Key Takeaways

- According to VanEck, Bitcoin could reach as high as $180,000 at the end of 2025 with enough institutional purchases.

- Analysts like Dean Chen believe that Bitcoin can reach $180K only if ETF and corporate inflows remain strong.

- Bitcoin may experience volatility inclusive of more effort going into developments surrounding mining.

As the cryptocurrency market continues to mature, digital assets like Bitcoin (BTC) carry great potential for the upside. Leading global investment management firm VanEck (formerly VanEck Global) maintained their bullish stance on BTC, projecting a $180,000 price for BTC by the end of 2025.

The report states that the drop in Bitcoin treasury companies’ mNAV (market net asset value) is due to lower Bitcoin volatility and may continue its downtrend if volatility remains low. However, VanEck also suggests that a sharp spike in volatility may trigger larger price swings for digital assets like Bitcoin. The move could get magnified as dealer hedging activity brings extra pressure to the market.

Bullish Outlook from VanEck

VanEck’s head of digital asset research, Mathew Sigel, and investment analyst Nathan Frankovitz emphasize that Bitcoin is primed for a significant rebound rather than a prolonged correction. The Chaincheck report highlighted

“Bitcoin hit all‑time highs in August despite an early‑month dip; deepening mining consolidation and miner AI‑hosting pivots underscore structural shifts even as volatility stays suppressed.”

What experts believe

Dean Chen, an analyst at Bitunix Exchange, says

Our assessment is that the core of VanEck’s argument lies in ‘structural buying demand and a rebound in leveraged sentiment.’

Dean expands on the details for early August, when BTC briefly fell to around $112,000 before rebounding on August 13 to retest the July high of $123,838. At the same time, CME futures spreads widened and funding rates turned higher, while inflows from ETFs and corporate treasuries in July continued to absorb available supply—supporting the narrative of a potential new high by year-end. After briefly dipping near $112K in early August, BTC rebounded to retest $123.8K as CME spreads and funding rates rose, while ETF and corporate inflows absorbed supply—fueling expectations of new highs by year-end.

The analyst believes that Bitcoin can reach $180K from $120K (about 45% upside), but only if ETF and corporate inflows remain strong, real interest rates and the U.S. dollar remain supportive, and capital rotation favors BTC over altcoins. Otherwise, the move higher will likely be slower and more volatile.

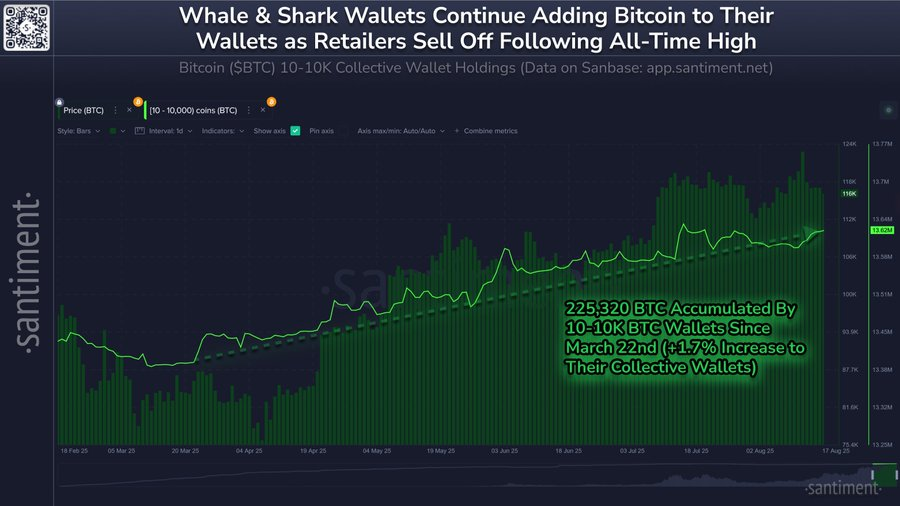

On-Chain Data Suggests Strong Accumulation

According to Santiment, big holders with 10-10K BTC wallets are not only accumulating during the recent price drop, but since August 13, they’ve added 20,061 BTC, and since March 22, about 225,320 BTC. The accumulation of BTC by large holders has correlated with future price increases and suggests that large holder accumulation could be a leading factor for bullish price momentum. Accumulation appears to be strong with big holders, although capital rotates to altcoins, including layer 2, which may continue to mitigate bullish sentiment in the near term.

The official ChainCheck report also states that 92% of on-chain holdings were profitable before BTC’s recent all-time high, providing a solid foundation for further gains. Corporate investments, particularly from firms like MicroStrategy, have stabilized BTC amid Ethereum’s rising institutional inflows.

The leading public companies, such as MicroStrategy (MSTR), continue to acquire Bitcoins and are still holding onto their balance of 629,376 BTC. According to SoSoValue, U.S. spot BTC ETFs have total cumulative net inflows of $54.85 billion and total net assets of $150.89 billion.

Mining Trends for Bitcoin Ecosystem

The above chart highlights that the Bitcoin network holds strength while prices are continuing to rise, supporting the bullish outlook for the largest cryptocurrency. Pullbacks have signalled a volatile path ahead. VanEck highlights that TeraWulf (WULF) signed an agreement backed by Google to host 200 MW of AI load, and it is making progress in AI-based mining. The U.S.-listed miners now control 31.5% of the global hashrate, which is a record high and shows more consolidation.

VanEck is continually optimistic on Bitcoin, attributing inflows from institutional activity as the greatest variable for future growth. Ethereum is receiving momentum and some hype, but BTC momentum stands strong, with aggressive targets of $180,000 and possible new highs to follow. The crypto investors should observe trends in ETF inflows for these digital assets combined with the on-chain data and regulatory movements as they set their leadership with Bitcoin for the year 2025.