Key Takeaways

- Binance’s XRP exchange reserve has decreased by 11.4 million XRP amid a price decline, potentially indicating accumulation.

- 77.17% of Binance traders are betting on long positions in XRP.

- An expert predicted that if XRP holds above the $2.71 level, it could be propelled to $3.60.

Bullish sentiment around XRP is heating up, even as the price continues to slip for consecutive days. This follows a notable drop in exchange reserves, massive XRP outflows, a long/short ratio above 3, and bullish predictions from experts.

On-Chain Signal Bullish Sentiment

Over the past 24 hours, several bullish developments have been recorded on on-chain analytics tools, hinting that a potential reversal may be coming for XRP.

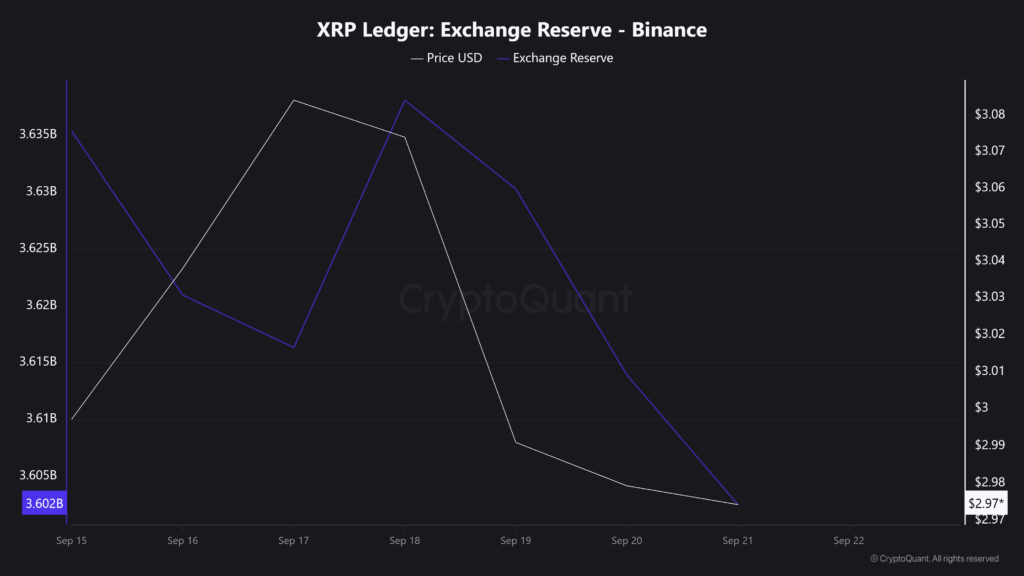

Falling XRP Exchange Reserve

Data from the on-chain analytics tool CryptoQuant reveals that Binance’s XRP exchange reserve has dropped by 11.4 million XRP over the past 24 hours. Exchange reserves indicate how much of an asset exchanges hold, and declines in reserves hint at ongoing accumulation by investors, whales, and institutions.

This bullish development, which emerged while the asset was tumbling, suggests that whales or long-term holders may be taking advantage of the price dip by following a “Buy the Dip” strategy.

Also Read: Why is Crypto Falling Today? BTC falls 3%, ETH slips 7%, XRP down 6%

Current Price Momentum

At press time, XRP is trading near $2.86, down 3.75% over the past 24 hours. However, during the same period, the asset has seen a significant surge in trading volume compared to the previous day, indicating heightened participation from traders and investors.

77% Traders Go Long

Despite the price decline, sentiment among both investors and traders appears bullish. Coinglass, an on-chain analytics tool, reveals that Binance’s XRPUSDT Long/Short ratio has reached 3.38, indicating that for every 3.38 long positions, there is one short position.

This metric further shows that currently 77.17% of traders are betting on long positions, while 22.83% are on short positions.

Expert Bold Price Predictions

Given the current market sentiment and recent developments, several bold predictions have emerged on X.

In a post, a well-followed expert shared that if XRP holds above the $2.71 level, it could build strong buying pressure and potentially propel the asset to $3.60. Meanwhile, another crypto expert shared a similar prediction, noting that if XRP holds above $2.47, the target could still be $4.804.

Besides this, several similar predictions have surfaced on X, suggesting that XRP has strong upside potential.

XRP Price Action and Technical Analysis

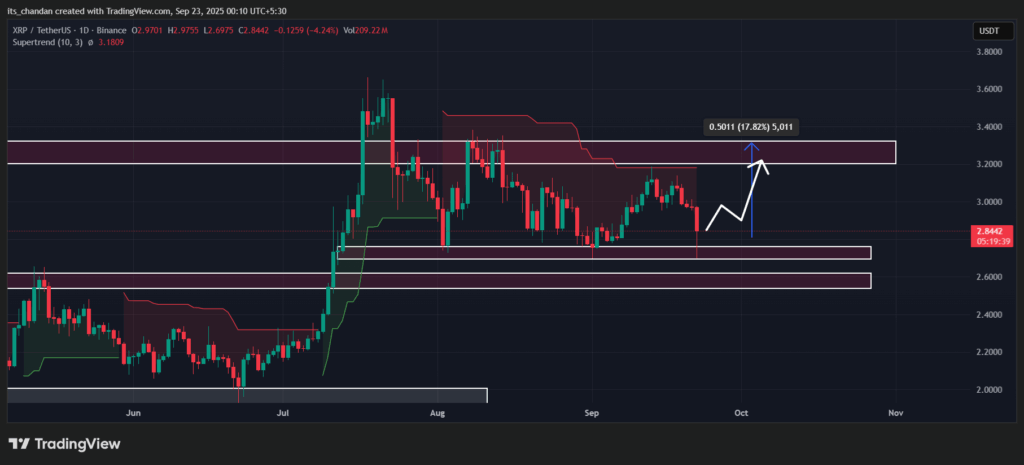

According to TradingView’s daily chart, following the recent dip, XRP has successfully reached the key support level of $2.695. This marks the fourth time since July 2025 that the asset has reached this level, historically, each time it has reached this point, a strong rebound has been recorded, as evident on the daily chart.

Based on the current price action, if XRP holds this support, it could see an impressive 17% price increase.

However, this bullish thesis remains valid only as long as XRP stays above the $2.695 level; if it falls below, the outlook could be invalidated.

However, the Supertrend technical indicator has turned red and is hovering above the XRP price, hinting that the asset is in a downtrend; it will turn green if the trend reverses.