Key Takeaways

- Ethereum is up 10% to $3,940 in the last five days, with a Cumulative ETF Total Net Inflow of $9.62B.

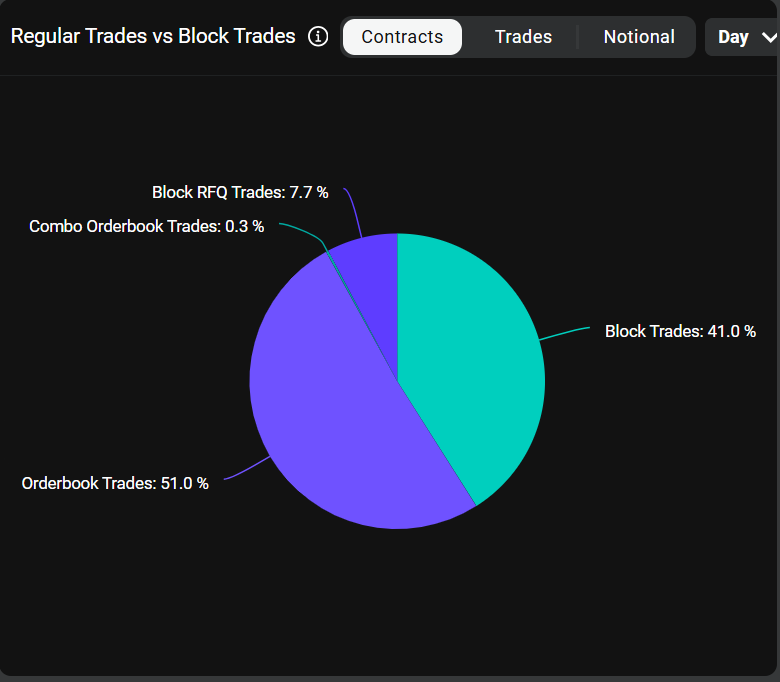

- 30,000 block trades and more than 420K call vs. 105K put contracts signal strong upside potential for the asset.

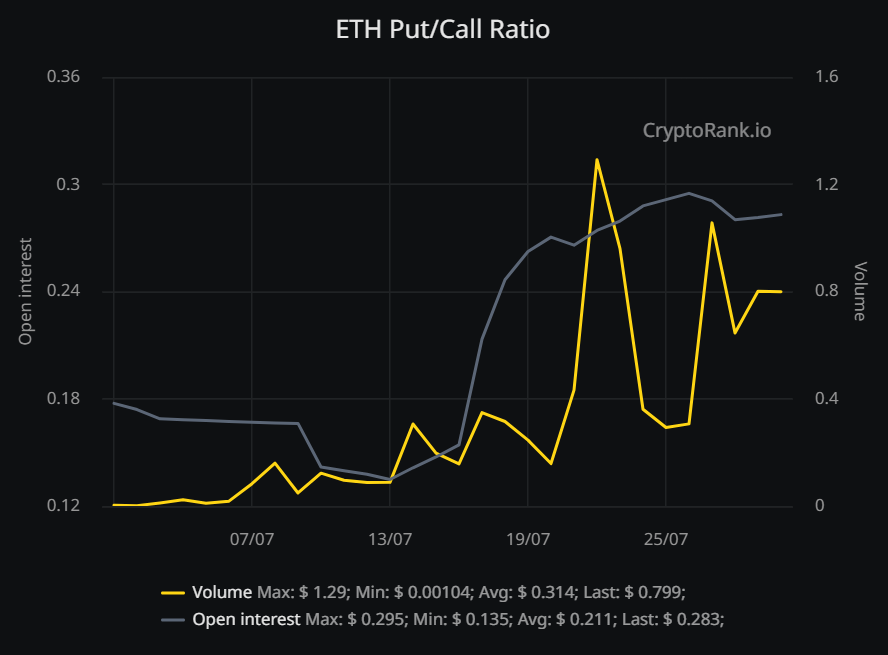

- A 0.28 put/call ratio hints more bullish bets among traders this month.

The Ethereum (ETH) price trades sideways on Wednesday. The second-largest cryptocurrency touched the yearly high of around $3,941.86 on Monday. However, it has been struggling with the momentum since then.

ETH price jumped over 10% since Friday, climbing from $3,570 to $3,940. The current month options data suggests a 30% chance of the price hitting $6,000 by year-end.

What Ethereum Options Data Suggests?

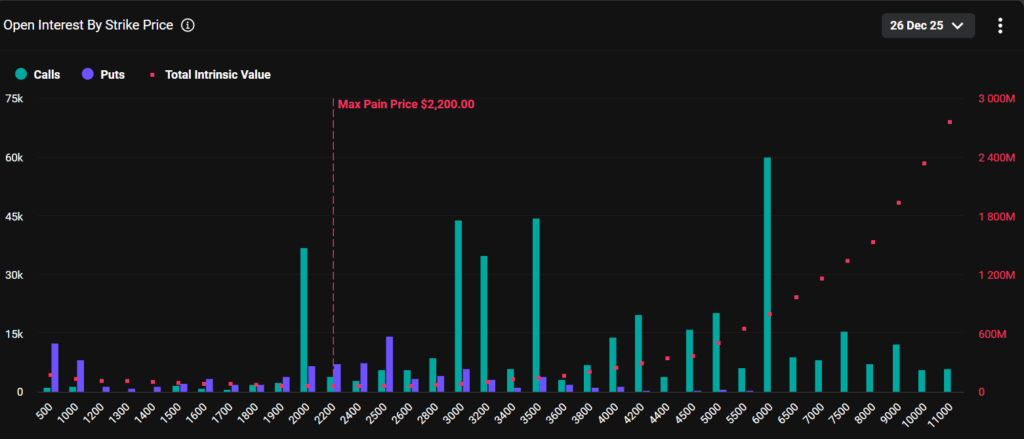

Data from on-chain analytical firm Derive indicates institutional investors are buying call options that will pay off if the Ethereum price reaches $6,000 or greater by December. The major block trades in these options, including 30,000 contracts targeting $6,000, all show this optimism isn’t solely retail investor excitement.

Current data from the Ethereum options market (expiring December 26, 2025) shows a strong bullish bias. Call open interest is overwhelmingly higher than puts (420,634 vs. 104,966 contracts), and major bets are focused on higher strike prices, especially $6,000 and above.

What Does Put/Call Ratio Tells?

According to CryptoRank, the put/call ratio is just 0.28. The chart signals a shift from bearish sentiment (put/call ratio peaking at 0.36 mid-July) to a more balanced or bullish outlook (declining to 0.283 by 25/07), suggesting traders expect ETH prices to stabilize or rise shortly.

Regular Trades vs Block Trades

The 51.0% order book trades and 41.0% block trades indicate considerable market activity, including significant institutional interest (block trades) with an overall bullish sentiment. A target of $6,000 ETH would indicate potential support from both retail and larger investors, especially if sentiment remains intact as we approach strong support (without going under), and the put/call ratio has dropped to 0.283, suggesting growing trader confidence that could push ETH back toward that price.

Institutions Accumulating Ethereum

The cumulative ETF total net inflow for Ethereum stands at $9.62 billion as of 29 July 2025, highlighting the continued interest from large investment firms that has strengthened the belief that cryptocurrencies are growing into an asset class.

Companies are establishing Ethereum treasuries, with institutions like SharpLink Gaming now holding over 360,000 ETH, worth more than $1.3 billion, as part of their core treasury strategy. Most of these companies are involved in staking these assets, which are generating yields.

What Is a Put-Call Ratio (PCR) In Crypto?

The Put Call Ratio (PCR) is a measurement to know about the investor bias as a whole. It is used to check the placement of bets on falling or rising prices, which is calculated by dividing the number of outstanding put options by the number of outstanding call options. The put-call ratio is an indicator of whether investors

A put option gives the buyer the right (not the obligation) to sell the asset at a predetermined price. This would be used when a trader thinks the price is going down.

A call option gives the buyer (the option holder) the right (not the obligation) to buy the asset at a predetermined price. The trader will use this only when he thinks the price will go up.