Key Takeaways:

- Trump called on the Fed to cut rates by 3 points, triggering a broad market rally.

- Bitcoin hit $112K ATH before easing to $111K, driven by Trump’s rate-cut call and strong corporate buying.

- Gold rose 0.18% on softer dollar expectations and Fed pressure.

- BlackRock and Metaplanet ramped up Bitcoin buying, accelerating corporate accumulation trends.

Global financial markets rallied sharply on Thursday following comments from U.S. President Donald Trump, who publicly urged the Federal Reserve to lower interest rates by three percentage points.

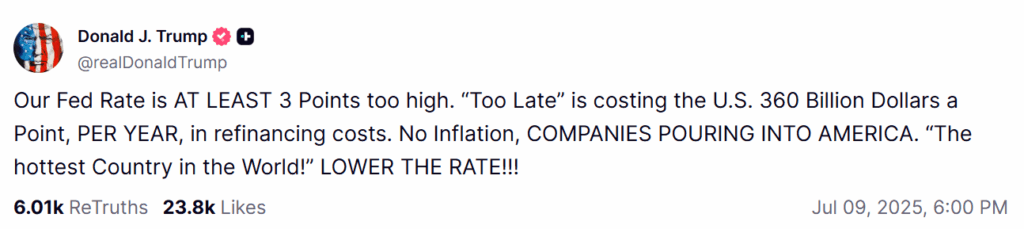

In a post on Truth Social, Trump stated that the Fed rate is “at least 3 points too high,” calling the current monetary policy a drag on U.S. refinancing costs and business momentum.

The remarks intensified speculation over the central bank’s next steps, with investors increasingly anticipating a shift in policy tone despite Fed officials signaling caution in recently released minutes.

At the same time, Bitcoin surged to a new all-time high above $112,000 before easing to $111K, fueled by Trump’s comments and a deepening corporate accumulation trend. BlackRock’s spot bitcoin ETF, IBIT, expanded its holdings to over 700,000 BTC, more than half the total managed by all U.S. bitcoin ETFs combined.

In Japan, tech investment firm Metaplanet increased its treasury position to 15,555 BTC, adding over 2,200 coins in recent weeks. The firm stated that it plans to utilize bitcoin as strategic collateral for future acquisitions, with long-term targets as high as 210,000 BTC.

The dual push: political pressure for rate cuts and aggressive institutional demand for crypto, drove a sharp rally across equities and digital assets.

Market Prices

Global Indices

- S&P 500 (SPX): 6,263.25 ▲ +0.61%

- Dow Jones (DJI): 44,458.30 ▲ +0.49%

- Nasdaq Composite (IXIC): 20,611.34 ▲ +0.94%

- Nikkei 225 (NK2251D): 39,670.0 ▼ −0.33%

- Euronext 100 (N100‑D): 1,600.48 ▲ +1.02%

- FTSE 100 (UK 100): 8,905.0 ▲ +0.02%

Commodities

- Gold (XAU/USD): $3,323.76 ▲ +0.29%

- Silver (XAG/USD): $36.47 ▲ +0.31%

- WTI Crude (USOIL): $68.43 ▲ +0.28%

- Brent Crude (BRENT3!): $68.19 ▼ −0.20%

Cryptocurrencies

- Bitcoin (BTC/USD): $111,010 ▼ −0.25% (recorded intraday ATH > $112K)

- Ethereum (ETH/USDT): $2,777.17 ▲ +0.30%

- Solana (SOL): $163.35 ▼ −1.88%

- Binance Coin (BNB/USDT): $672.44 ▲ +0.56%

Major Stocks

- NVIDIA (NVDA): $162.88 ▲ +1.80%

- Tesla (TSLA): $295.88 ▼ −0.65%

- Microsoft (MSFT): $503.51 ▲ +1.39%

- Meta Platforms (META): $732.78 ▲ +1.68%

- Apple (AAPL): $211.14 ▲ +0.54%

- Amazon (AMZN): $222.54 ▲ +1.45%

Forex

- U.S. Dollar Index (DXY): 97.398 ▼ −0.07%

- EUR/USD: 1.1732 ▲ +0.11%

- GBP/USD: 1.3603 ▲ +0.14%

- USD/JPY: 146.242 ▼ −0.04%

Market Wrap-Up

Markets extended gains on Thursday as President Trump’s call for steep rate cuts lifted sentiment across equities and digital assets.

Tech shares lifted Wall Street, while Asian markets remained cautious on lingering trade risks.

Gold edged higher on softer dollar expectations, and oil prices moved cautiously, with WTI ticking up and Brent slightly lower.

Bitcoin touched a new record ATH above $112,000 before easing to $111K, supported by Trump’s comments and continued institutional inflows from firms like BlackRock and Metaplanet.

Meanwhile, the dollar slipped as investors anticipated the Fed’s response to rising political pressure.

Read More: Trump’s 50% Copper Tariff Sparks Market Chaos: What It Means for Crypto