Jupiter (JUP) operates as a top decentralized finance protocol on the Solana blockchain, that provides both decentralized exchange aggregation and perpetual trading services. The platform demonstrates high user demand because it has locked $2.4 billion in total value, which generates consistent revenue through trading fees. The current price trend indicates that short-term movements in JUP will result in significant market volatility. The recent $35 million strategic investment from ParaFi Capital demonstrates institutional confidence, which will help support future growth.

Protocol Fundamentals

Jupiter optimizes trades across Solana liquidity pools while offering perpetual futures trading. Its TVL of $2.428 billion positions it among the leading Solana-based protocols, benefiting from high throughput and low transaction costs.

The protocol generates substantial revenue from transaction fees. Annualized figures indicate total fees of $672.41 million, with net revenue of $156.43 million. Token holders have captured $144.15 million of this value, reflecting a focus on stakers and loyal users. Jupiter currently operates without large incentive programs, suggesting a self-sustaining model that could enhance long-term profitability.

Over the past 30 days, Jupiter carried out $31.7 billion in DEX aggregator volume and $9.86 billion in perpetual trading. Direct DEX volume was relatively small at $1.71 million, which shows a strategic focus on aggregation and derivatives. With a market capitalization standing at $632.86 million and a fully diluted valuation of $1.34 billion. The project still has room for growth; however, thin liquidity of $3.7 million may lead to short-term price swings. Borrowed assets currently sit at $711.72 million, which points towards leverage activity within the ecosystem.

From a valuation perspective, the protocol displays an attractive price-to-sales ratio of approximately 4.05, which exceeds the ratios of its competitors Uniswap and 1inch, making it a clear winner. The strong reason is that Solana offers faster transaction speeds at lower costs.

Revenue and Profitability

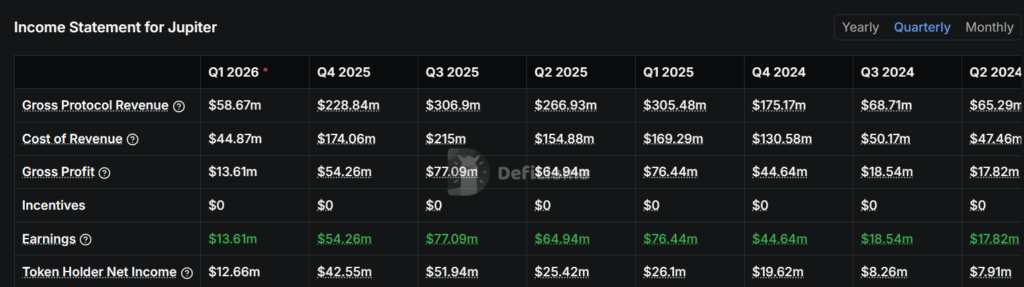

Jupiter’s income statement illustrates a lean and efficient structure. Gross revenue totals $228.84 million, with $174.06 million spent on operational costs, primarily from the perpetual exchange, which accounts for 75% of fees. Gross profit of $54.26 million represents a 24 percent margin, fully translating to earnings.

The distribution of value is geared toward token holders, with a noticeable chunk of aggregator fees that are most likely put toward buybacks or token burning, which can help enhance shareholder value. Although the project shows no net losses, the high cost ratio highlights potential for improvement. Relative metrics, such as the reduced reliance on perpetual trading or the increasing margins from aggregator services, demonstrate the project has room for growth. Perpetuals, which offer growth potential but also expose the platform to derivatives market volatility, substantially help to drive the overall revenue.

Price Trends

At the time of writing, $JUP is changing hands near $0.194 with a circulating supply of 3.24 billion tokens. The short-term price trend has been favorable, with a 24-hour gain of nearly 6%. However, the broader trends for the asset remain bearish: the 30-day change is -7.4%, the 90-day decline is -46%, and one-year losses exceed 79%. This decrease corresponds to wider crypto market shifts since 2024 and challenges around the Solana ecosystem. Recent developments may indicate initial signs of stabilization, as renewed interest in DeFi continues to develop.

Trading Activity and Liquidity

Spot trading volume over the past 24 hours reached $31.67 million, while futures volume totaled $153.01 million. Liquidations were minimal, suggesting cautious leverage use. Open interest stood at $46.64 million, highlighting engagement from derivatives traders.

The difference between spot trading and perpetual trading volumes shows that Jupiter attracts the market participants who operate in the financial markets with high leverage. The performance process depends on Jupiter’s aggregator system; the main reason involved here is the thin market conditions that restrict the ability for the large trades’ execution.

Strategic Investment and Growth Prospects

A recent $35 million investment from ParaFi Capital serves as a strong bullish signal. The funding, provided entirely in $JupUSD at spot price with a long-term token lockup, reflects institutional belief in Jupiter’s undervaluation. ParaFi aims to support expansion of Jupiter’s perpetual offerings, aggregation infrastructure, and potential new financial products.

The long-term growth is supported by this capital injection, which reinforces Jupiter’s treasury and development that aligns with market incentives. In a competitive Solana DeFi landscape, it gives Jupiter an upper hand when compared to its competitors such as Raydium and Orca.

Risks Associated

Jupiter faces multiple challenges, including Solana network scalability and legal investigations of derivatives trading. In addition to this, the trend opens up the possibility of a market downturn. The project may experience profitability challenges considering both operational costs and low liquidity, which could add financial pressure in the case of low sales volumes or low market interest. The absence of incentives allows organizations to conduct focused campaigns, which could possibly help them grow their metrics, such as TVL, and also attract new users to the ecosystem.