Hyperliquid (HYPE) extended its sixth consecutive decline with today’s 5% price drop, but whales appear to be embracing a ‘buy the dip’ strategy amid the uncertainty.

Today, crypto transaction tracker Onchain Lens shared a post on X highlighting that two crypto whales have added millions of dollars’ worth of HYPE amid the ongoing price decline, a move that is now drawing significant attention from crypto enthusiasts.

In the post, Onchain Lens shared that crypto whale wallet address “0x330” spent $2.9 million USDC to purchase 98,739 HYPE tokens at an average price of $29.37, while another wallet, “0x1EC,” spent $1.3 million to increase its HYPE holdings to 97,679 tokens, now valued at $2.85 million.

Whales are investors who hold a massive portion of any assets, and their activity strongly influences its price because it often signals an upcoming move.

When whales buy an asset, it not only suggests that the asset may be poised for a major rally but also indicates that the specific price level is attractive and reflects strong long-term potential. Additionally, their activity and transaction patterns act as indicators that can hint at an upcoming rally in the crypto market.

The whales’ recent purchases come at a time when the overall sentiment remains bearish. Now it is raising questions whether whales are positioning early for a reversal or simply taking advantage of the ongoing dip while retail interest fades.

As per the advanced charting tool TradingView, HYPE has declined 5.15% and is currently trading at $27.85. Meanwhile, investor and trader participation has also fallen, as reflected in the trading volume, which dropped 7.55% to $369 million over the past 24 hours.

Why is Hyperliquid (HYPE) Price Declining?

The key catalyst reinforcing HYPE’s bearish outlook is the current market sentiment, along with traders’ fading interest in the asset, as recorded by the analytics platform Coinglass.

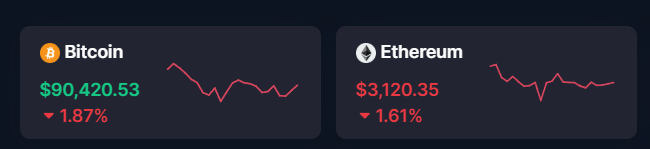

Today, the crypto market is down 1.26%, pulling the total market cap back to $3.07 trillion. Meanwhile, major assets Bitcoin (BTC) and Ethereum (ETH) are following the trend, declining 1.85% and 1.75%, respectively, during the same period.

Traders Step Back Amid Volatility

According to Coinglass data, HYPE Future Open Interest (OI) dropped 7.90% to $1.44 billion over the past 24 hours. The decline in OI indicates a sharp decline in leveraged activity, suggesting traders are cautious as selling pressure intensifies.

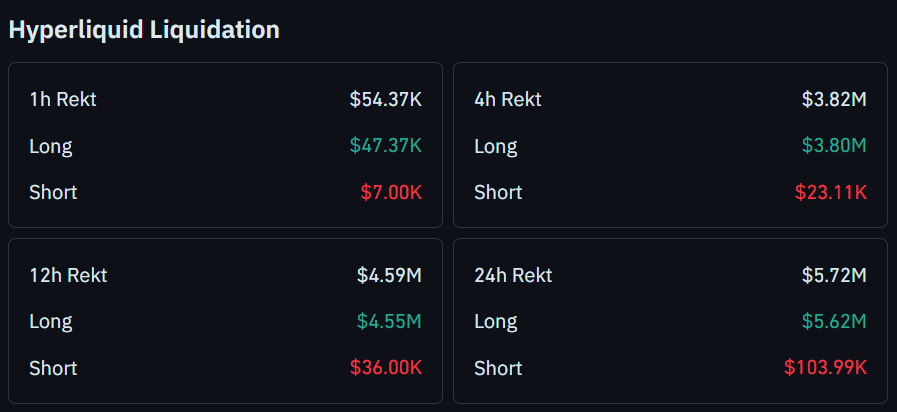

At the same time, traders’ long liquidation reached $5.62 million compared to short liquidation, which recorded as $103.99k.

As of now, HYPE’s Long/Short ratio reaches 0.9099, indicating a bearish sentiment among the traders. The Long/Short ratio is a metric that defines the balance between bullish and bearish positions, offering a clear view of how traders are positioning themselves in the market.

Also Read: Why is The Crypto Market Struggling? Everything You Need to Know!