Key Takeaways:

- FIUSD stablecoin will integrate with Fiserv’s existing banking infrastructure, requiring no additional tech spend for clients.

- Strategic partners include Circle (USDC), Paxos, and PayPal (PYUSD) for cross-chain interoperability.

- Solana is chosen for its low-cost, high-speed stablecoin transactions.

- Merchant rollout targets 90B annual transactions across Fiserv’s Clover Point of Sale (POS) systems.

The Sleeping Giant of Payments Wakes Up

As crypto startups compete for stablecoin dominance, Fiserv, the $90 billion fintech platform with 40% of US bank accounts, has entered the race with a nuclear option: FIUSD. Unlike the latest rental decentralized finance (DeFi) farm, this stablecoin is for bankers, who still send fax meeting agendas.

Think of it as USDC in a suit and tie. No wallets to download, no gas fees, just moving balance sheets at blockchain velocity.

Why Banks Could Actually Use This

FIUSD’s killer features for traditional finance:

✅ Plug-and-play Software Development Kit (SDK) integrates with existing Fiserv core banking systems

✅ Built-in compliance using legacy fraud monitoring tools

✅ Deposit token option to ease capital requirements (coming 2026)

The Solana choice raised eyebrows, but the enterprise stated that they needed a chain that could handle Black Friday volumes, and Ethereum’s L2s weren’t battle-tested enough.

The PayPal Partnership Play

The real game-changer? Interoperability with PayPal’s PYUSD, creating:

- Cross-border corridors: PYUSD ↔ FIUSD swaps for 200+ countries

- Merchant liquidity: Instant settlement for Clover POS systems

- Regulatory cover: Both stablecoins are regulated by the New York State Department of Financial Services (NYDFS)

PayPal’s 400M users meet Fiserv’s merchant army – that’s the Web2<>Web3 bridge many institutions need nowadays.

The Stablecoin Wars: Enterprise Edition

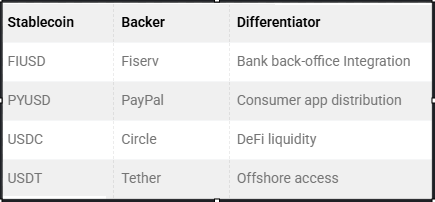

FIUSD enters a crowded field:

So far, analysts note Fiserv’s advantage: existing relationships with JPMorgan Chase, Bank of America, and 8,000+ regional banks.

The Boring Revolution

This is not crypto’s equivalent of a moonshot; it looks more like an interstate highway system being built under Wall Street. If FIUSD sees a favorable outcome, it would do for stablecoins what Automated Clearing House (ACH) did for electronic payments: it would make them invisible infrastructure.

Final Thought: Will banks really adopt this over SWIFT?

For 24/7 settlement? Yes. For everything else? SWIFT isn’t going anywhere – yet. When your local credit union starts offering “blockchain-enabled” services in 2026, remember this launch.

For more on bank-grade crypto, read: Societe Generale Makes Banking History with First Public Stablecoin: USDCV