- Nvidia overtakes Microsoft, Apple, Amazon & Alphabet to become world’s biggest company with $4 trillion market cap.

- Growing demand for AI-powered technology fuels NVDA price surge.

- Strong earnings and “Golden Cross” technical signal also boost Nvidia bulls.

- Nvidia (NVDA) nears $170 resistance, but further upside remains possible despite challenges from Trump’s trade policies.

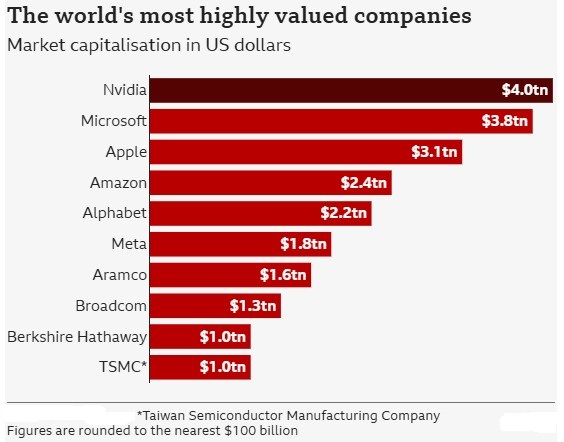

Nvidia (NVDA) hit a record high of $164.42 on Wednesday, making the California-based chipmaker the world’s most valuable company with a market capitalization of $4.0 trillion. In doing so, Nvidia surpassed tech giants Microsoft, Apple, Amazon, and Alphabet — despite prevailing market pessimism linked to U.S. President Donald Trump’s newly announced tariffs.

Source: BBC

Key drivers behind this historic rally include soaring global demand for technology powering Artificial Intelligence (AI), as well as Nvidia’s strong quarterly earnings released in late May. The company’s transformation is striking: eight years ago, its stock traded at less than 1.0% of its current price while competing with Advanced Micro Devices (AMD) in the graphics card space. The explosion of AI — especially generative AI models like ChatGPT — has since accelerated demand for Nvidia’s advanced chips, fueling its meteoric rise.

Many market watchers also credit Nvidia Chief Executive Officer (CEO) Jensen Huang as a major force behind the company’s success. Meta CEO Mark Zuckerberg recently dubbed him “the Taylor Swift of tech,” reflecting Huang’s growing influence in the AI and semiconductor space.

Wall Street’s confidence in AI innovation — coupled with a relatively muted response to Trump’s trade policies — has further supported NVDA’s momentum on the Nasdaq.

Nvidia’s earnings report, released on May 29, revealed a 69% year-over-year revenue surge in the first quarter (Q1) of fiscal year 2025 to $44.06 billion, compared to $26.04 billion in Q1 2024 and $39.33 billion in the fourth quarter (Q4) of 2024. Although Net Income dropped from $22.09 billion in Q4 2024 to $18.77 billion, it remained significantly higher than the $14.88 billion reported in Q1 2024.

It’s also worth noting that April’s U.S. export restrictions targeting Nvidia’s China-specific “H20” AI chips had a reported negative impact of around $4.5 billion, according to CEO Huang — slightly less than the $5.5 billion loss that was anticipated. Huang has publicly criticized these export bans but raised optimism in early May after traveling to Saudi Arabia with U.S. President Donald Trump. The company later suggested that “hundreds of thousands” of its AI chips could soon be deployed in the region.

Technical Analysis

Nvidia shows a classic bullish Simple Moving Average (SMA) crossover on the daily chart, signaling more upside ahead despite the 14-day Relative Strength Index (RSI) entering overbought territory.

NVDA: Daily Chart Hints At Further Upside

Source: TradingView

A confirmed Golden Cross—where the 50-day Simple Moving Average (SMA) crosses above the 200-day SMA—adds to bullish signals from the Moving Average Convergence Divergence (MACD), supporting further upside in Nvidia (NVDA) prices.

With this momentum, NVDA appears set to test an upward-sloping resistance line drawn from late June 2024, located near $170.00.

Notably, the last Golden Cross formed in late January 2023 led to a sharp rally from $19.20 to the record high of $153.13 in January 2025, suggesting that significant upside may still lie ahead.

On the downside, any pullback remains limited for now, with the three-month ascending trendline near $154.50 and the January 2025 peak of $153.13 offering immediate support.

Conclusion

Nvidia’s historic climb to a $4 trillion market cap and global leadership reflects booming demand for artificial intelligence (AI), strong financials, and clear technical strength. Despite headwinds from U.S. trade restrictions, investor optimism remains solid, supported by a confirmed Golden Cross and bullish momentum. With price action approaching the $170 resistance and a strong foundation of institutional confidence, NVDA appears well-positioned for further gains—provided broader macro risks remain in check and AI adoption continues accelerating.