The cryptocurrency market has lost about $730 billion in the last 100 days, as of February 20, 2026. This quick drop shows that a lot of money is exiting the market. Smaller altcoins have lost the most, while leading coins like Bitcoin have held up a little better. Traders are now closely watching for any signs that the market might have hit rock bottom, even though there is still a lot of selling going on.

A Big Drop in Prices Across the Market

The Bitcoin market experienced a major downturn as its market capitalization decreased from $1.69 trillion on November 22, 2025, to $1.36 trillion, which represents a 21.5% decrease. The market decline that occurred shows that investors now display increased caution because they worry about ongoing economic uncertainty and inflation pressures and the worldwide markets experience stricter regulatory scrutiny. The market downturn demonstrates that traders need to evaluate their cryptocurrency holdings because all digital assets face challenges from worldwide economic conditions.

Major cryptocurrencies face market declines that extend beyond Bitcoin and stablecoins, according to data from other top digital currencies. The total market capitalization decreased by 15.2% as it dropped from $1.07 trillion to $810.65 billion, which shows that market investors have lost confidence throughout the entire market instead of only in smaller tokens.

The effects of the situation have hit mid- and small-cap altcoins with greater force. The assets experienced a 20% decline, which brought their value down from $390.4 billion to $267.6 billion during the defined time frame. Investors are now considering large-cap cryptocurrencies, suggesting a tendency to shift over to safer and more reliable investment choices. The assets operating with low liquidity and high risk are going through inclined selling pressure as the capital is rotating towards more trusted and well-established projects.

Overall, the current trend suggests that the big players are prioritizing security and liquidity over chasing short-term gains in an uncertain and volatile market environment.

Whale Activity and Market Sentiment

Whale inflows to Binance averaged $8.3 billion over the past 30 days, according to blockchain analytical platforms like CryptoQuant. This number is the highest level since 2024. These big transfers often happen before people sell their stocks or make changes to their portfolios. They could also have something to do with derivatives trading or managing liquidity.

In the past, big changes in whale activity like this have often happened at the same time as changes in market sentiment. The current rise is linked to major players reevaluating their positions after a long period of decline. The bearish momentum continues to be solid because there aren’t enough strong buying signals to equalize these inflows.

Bitcoin’s Technical Structure

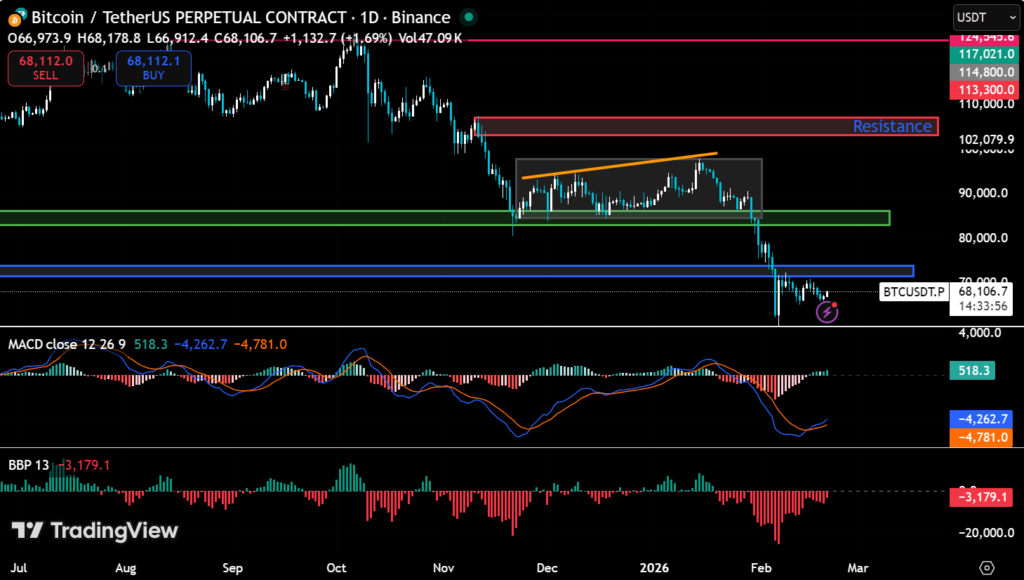

Bitcoin is now valued at $68,106.7, which experienced a gain of 1.7% in the past 24 hours from $66,970. The high was $68,178.8 and the low was $66,912. 4. Even though the current value is a small gain, the asset has lost more than 24% in the last month and about 30% in the last year.

The technical charts for the BTCUSDT perpetual contract on Binance show a clear downtrend from the peak in November 2025, which was close to $124,545. The $90,000 and $80,000 support levels have already been broken, and $110,000 is now a strong resistance level. Indicators like MACD show that bearish pressure is still there, and Bollinger Bands show that the market is oversold. However, without strong volume, it’s hard to say if the market will bounce back.

Overall, the technical picture indicates that the market remains cautious, with risks outweighing the likelihood of a swift recovery.

Market Indicators That Are Neutral

Even though there have been losses, some indicators show that the market is in a neutral phase. The total value of all cryptocurrencies is about $2.4 trillion, which is only 0.5% higher than it was 24 hours ago. CoinGlass says the average RSI is close to 45, which means that the market is not too overbought or too oversold.

The Altcoin Season Index is also at 45, which means that altcoins aren’t moving very quickly. Bitcoin dominance is still around 57%, which means that investors haven’t moved a lot of money into alternative coins. In other words, there isn’t much proof of a broad sector rally, which means that altcoins are still lower than Bitcoin.

On-Chain Activity Shows Less Demand

Prices and network activity have both slowed down. Santiment says that the growth of Bitcoin’s active supply has stopped, and the number of transactions is going down. Unique addresses that make transactions have dropped 42% from their highs in 2021, and new addresses are 47% behind, which shows that investors don’t care.

According to Glassnode, Bitcoin is now below its True Market Mean and close to the realized price of $54,900, which is the average cost basis for all circulating coins. In the past, breaking this level has meant longer bear phases. Accumulation scores are low, and the Spot Cumulative Volume Delta (CVD) is still negative. This means that sellers are still in charge of order flow.

In Conclusion

The $730 billion loss shows that the market is tired of the same old things, and altcoins took the biggest hit. It looks like recovery will depend on more activity on the blockchain and more whale buying. If key support levels break, the market could reset for several years. This is a very important time for investors to keep an eye on.