More: Bitcoin No Longer ‘Digital Gold’? Crypto Chaos Leaves Gold in Spotlight

Remarks About Inflation & Potential Impact On Crypto Market

On the inflation front, Paulson addressed the impact of President Trump’s tariffs, saying her “base case is that tariffs will increase the price level, but they won’t leave a lasting imprint on inflation.” She argued that monetary policy should look through tariff effects on prices, as the recent data show tariff-induced price increases have been smaller than anticipated.

While acknowledging the recent rise in goods prices, Paulson said she does not see “conditions as supporting problematic spillovers” into broader inflation trends. She observed that now with companies being more concerned with retaining market share, they will be less prone to transfer higher costs to consumers and this has assisted in keeping inflationary pressures within check.

Paulson is not alone in this view, and is consistent with the other policy makers that think the price pressures that are caused by tariffs are short term. With Federal Reserve Chair Jerome Powell speaking on the economy and monetary policy tomorrow, investors will be seeking further indicators of the rate changes and reaction of the central bank to the changing economic environment.

The statement by Paulson has also had an impact on the mood in the digital asset market, where traders seen to support the further reduction of rates can be interpreted as a positive indication of liquidity-driven assets. The expectation of reduced rates in the United States has caused fresh optimism in the major cryptocurrencies as investors are betting on a more accommodative policy position that favored relaxed risk-taking.

Read More: Will Crypto Market Crash Further? China Poised To Hit Back At Trump Tariffs