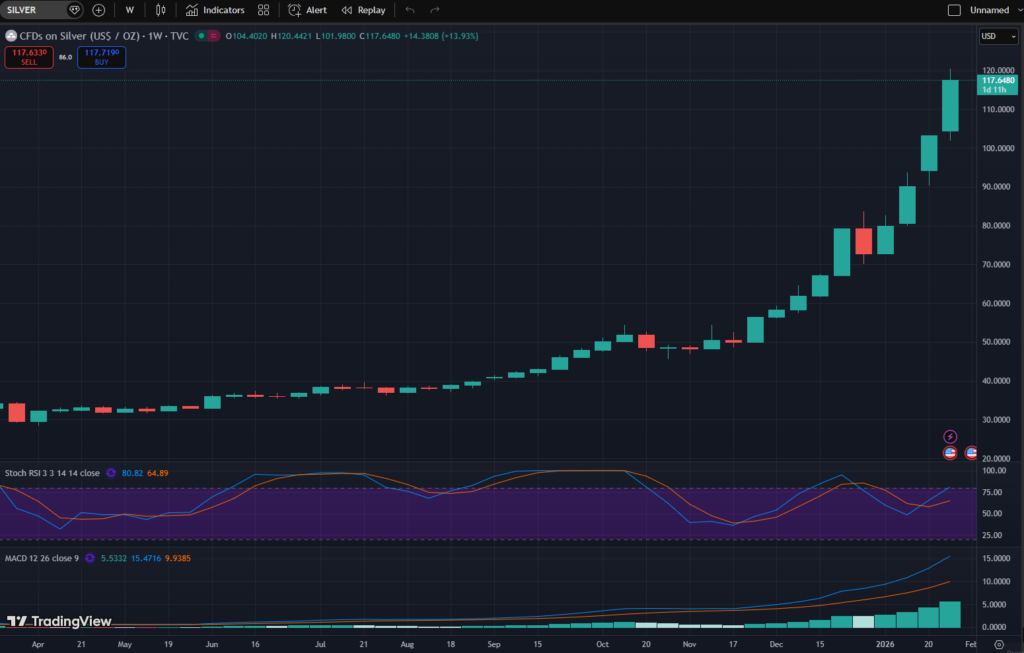

A powerful gold and silver surge sent prices to all-time highs (ATHs) this week as gold crossed U$D 5,500 and silver U$D 117,000. The historic rally, which started recently and is picking up steam as we approach the latter part of January 2026, is being driven by a combination of a weak dollar and investors seeking safety amid U.S.-Iran tensions and fears of currency debasement.

Why the Metals Are Exploding Higher

This is not just a blip on the radar. The gold and silver surge represents one of the largest capital shifts we’ve ever seen, and it can be traced back to macroeconomic concerns and extreme anxiety. The U.S. Dollar Index has plummeted to multiple-year lows as investors view the Trump Administration as having a permissive attitude towards the dollar’s decline. This is resulting in decreased values for dollar-denominated assets/investments and therefore increasing interest in hard assets like metals more attractive.

Parallelly, increasing national debts are creating concerns that governments may inflate away their obligations, which has historically driven demand for gold. On its side, Silver is experiencing what many are considering to be a ‘once in a century’ opportunity as demand for the metal as a safe investment grows while supply from manufacturers is low due to shortages of materials required for producing solar panels and artificial intelligence (AI) hardware.

If Iran Suffers, China is Highly Affected

In a short recap, Iran’s growing instability is also the top threat to global oil markets. China now buys around 90% of Iran’s crude (up from 25% in 2017), this ties Iran’s stability to China’s energy security. Nationwide protests add a USD 3 or 4 per barrel geopolitical risk premium. Sanctions and tensions have pushed Iranian floating oil storage to a record 166 million barrels.

As an already regular bully, U.S. threats of 25% tariffs on countries trading with Iran would severely disrupt the sanctioned oil system, given Iran’s reliance on Chinese refiners. In 2025, China’s trade surplus hit a record USD 1.2 trillion. While U.S. exports fell, other markets compensated, though stronger reactions are expected this year.

The Huge Amount of The Move (and the Crypto Implications)

The scale of this gold and silver surge is best understood through market capitalization (marketcap). Combined, gold (USD 38.8 trillion) and silver (USD 6.6 trillion) now represent a shocking nine times the market value of tech giant Nvidia. This indicates that there is an enormous shift of capital: the world’s largest capitals are (for now) moving into physical assets for protection.

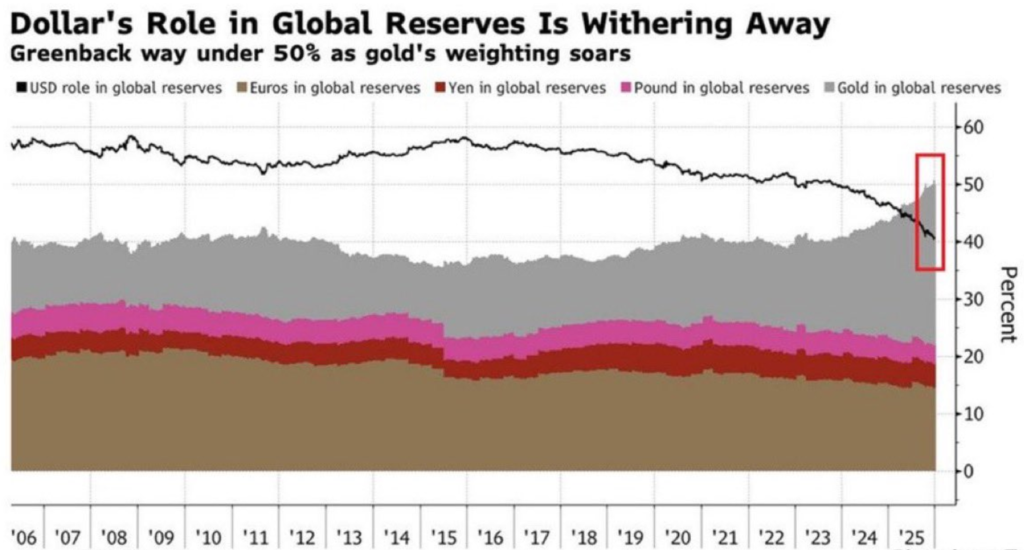

According to financial analysts, the dollar’s share of global reserves has fallen to 40% approximately, while gold is up 28% (the highest market share of gold in the last 30 years). This is more than a trade; diversifying out of the traditional currency system is taking on a slow-motion manner.

On the other hand, there is a massive gap compared to the crypto market; for instance, gold and silver are now 22 and 3.6 times (respectively) larger than Bitcoin (BTC). With gold representing a benchmark store of value, supported by centuries of trust, the crypto market is just a kid by comparison. If Bitcoin ever reached gold’s market capitalization, it would be because enough capital decides to trust in digital assets as much as physical ones, and not just hype.

At the same time, putting this in perspective, the potential is huge, but the two main stoppers are still market maturation and, obviously, adoption. Doing a bit of math, if today Bitcoin matched gold’s marketcap, a single BTC could be around USD 1,900.000.

Summing Up

The relentless gold and silver surge could be seen as a flashing warning light on the global economic dashboard. The final takeaway is that this move signals an aggressive loss of confidence in fiat currency stability and a flight to historic stores of value. With the U.S.-Iran relationship, among other geopolitical tensions arising in the world, markets are shaking, hoping for some signals to light up the path to peace.

For the crypto community, it stresses a parallel narrative of seeking sovereignty. The gold and silver surge shows how tough metals are winning the current battle for institutional capital. But, while volatility seems guaranteed, the underlying drivers (a weak dollar, debt, and geopolitics) show no sign of abating.